China’s Landlords Hit With First Rent Price Slump As Economy Falters

Tyler Durden

Sat, 08/15/2020 – 18:40

Middle-class households in China are facing the first rental income slump ever, sparked by the virus-induced downturn, pressuring the private-property market.

Rents are declining in many metropolitan areas, mainly due to jobless tenants leaving town. A glut of empty apartments is becoming a major headache for landlords, as rent discounts have been introduced to entice tenants to remain in leases.

Reuters spoke with Li, who declined to give her full name, said she was scaling up the social ladder with the ownership of two apartments that were used for a steady rental income stream before the virus pandemic.

Li now said she’s “almost halved the rent at one of her apartments between February and May to hang on to a tenant, while her own salary was slashed 25% as her employer made coronavirus cutbacks.”

“I must pay the rent of my room in Beijing, and monthly mortgages for the two apartments,” she said.

She is among the millions of middle-class landlords in China who have been devastated by the downturn. Many of these folks are experiencing the first period of rental income declines, as some are highly leveraged.

Housing data provider Zhuge House Hunter said rents in 20 major cities fell 2.33% in July YoY, the fourth consecutive month of declines.

Rental woes in China reveal housing market froth that is at risk of imploding if the overall economy remains downward sloping.

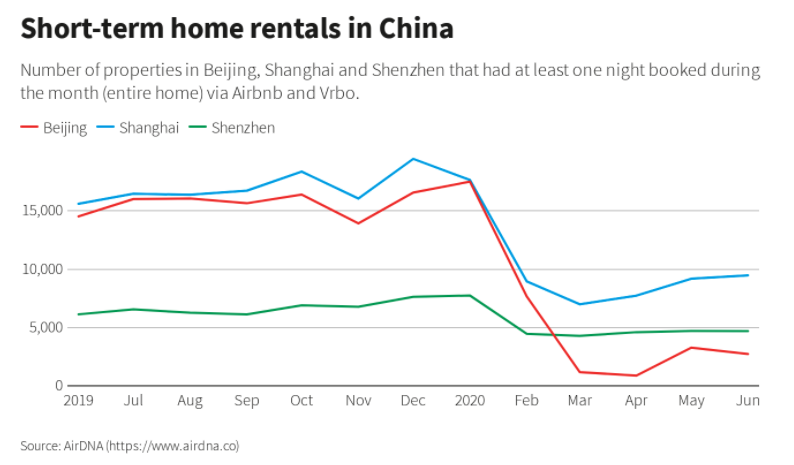

Demand for short-term rentals is also another problem for landlords, stripping any alternatives for generating income on their properties.

“Two groups … suffer the most,” said Yuan Chengjian, vice president of Zhuge House Hunter. “One is long-term rental firms … the other is investors who buy properties through high leverage financing because they pay off part of their mortgages with rent.”

Reuters also spoke with Luo Shuzhen, a landlord with two buildings totaling 80 rooms for sublet, said she must postpone updates on her buildings because tenant numbers have dropped 30% this year.

“It’s hard to say how long the epidemic would last, so I’m not sure whether I can maintain the rental business in the second half,” said Luo, who runs a convenience store.

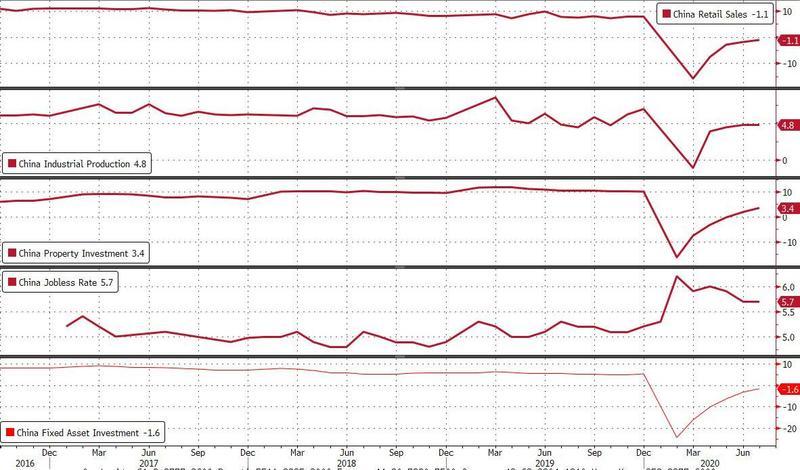

The next big problem for landlords is the stalling recovery. China’s retail sales slipped in July, dashing hopes for a robust “V-shaped” recovery.

With mortgage defaults low, the non-performing loan ratio in the country stands around 2.1% at the end of June.

Tracy Wan, senior director of Asia-Pacific structured finance at Fitch Rating, said:

“Half of the transactions in the securitization market use 90 days as the definition for default, while the other half use 180 days. For those who use 180 days, you’d have a longer time to recognize defaults, and that number is still going up.”

And while landlords in China are pressured by plunging rental income, a similar story is playing out in New York City.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com