Is Dave Portnoy The Market’s Mad Genius: Here Are The Top 40 Stocks In The Top-Performing “Retail Favorites” Basket

Tyler Durden

Sun, 06/14/2020 – 21:00

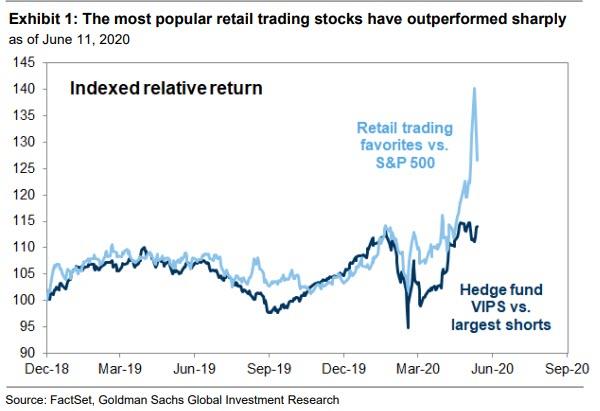

On Saturday, we reported that something remarkable was taking place in capital markets: a basket of “retail favorite” stocks had outperformed not only the broader market by a wide margin, at one point last week surging as much as 35% YTD, but also the basket of most popular, “hedge fund VIP” stock.

How is this possible? For the answer to this question, we urge readers to catch up on this fascinating topic, starting with How Retail Investors Took Over The Stock Market, and concluding with Goldman’s Clients Are Getting Angry That Teenage Daytraders Are Crushing Them, while also noting a tangent we touched on twitter yesterday discussing the bizarrely-symbiotic relationship between Robinhood traders and HFT firms (which among other things has allowed Hertz to be on the verge of selling up to $1 billion in bankrupt equity as soon as tomorrow).

This is how a few thousands retail daytraders on Robinhood move the market: RH sells their orderflow to HFT algos who frontrun the trades and massively accentuate the momentum https://t.co/hlFBs8dEaL pic.twitter.com/HtT8OHHYZ0

— zerohedge (@zerohedge) June 13, 2020

https://platform.twitter.com/widgets.js

Whatever the reason behind the sizzling outperformance of retail stocks, one question remains: is Barstool Sports’ Dave Portnoy the market’s crazy genius of the day, able to whip up his frenzied 1.5 million twitter followers into a daytrading army that jumps from one opportunity to another, sending stocks surging then tumbling as he shifts his focus from one pennystock to the next.

Much has been written about Dave Portnoy over the past few days, perhaps too much, starting with Bloomberg’s “Barstool Sports’ Dave Portnoy Is Leading an Army of Day Traders” (a profile he didn’t take kindly to), to the FT’s “the ‘retail bros’ betting on a quick recovery from the pandemic” and so on, the main thrust of which is the question whether the Fed has made markets too easy for people like Portnoy to massively outperform the “smart money”…

Rule one is that “stocks only go up”, as he frequently reminds his 1.5m Twitter followers.

Rule two: “When in doubt whether to buy or sell see Rule One.”

… and when will his moment of market dominance come to an ends.

While traditionally it would have been easy to dismiss Portnoy’s market prowess, the reality is that in a world where the Fed Chair has explicitly blessed his trading “strategy” of buying everything, and just doubling down when everything drops as the Fed will be there to bail him out, it has become virtually impossible to ignore what Portnoy’s strategy is: after all, in a way Portnoy has become the Fed’s investing “vessel” – showing everyone how it’s done in a world where the Fed has blessed the stock bubble. We will therefore pass judgment.

