Billionaire Novogratz Warns “Frenzied Market Bubble” Will Pop If BIden Wins

Tyler Durden

Sun, 08/16/2020 – 20:00

Just days after bond king Jeffery Gundlach steamrolled over the widespread consensus that Biden will defeat Trump in the upcoming presidential election, doubling down on his contrarian bet that Trump will win a second term on November 3 (as he correctly predicted would happen in 2016 over the chorus of an army of so-called experts, all of whom were certain that Hillary would crush Trump), another billionaire made a non-consensus forecast on Friday when former hedge fund icon and cryptocurrency investor Michael Novogratz – a big fan of Democrats – said the relentless rally in the stock market could end if Joe Biden wins the U.S. presidency.

“Electing Biden and Harris, as much as it’s gonna be great for the country, is not going to be great for the market,” Novogratz said Friday in a Bloomberg TV interview.

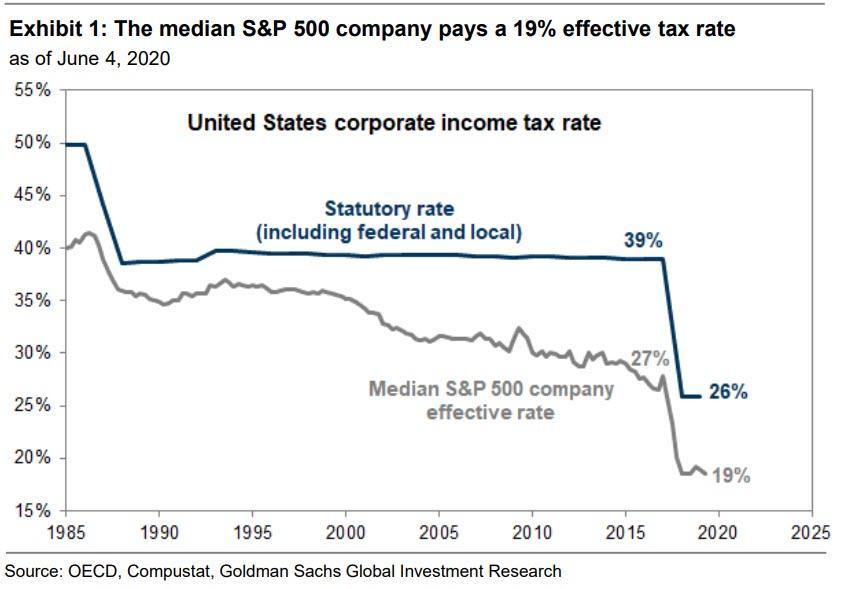

According to Novogratz, founder of Galaxy Investment Partners and an outspoken cheerleader for cryptocurrencies, the stock market was in a “liquidity-driven frenzy,” fueled by stocks like Amazon and Tesla. Should Democrats take control in November, Wall Street can expect higher corporate and capital gain taxes, as well as increased rates for the wealthy, he said echoing an identical warning from Goldman (which despite still expecting higher taxes just hiked its S&P year-end forecast to 3,600 in what can only be seen as an attempt to encourage its clients to buy anything… that Goldman has to sell).

“Everything is trading literally like bitcoin in 2017 into a speculative frenzy. Those frenzied bubbles normally end with policy response,” said Novogratz, who has described his politics as center-left. “Usually it’s the Fed’s action, but action on raising taxes could end this froth. I mean Amazon’s an amazing company, it’s doing amazing through Covid, but it’s trading a hundred times earnings on a gigantic multiple.”

That said, Novogratz does not expect the Fed to in any way get in the way of the market, and expects the Fed to be “even more dovish” at its next meeting, which could drive stocks higher, push gold to $2,500 to $3,000 an ounce and send cryptocurrencies to all time high, especially now that it is becoming particularly clear that the Fed is working on its own “digital currency” which it will use to deposit funds directly into the accounts of Americans during the next crisis in a last-ditch effort to spark an inflationary inferno and “inflate away” the insurmountable US debtload.

Yet even though he sees a market crash, like many Wall Street Democrats Novogratz said Biden and Kamala Harris would be “good overall for financial firms” which is odd as it would require far higher interest rates, which in turn would lead to an even greater wipeout for tech stocks and any security with duration exposure. As Bloomberg notes, in an earlier interview, he described Harris, a U.S. senator from California, as someone who “brings star power to the ticket.”

Nobogratz also touched on several other topics including:

- Bitcoin – He said he thought the cryptocurrency, which has surged in value in recent weeks, had “crossed the Rubicon” on the question of whether it’s a good store of value, and said he considers it a better investment than gold at the moment. About 25% of his money is tied up in crytpocurrencies, he said.

- New York’s future – “New York taxes are certainly as high as they can go and we’re seeing that outflow of human capital. Services are gonna go down and so it’s gonna be a very tough run for city.” As for those who left because of coronavirus, he expects it could be six months to a year after the “all-clear sign” before many of them return.

Excerpts from the Novogratz interview below:

[youtube https://www.youtube.com/watch?v=tVUBcOyqOGE]

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com