US Manufacturing Storms Ahead: ISM Smashes Expectations As New Orders Soar To 16 Year High

Tyler Durden

Tue, 09/01/2020 – 10:14

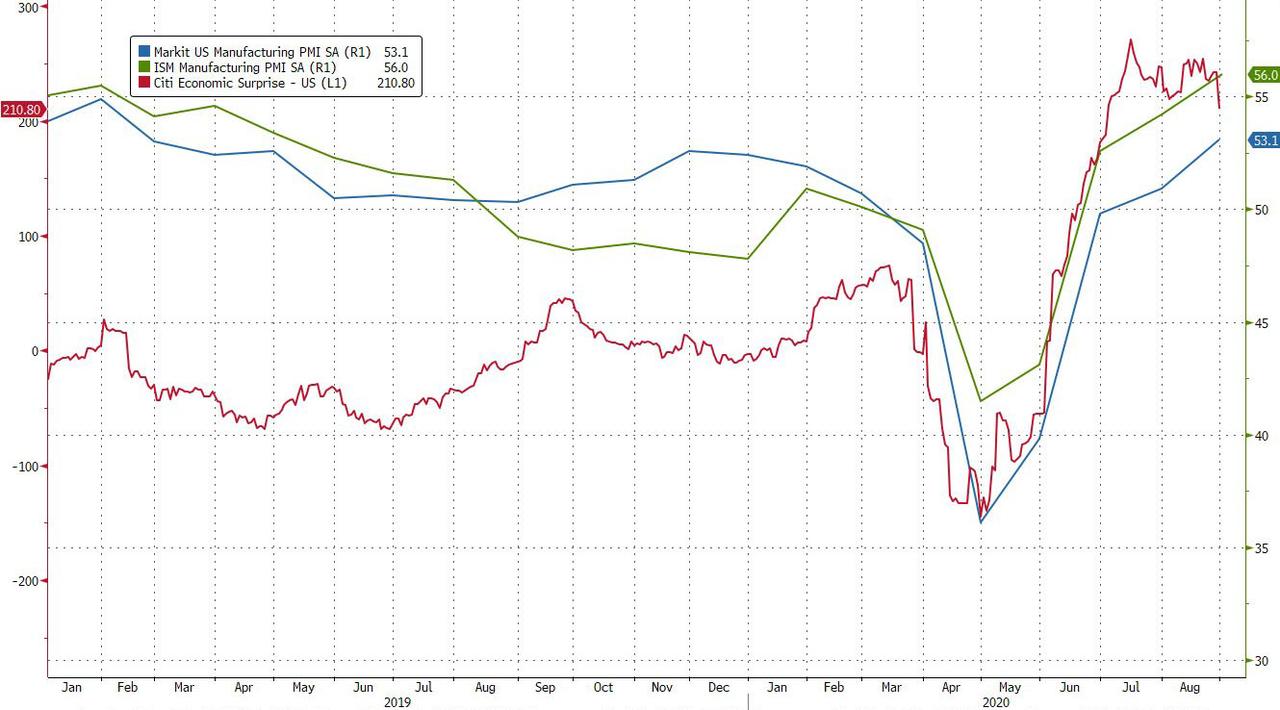

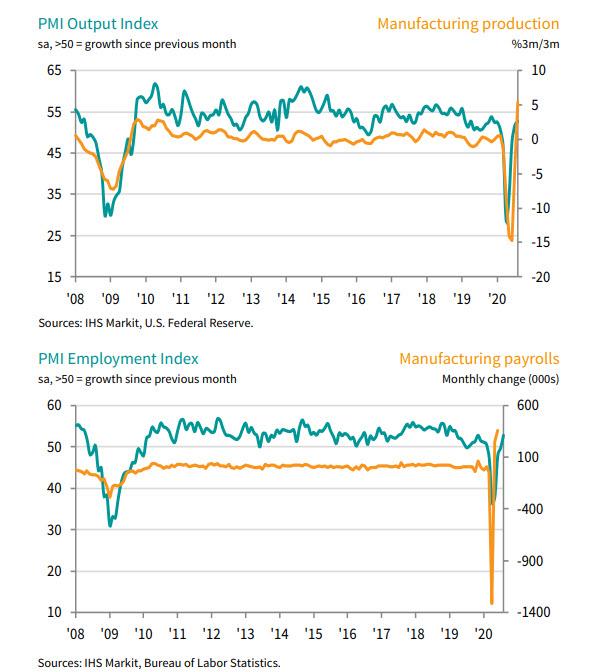

Following more rebounds in ‘soft’ manufacturing survey data in Europe and Asia (and LatAm – Brazil Manufacturing PMI exploded to a record in July), both ISM and Markit’s measures of US manufacturing sentiment were expected to continue their v-shaped recovery, and they did just that, when first the Markit PMI printed at 53.1, the highest level since January 2019, followed by the ISM Manufacturing, which smashed expectations, printing at 56.0, the highest since November 2018.

