“Long Tech Stocks” Is The Most Crowded Trade Ever

Tyler Durden

Tue, 07/14/2020 – 21:50

The monthly Fund Manager Survey from Bank of America is best known for two things: the recurring, apparent schizophrenia of the financial professionals polled, and the monthly chart showing what everyone on Wall Street thinks is the most crowded trade, i.e., what they think others have as their top trade.

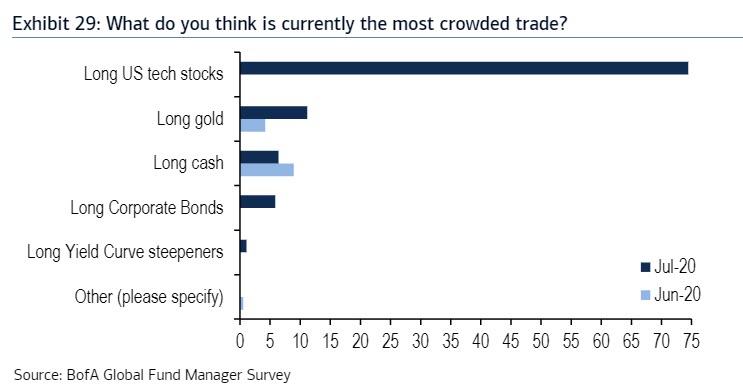

This month did not disappoint: not only did it confirm that the one trade – which everyone already knows – is the most popular on Wall Street, is indeed seen as such but it is in fact more so by the biggest margin on record. We are of course talking about “Long US tech stocks” which is what 74% of BofA survey respondents said they thought was the most crowded trade on Wall Street. (Long Gold and long cash were “most crowded trades” #2 and #3, respectively).

