“Paralyzed By The Pandemic” – World’s Largest Diamond Company Considers Restructuring

Tyler Durden

Mon, 07/27/2020 – 02:45

De Beers Group, the world’s largest oldest diamond company, is expected to undergo a restructuring period as diamond sales collapse.

Bloomberg notes the company “is considering ways to restructure mines, expand in jewelry and overhaul diamond sales.” Adding that it must “rethink its entire business in an industry left paralyzed by the pandemic.”

There’s going to be no V-shaped recovery for the diamond industry this year. The industry has been severely damaged by the virus-induced downturn, as consumers across the world can no longer afford pricey diamonds.

Even before the global downturn, diamond sales were waning with De Beers. The younger generation lost interest in the whole marriage thing, as their finances, with insurmountable debts and no savings, made it near impossible to layout enough money for weddings and a diamond ring.

The came big bad COVID-19, led to a further collapse in consumer finances, along with a period where jewelry stores were closed around the world. This pressured De Beers, who reported $56 million in rough diamonds sales in 2Q20, down 96% from a year earlier. RBC expects the diamond company to post a $100 million loss in 1H20.

Read: Diamond Crisis – De Beers Records Lowest Profits Since 2009

De Beers CEO Bruce Cleaver told employees this week, in an email, that it will “narrow the gap between its revenue and costs.” He warned diamond demand would slump in the near term.

“Covid-19 has compounded and exacerbated difficulties that already existed in the diamond world,” Cleaver said. “These difficulties, which have inhibited our growth over the past several years, have become even more urgent to address. They require us to act now to protect the short-term health of the business while refocusing and reorienting it to realize our long-term potential.”

Cleaver didn’t layout all the changes in the company email. Bloomberg notes the restructuring will likely result in job cuts.

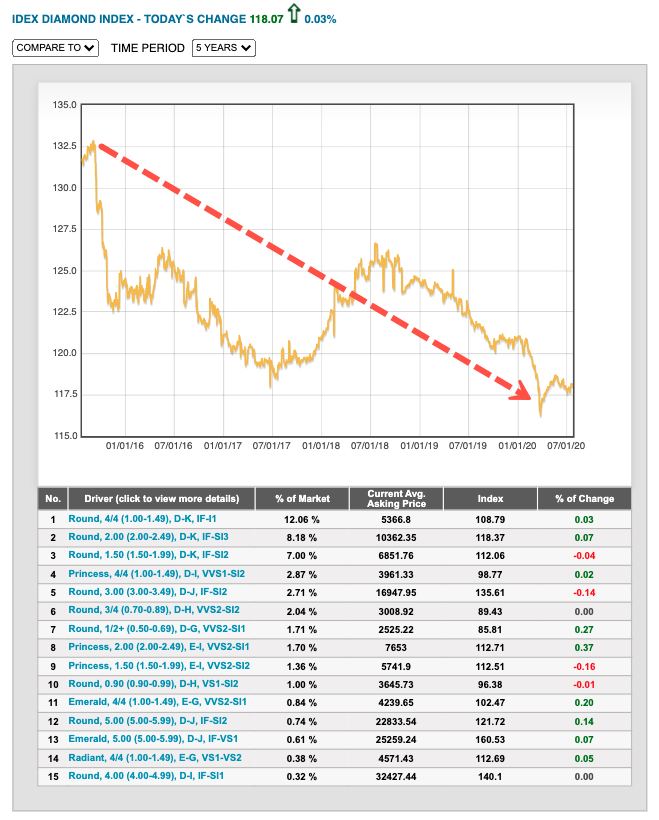

Shown below, spot diamond prices via IDEX show prices have been slumping for more than 5-years.

The world’s largest diamond company appears to have gone bust.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com