World Recovery Running On Fumes As Virus Pandemic Reemerges

Tyler Durden

Tue, 07/21/2020 – 04:15

The resurgence of the virus pandemic is at risk of derailing the global economic recovery.

Goldman Sach’s latest Coronavirus Global Activity Tracker, published each Wednesday to track the impact of the virus outbreak on economic activity on a per-country basis, shows mobility, industrial activity, consumer activity, labor market, and travel trends are stalling in major economies.

The note first points out mobility data in Croatia, Israel, Australia, Japan, and Hong Kong, has likely peaked after surging for a couple of months due to, in some of these countries, surging virus cases. On a weekly percentage change basis, all countries, except for Croatia, have seen mobility trends in late June turn lower.

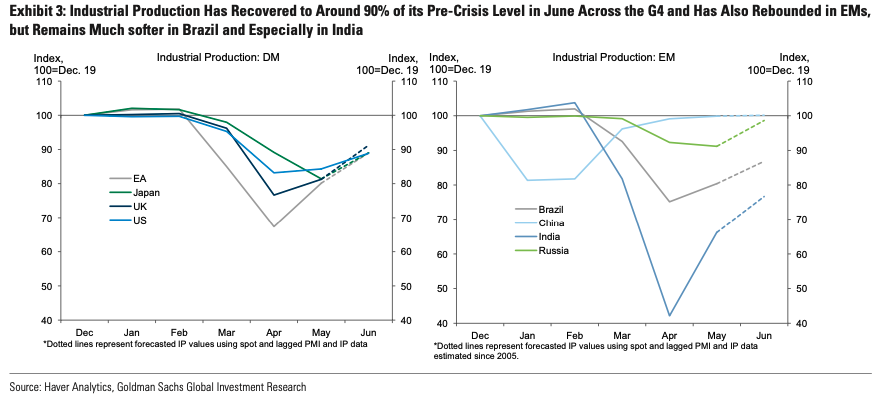

Goldman’s industrial activity trackers were stable in China and the US, at 4% YoY and -11% YoY, respectively. China’s industrial revival post-pandemic lockdowns has been more robust than the US.

There is no V-shaped recovery here. Goldman’s industrial activity trackers also show activity levels around 90% of pre-corona levels in June across G4 countries. Rebounds in BRICs have been much softer than developed economies.

The note transitions from examining industrial activity to the consumer. To sum up, the consumer in the US and China are still fragile in the first week of July.

As we’ve covered in several recent pieces, global restaurant bookings on a YoY percentage change stalled in mid/late June.

Goldman’s trackers on global movie theaters is self-explanatory.

Global retail and recreation activities stalled in June then edged lower through the first week of July.

Global workplace visits stalled as early May 30 and trended lower through July 11.

As for travel, we’ve noted countless times, the recovery is years away.

Goldman concludes the note by saying the virus-induced recession will have “scarring effects” on the global economy. We’ve noted these scarring effects are rising bankruptcies, permanent job loss, and social unrest that will result in a prolonged downturn, if not a double-dip recession for the US, and maybe other region regions in the world dealing with similar socio-economic chaos and rising virus cases.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com