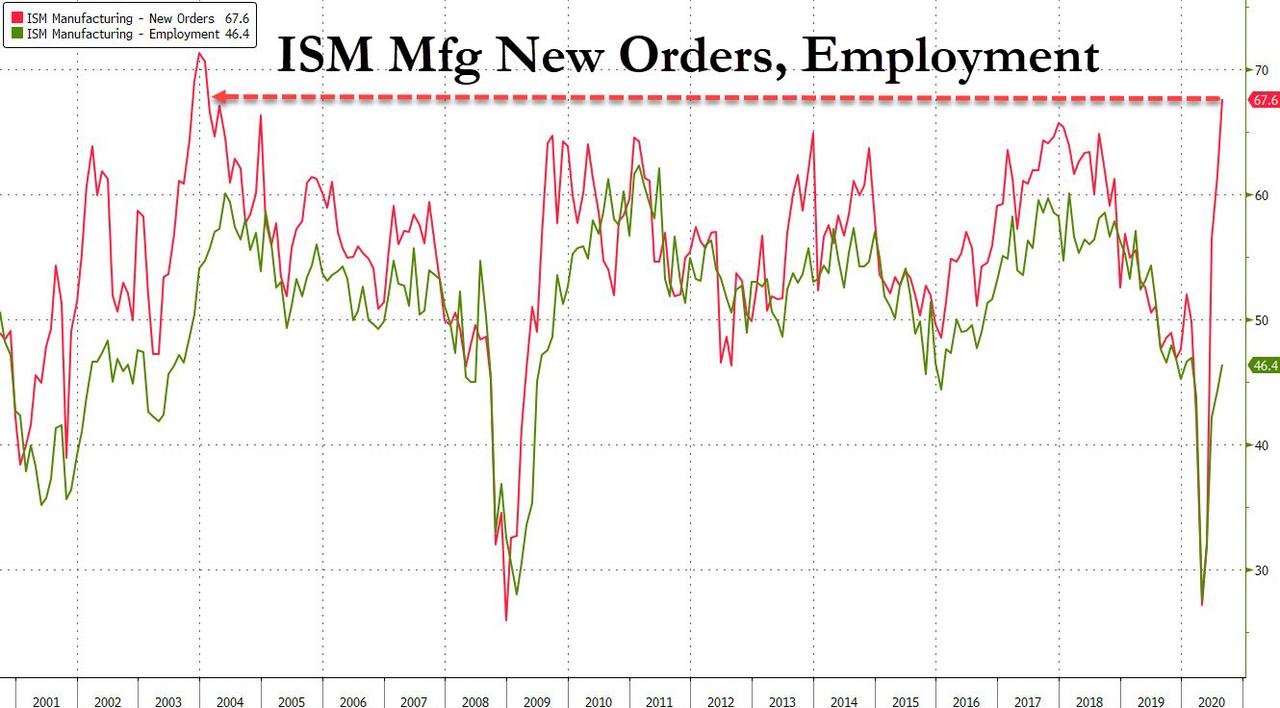

Just like last month, the ISM surge was driven largely by New Orders which spiked from 61.5 to 67.6, the highest level since Jan 2004, and while employment continued to rise, from 44.3 to 46.4, it remains in contraction territory.

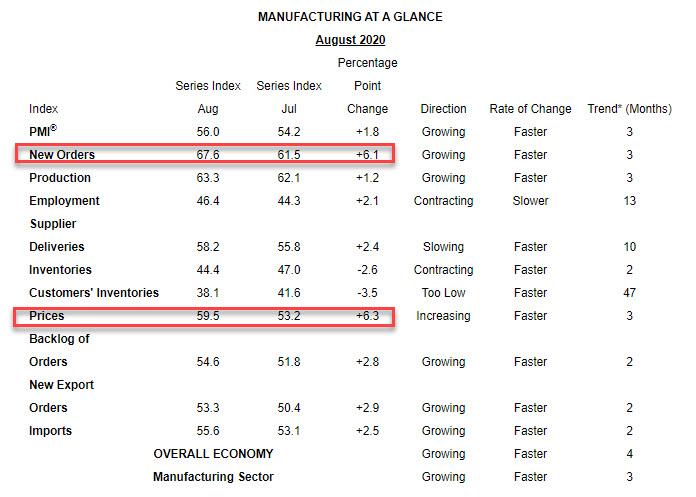

Looking across the data, virtually all ISM components improved with the exception of Inventories which dipped for both producers and customers, a sign that destocking is taking place and which is actually bullish for even more future demand.