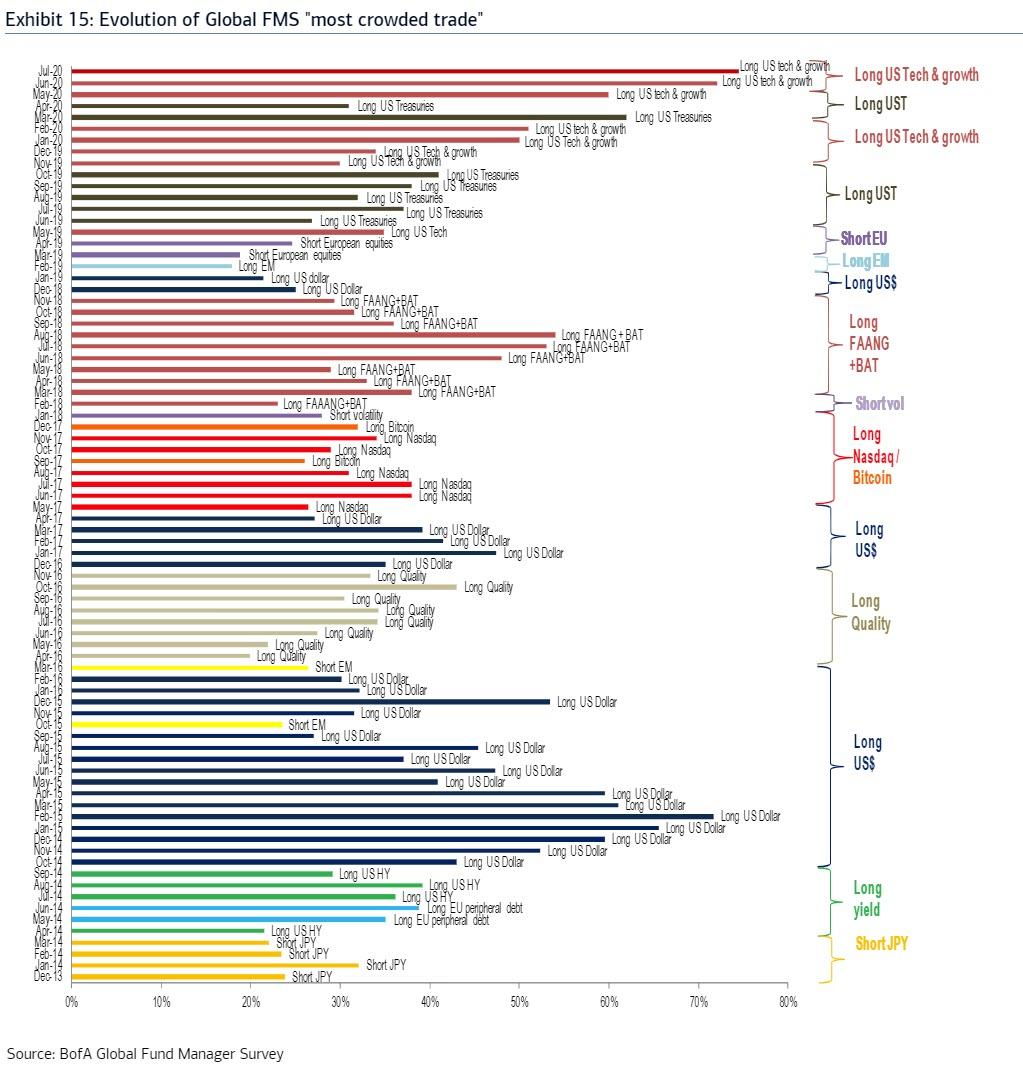

So convinced are finance professionals that everyone is “all in” tech, that the percentage of agreement behind tech being the most crowded trade is the highest of any monthly response in polling history, surpassing even the “Long US Dollar” responses attained during the dollar explosion in 2014/2015 when the ECB disintegrated the Euro.

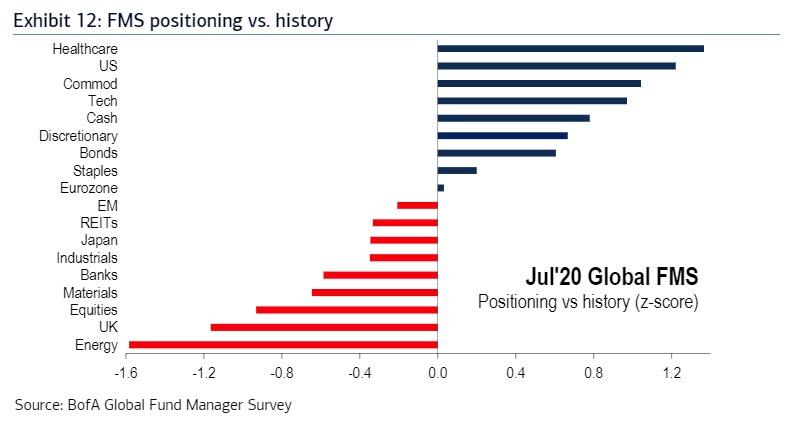

Of course, having learned from our previous observations that there is a flawed reflexivity in the BofA Fund Manager Survey, some – such as Bloomberg’s Ye Xie – were skeptical that there is a convergence between perception and reality, and that it wasn’t actually the case that everyone is “all in” tech stocks; to justify their skepticism, they pointed out another chart from the same BofA poll which showed that tech stocks were only modestly above historical average z-scores in terms of positioning.

