Will Skilled Hands-On Labor Finally Become More Valuable?

Tyler Durden

Sun, 08/23/2020 – 12:40

Authored by Charles Hugh Smith via OfTwoMinds blog,

The sands beneath what’s scarce and what’s over-abundant are shifting.

On a recent visit to the welding shop where my niece’s husband works, I asked him if they had enough welders for their workload. His answer surprised me: “If you asked every welding shop in the country if they have enough welders, the answer would be no.”

The reasons for this disparity between the economic need and the workforce’s skills aren’t that complicated. Many of the skilled welders are Baby Boomers who are retiring or nearing retirement, and there aren’t enough younger trained welders to meet the need.

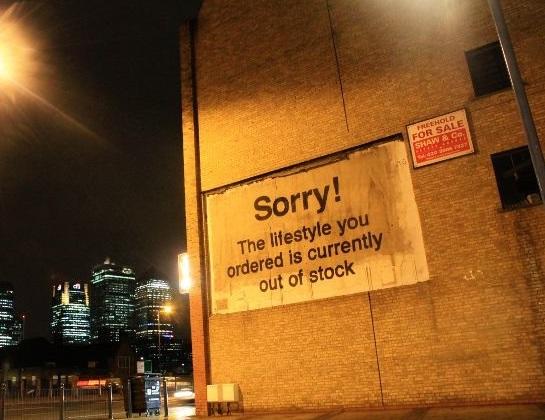

Though there appears to be an uptick in the number of young people interested in apprenticing to construction trades, the cultural zeitgeist has largely disdained hands-on, real-world skills in favor of making videos, becoming social-media influencers, joining an investment bank to make bank, working for a tech startup to score a quick million or two in stock options or if no creative way to make it big presents itself, join the cushiest bureaucracy available with lifetime security, or seek out a non-profit doing some virtue-signaling projects to pad your resume.

As for hands-on skills, becoming a chef certainly topped becoming a crane operator, as attaining semi-celebrity has become a core ladder of social mobility. The desirable livelihoods are creative, virtue-signaling, semi-celebrity and perhaps most importantly, clean white-collar (mostly digital) work.

On top of this cultural disdain we can overlay the general surplus of labor globally and the relative scarcity of profitable homes for capital. As I have often mentioned, the twin drivers of wealth for the past 30 years (arguably even longer) have been financialization and globalization, both of which heavily favor capital over labor, with the exception of tech-managerial skills needed to maximize profits in financialized, globalized ventures.

Could all these trends reverse? All trends eventually reverse (the way of the Tao is reversal), and so the question can be phrased: are we reaching the tipping point?

I have argued that we’ve reached Peak Financialization and Globalization, and these trends are now reversing.

As for the cultural zeitgeist, historian Peter Turchin has noted that national-imperial declines are characterized by a surplus of entitled elites (what Turchin calls “overproduction of parasitic elites”), stagnation of wages and a decay in public finances.

All three are clearly visible: there simply aren’t enough elite slots offering high pay, full security, cultural recognition and status, etc. for the millions of aspirants with advanced degrees, family connections, etc.– conditions that would have guaranteed an elite slot a generation or two ago.

Conventional wages have been stagnating or decades. Adjusted for inflation (which is understated), wages have stagnated since the 1970s, and even in the top tiers of employment, since 2000.

Public finances were precariously dependent on soaring debt before the pandemic, and now the explosion of debt is rapidly increasing the fragility of public finances globally.

Central banks can create money out of thin air, but they can’t create skilled, experienced workers out of thin air. That takes years of training, experience, effort and dedication.

Longtime readers know that I focus considerable attention on scarcity as the source of value and on the difference between tradable and untradable labor. Digital editing of a video can be done anywhere on the planet, so it’s tradable. Welding a boat trailer or installing a roof vent must be done locally, so it’s untradable.

What’s tradable is unlikely to be scarce (and thus valuable) while what’s untradable could well be scarce (and thus valuable)–for example, high-level welding skills.

History offers a number of examples of labor gaining value while capital lost its footing.

The Black Death killed so much of the workforce (40% or more) that the survivors were able to command a premium for their labor and also break free of feudal constraints by moving to so-called “free cities” in the Netherlands and elsewhere to set up shop as independent craftspeople / entrepreneurs. This fueled the rise of the middle class and what we might call classical capitalism, as opposed to the distorted, parasitic, predatory finance capitalism that dominates the global economy today.

Another example is the hyper-inflation in pre-Nazi Germany, when owners of capital (financial wealth) complained bitterly about the soaring wages demanded by skilled craftspeople.

Think about it: a rich person needs some welding, plumbing, etc. done as a necessity, not as a luxury. The skilled worker refuses payment in increasingly worthless “money” (currency) and demands payment in gold or silver. What can the (formerly rich) person do but pony up the gold?

The sands beneath what’s scarce and what’s over-abundant are shifting, and those skills that are untradable are increasingly likely to become more valuable than either tradable labor or conventional capital, which faces rapid depreciation as the wheels fall off financialization and dependence on debt to fuel over-consumption.

* * *

My recent books:

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World ($13)

(Kindle $6.95, print $11.95) Read the first section for free (PDF).

Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic ($6.95 (Kindle), $12 (print), $13.08 ( audiobook): Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake $1.29 (Kindle), $8.95 (print); read the first chapters for free (PDF)

Money and Work Unchained $6.95 (Kindle), $15 (print) Read the first section for free (PDF).

* * *

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com