Stocks Slide After Fed’s Kaplan Says Emergency Facilities To Be Pulled Back As Economy Improves

Tyler Durden

Mon, 07/13/2020 – 14:26

In an almost verbatim repeat of what the new head of the NY Fed’s Markets Group (aka the de facto head of the Plunge Protection Team), Daleep Singh said last week, when discussing the Fed’s purchases of corporate bonds and ETFs, saying that “If market conditions continue to improve, Fed purchases could slow further, potentially reaching very low levels or stopping entirely”, moments ago Dallas Fed President (and FOMC voter) Robert Kaplan said emergency lending facilities launched by the central bank were necessary to support market function, “but they won’t be left in place indefinitely.”

“A number of those actions were necessary. The key is what we do from here. How long does this need to go on for?” asked the former Goldman partner, adding that he is a “believer that we will need to get back to more unaided market function without as much intervention from the Fed. We’re just not at that point yet.”

Did the nearly $10BN in daily purchases of Treasurys and MBS give it away?

Sarcasm aside, and clearly unaware of the reflexivity behind the market and the Fed’s balance sheet, Kaplan said that “I think it’s wise for us to be telegraphing as the economy improves we’ll be appropriate in showing restraint and pulling back some of these programs.”

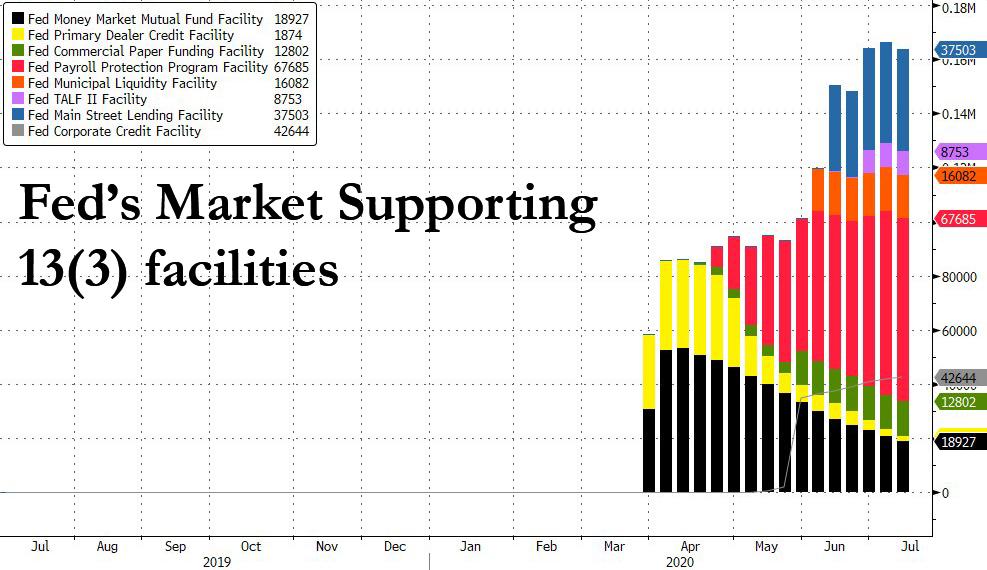

Of course, the moments the Fed “telegraphs” the economy is improving and does in fact “pull back” on some of these programs which are charted below..

… is the moment stocks will plunge, as by now even 10 year old Robinhood traders know that without the Fed propping up risk assets every single day, stocks will plunge until such time as the Fed resumes these emergency programs.

In fact, one can argue that today’s swoon in Tesla and the broader Nasdaq, which has since affected the broader market, took place just after Kaplan warned that the Fed’s market support won’t last forever, to which markets made it clear that the support better last forever, or the Fed will have another crash on its hands in no time.

And speaking of Tesla, – TSLA shares have plunged almost $300 from record highs hit just a few hours earlier…

… and the Nasdaq is suddenly rolling over hard, leading the rest of the market lower…

And suddenly, 400,000 Robinhood’rs were silenced…

Especially the 40,000 or so that added today:

Only 18.7K new greater fools now. Was almost 40K earlier pic.twitter.com/A0WXf9H6sr

— zerohedge (@zerohedge) July 13, 2020

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com