On ISM, Chair Timothy Fiore said that “The August PMI registered 56 percent, up 1.8 percentage points from the July reading of 54.2 percent. This figure indicates expansion in the overall economy for the fourth month in a row after a contraction in April, which ended a period of 131 consecutive months of growth. The New Orders Index registered 67.6 percent, an increase of 6.1 percentage points from the July reading of 61.5 percent. The Production Index registered 63.3 percent, up 1.2 percentage points compared to the July reading of 62.1 percent. The Backlog of Orders Index registered 54.6 percent, an increase of 2.8 percentage points compared to the July reading of 51.8 percent. The Employment Index registered 46.4 percent, an increase of 2.1 percentage points from the July reading of 44.3 percent. The Supplier Deliveries Index registered 58.2 percent, up 2.4 percentage points from the July figure of 55.8 percent.

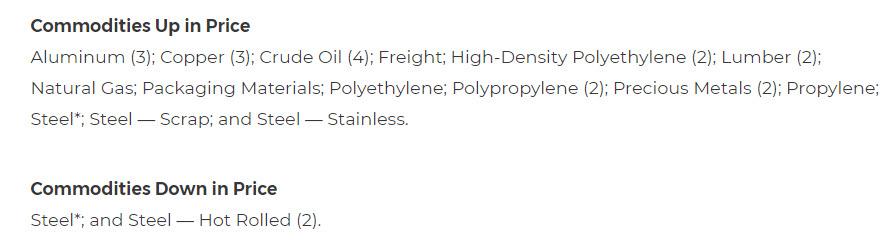

And while the Fed is desperate to average inflation higher, the ISM confirmed that at the commodity level, virtually everything was more expensive:

Meanwhile, unlike last month, when the Markit PMI unexpectedly missed, this time there was convergence between the two series, with Markit noting that the strongest Mfg PMI since Jan 2019 “was underpinned by stronger new order growth as exports rose at the quickest pace for four years.”

The ISM Survey respondents were mixed even as optimism about the future seemed to prevail (except for airlines), although some expressed concerns about the ongoing covid crisis, while others noted that some weakness is starting to emerge:

- “Watching COVID-19 situations in Mexico, Brazil, Philippines [and] Hong Kong. High rates of COVID-19 surging. Currently, lines of supply no longer impacted by COVID-19 related events.” (Computer & Electronic Products)

- “Business is very good. Production cannot keep up with demand. Some upstream supply chains are starting to have issues with raw material and/or transportation availability.” (Chemical Products)

- “Airline industry continues to be under great pressure.” (Transportation Equipment)

- “Current sales to domestic markets are substantially stronger than forecasted. We expected a recession, but it did not turn out that way. Retail and trade customer markets are very strong and driving shortages in raw material suppliers, increasing supplier orders.” (Fabricated Metal Products)

- “Homebuilder business continues to be robust, with month-over-month gains continuing since May. Business remains favorable and will only be held back by supply issues across the entire industry.” (Wood Products)

- “We are seeing solid month-over-month order improvement in all manufacturing sectors such as electrical, auto and industrial goods. Looking to add a few factory operators.” (Plastics & Rubber Products)

- “Rolling production forecasts are increasing each week compared to prior forecast.” (Primary Metals)

- “[Production ramp-up] has been a struggle. We have started and stopped lines numerous times at all 18 of our manufacturing plants due to COVID-19 issues. Surprisingly, our direct suppliers have done an excellent job on shipping ingredients and packaging on time.” (Food, Beverage & Tobacco Products)

- “Strong demand from existing and new customers for our products, stable-to-decreasing input costs for our operations, and record numbers of new business opportunities from prospective customers’ reshoring measures. All trends continuing from the first quarter of fiscal year 2017.” (Electrical Equipment, Appliances & Components)

- “Capital equipment new orders have slowed again. Quoting is active. Many customers waiting for the fourth quarter to make any commitments.” (Machinery)

- “We are starting to see parts of our business rebound in August, while other parts remained weak. Some of our export business has come back for the first time since the start of COVID-19; however, domestic portfolios remain mixed.” (Paper Products)

On PMI, Chris Williamson, Chief Business Economist at IHS Markit notes, made an interesting observation: while new export orders surged, “new orders and export sales at smaller manufacturers continued to fall, highlighting an unbalanced recovery in favor of larger firms.“

“The manufacturing upturn gained further ground in August, adding to indications that the third quarter should see a strong rebound in production from the steep decline suffered in the second quarter.

“Encouragingly, new order inflows improved markedly, outpacing production to leave many companies struggling to produce enough goods to meet demand, often due to a lack of operating capacity. Backlogs of uncompleted work consequently rose at the fastest rate since the early months of 2019, encouraging increasing numbers of firms to take on more staff.

“Key to the upturn was a jump in new export orders, which rose at the fastest rate for four years, reflecting improving demand in many foreign markets, and benefitting larger companies in particular. Disappointingly, new orders and export sales at smaller manufacturers continued to fall, highlighting an unbalanced recovery in favor of larger firms.

Overall a strong report for the month of August which may end up being a problem for the broader economy as it eliminates the need for an urgent intervention by Congress to reboot the fiscal spending that expired on July 31.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com