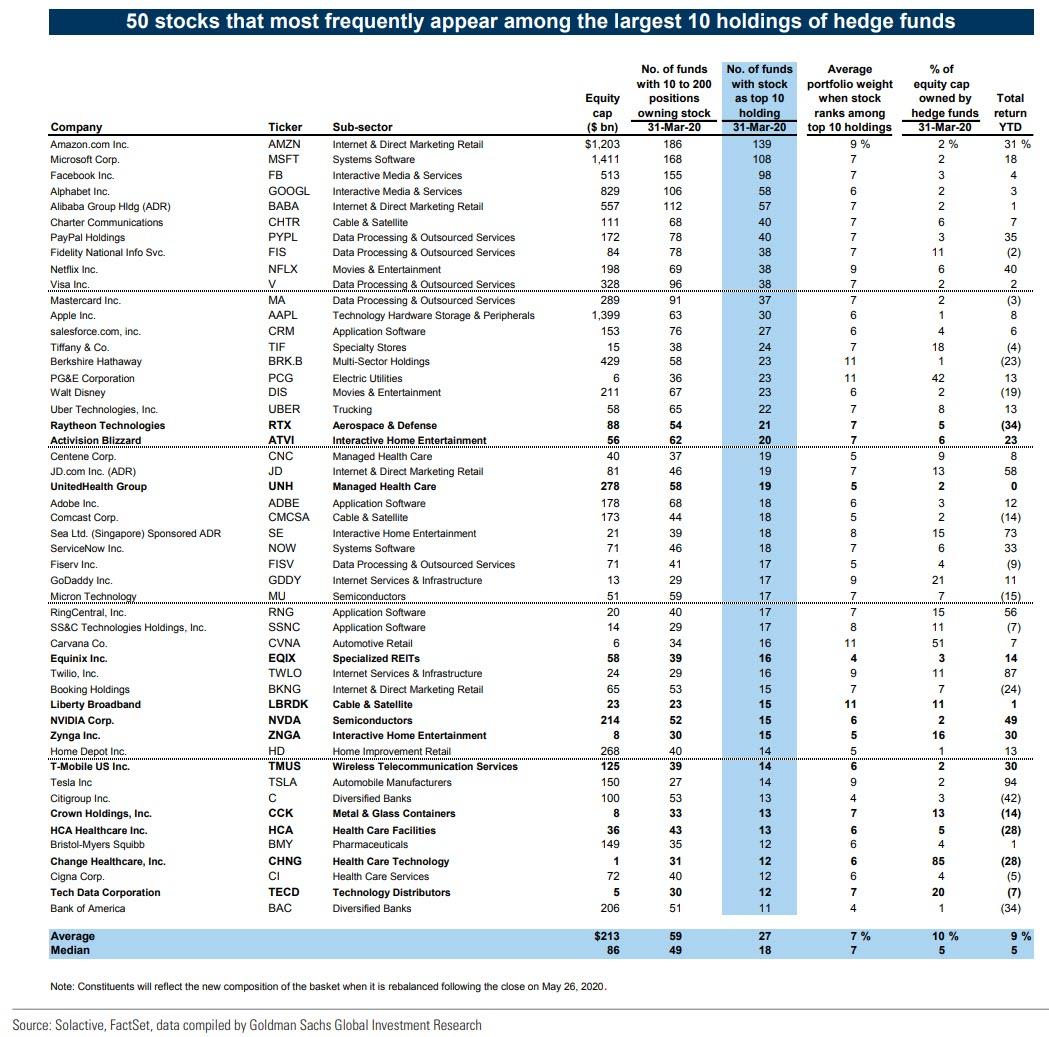

Only this time being a contrarian for the sake of being a contrarian appears a losing position, because one look at the latest Hedge Fund Tracker from Goldman confirms that – at the institutional and hedge fund level – everyone is indeed long tech stocks. A quick look at the hedge fund top 50 stocks (HF VIP list) shows that tech names account for 8 of the top 10 most popular stocks.

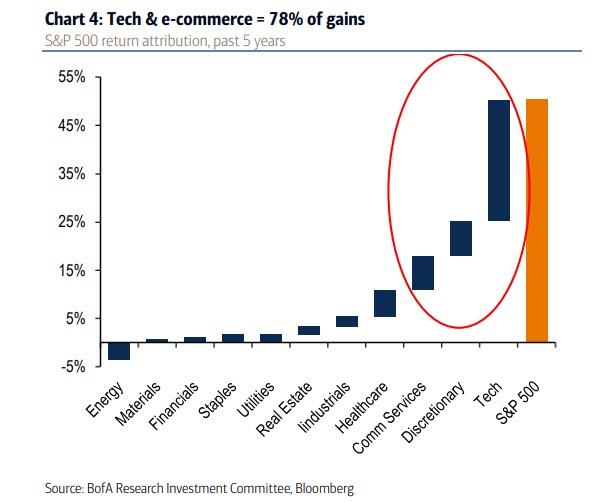

Of course, BofA observing that everyone is long tech is hardly a shock. After all, as BofA points out in another research report published today, without tech, S&P gains over the past five years would be 50% lower.

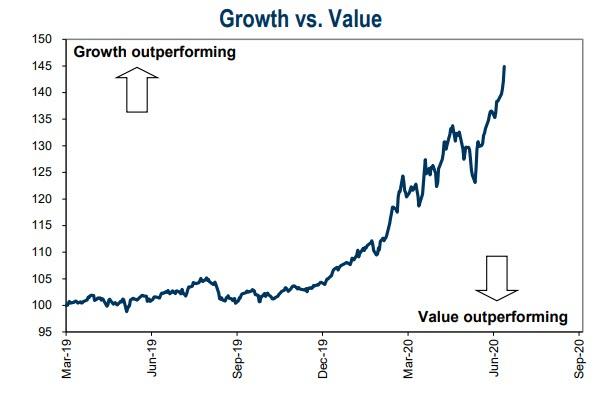

So yes, whatever works will continue to work, until there is a reason for it not to work. And since the Fed is now effectively punishing growth stocks (which is just another name for bank and energy stocks, by keeping rates at record lows), the growth to value outperformance will continue until there are no more value investors left.

Which is not to say that since it has worked so far, it will always work. Indeed, as BofA CIO Michael Hartnett notes, if one wants to be a true contrarian, “the best short is tech stocks given positioning and stretched performance.”

Just make sure to have a massive balance sheet if putting this short on as the likelihood of repeat margin calls before it finally does work is directly proportional to the likelihood that the Fed’s balance sheet will continue to grow by about one trillion dollars every month or so, just to avoid a complete collapse of the entire financial system.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com