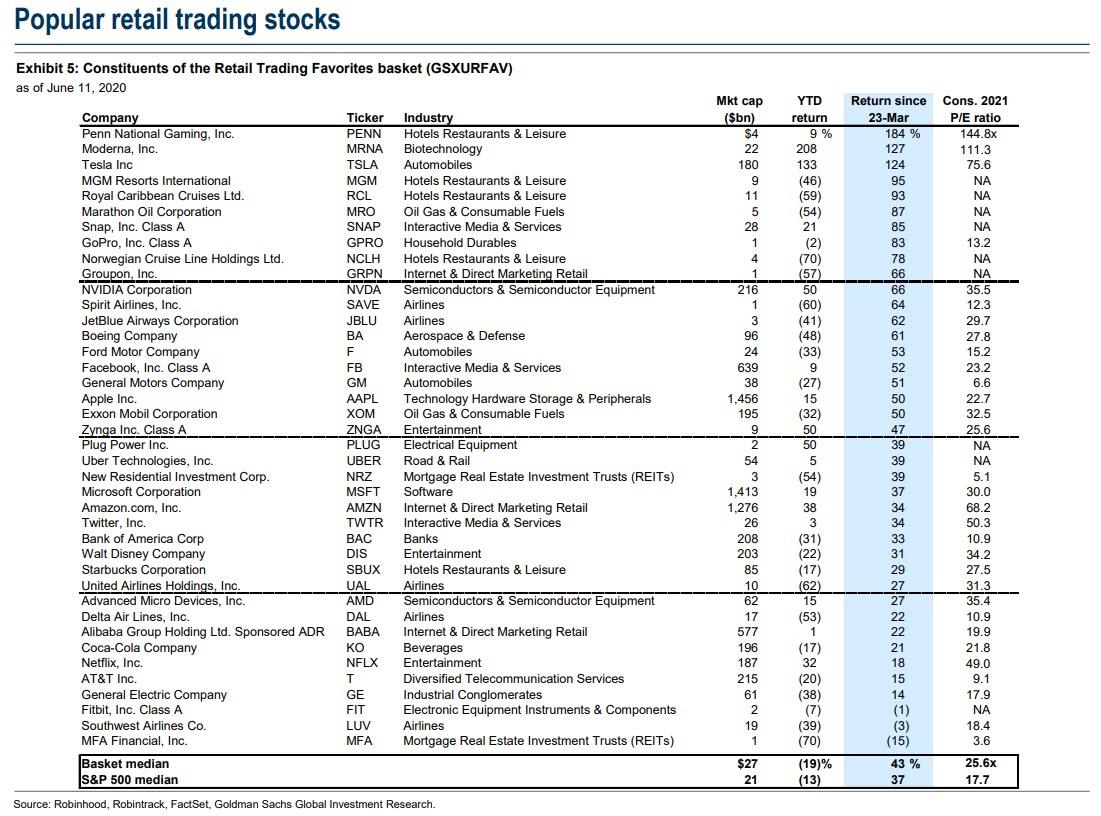

We will, however, point out, that Penn National Gaming (PENN), which Portnoy owns a lot of as he reminds his followers with the following blurb in his twitter bio “I own a ton of Penn Stock” as a result of PENN buying his company Barstool Sports for $450 million in January, just happens to be the top performing stock inside the top performing “retail favorites” basket as of this moment.

Did Dave Portnoy have something to do with the remarkable outperformance of not just PENN, but also Royal Caribbean, Spirit Airlines, Norwegian Cruise Lines and so on, since the March 23 lows? You bet he did.

Is it 9:30 yet? pic.twitter.com/qyGA546tR1

— Dave Portnoy (@stoolpresidente) June 14, 2020

https://platform.twitter.com/widgets.js

* * *

So in a world where rabid retail buying has dominated financial commentary for the past month, and where Hertz is about to make history by doing a targeted equity offering of bankrupt stock to the Robinhooders of the world, and raise up to $1 billion for the benefit of the company’s creditors, financial advisors and lawyers, it is rather prudent to know what are the top 40 market-moving stocks that make up the Goldman “Retail Trading Favorites” basket, as these stocks – for better or worse – will define the market landscape for the foreseeable future.

That said, with a median return of 43% since March 23, and a 25.6x 2021 fwd PE ratio, compared to the S&P’s 17.7x median, gamblers are faced with a daunting choice: either buy the basket in expectations that the biggest asset bubble of all time will only get bigger thanks to even more Fed stimulus in coming months, or the time has come to let some air out of this bubble, especially now that fears of a second wave are starting to spook stocks, and sending Eminis below 3,000 for the first time this month.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com