Trader: “It’s Going To Be One Of Those Days”

Tyler Durden

Fri, 06/19/2020 – 09:13

After weeks of chaotic surges and reversals in US equities, today has all of the hallmarks of being one of those sessions that, at the end of the day, if you didn’t trade you will look at your screens and wish you had.

On the other hand, however, as Bloomberg’s Richard Breslow notes, if you do trade, there is a good chance you will wish you hadn’t.

There has been more price action than it appears from a cursory look. Taking advantage of it has been another thing. And if you get gulled into chasing the market because you can’t stand watching it move without you, it has a way of punishing you for the lack of discipline. If you must get involved, pick your side and fade extremes that try to fool you into thinking you are wrong.

You won’t hear me say this very often, but it isn’t a day when following your instincts is necessarily a good strategy. Unless you are prepared to stick with positions longer than a day. And how many people are in the mood to initiate new strategic ideas on a Friday when more people have told me they’ve had enough of this week than are all ginned up.

There are a couple of things that are turnoffs and one that is worth thinking about.

I don’t like quadruple witching days. They are often busts that are way too big a distraction. And if you don’t see the flows, there is little way to profitably trade them. That’s two strikes and you’re out, as far as I’m concerned.

Also, a lot of the movement in asset prices have been in response to central bank comments, or the Chinese-buying-soybeans news, and the moves have been over before they were of tradable value. This one is dovish. That one is hawkish. It’s running about 50/50 so far. Then we go back to sleep. It’s hard to get too excited about fixed income moving events when volumes are so atrocious. Auctions go well. And then nothing. Don’t wait up for Fed Chairman Jerome Powell this afternoon, he won’t have changed his mind from earlier in the week.

One thing that does merit being on your radar is the big rally in China’s ChiNext Index. It seems to have taken over from the U.S. tech-heavy rally while making a four-year high today. And we all know, global equities love to follow a leader. The PBOC is being friendly and speculators are embracing the message. Before you get too excited, volumes in Europe have been very light in the early going despite a generally positive tone. But, it is entirely possible this will, all else being equal, be a net positive for U.S. markets. And color your day. But there is that option stuff to consider.

I know it isn’t popular to say, but the dollar looks OK. It’s had a nice 10-day rally. Right up to the resistance zone. Keep an eye on how it behaves in here. A lot of people have short positions because they think they are supposed to. The euro and sterling don’t trade like currencies just itching to take off. In any case, this will be the proving ground, one way or another

But, for now, most attention will be on the impact of quad witch. As a reminder, options and futures on indexes and equities are scheduled to expire, a quarterly event known as quadruple witching that typically spurs trading volume as large derivatives positions roll over.

While spikes in volume usually occur around the open and close, providing windows of robust liquidity, large price swings can happen suddenly at any time of the day.

“Investors need to be prepared,” said Chris Gaffney, president of world markets at TIAA Bank.

“When we see the run-up like we’ve seen and you have investors trying to protect their portfolios, protect the gains and having the uncertainty still out there, you’ve got some big options positions in the markets right now and the decisions to roll them or not on that day is what drives the volatility.”

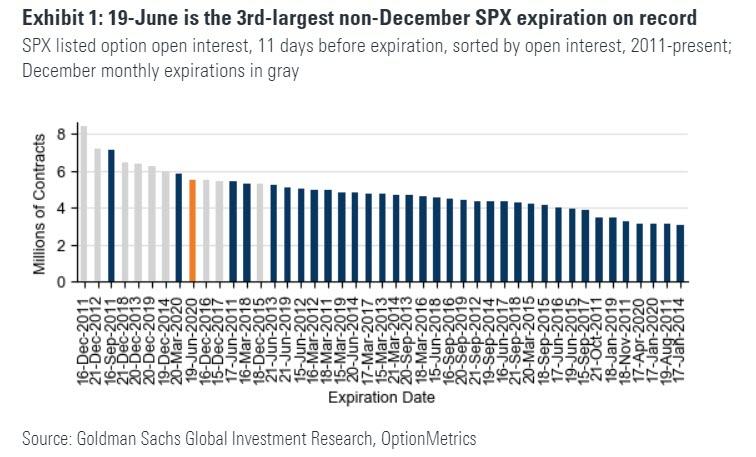

Today’s massive, $1.8 trillion op-ex, which will be the third-largest non-December expiration on record, but, as Goldman notes, as a result of a substantial amount of the open interest located below spot (largest concentration is at 2800-2900) “it is not immediately clear if this alone will have a material move on the market in the immediately preceding period”, and also whether this impact would be bullish or bearish.

So if Goldman is correct, tomorrow’s should be generally a non-event. But what about after?

Charlie McElligott, cross-asset strategist at Nomura Securities, warns that if history is any guide, investors may need to get ready for a market pullback or a wider trading range. Since 1994, the options expiration in June has seen stocks falling 88% of the time over the following week, with the S&P 500 sliding 1.2% on average, the firm’s data showed.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com