“No Recovery In Sight”: Container Volumes At The Port Of Los Angeles Flatline

Tyler Durden

Mon, 09/07/2020 – 21:00

Submitted by Christopher Dembik, head of macro analysis at Saxo Bank

In today’s edition, we focus once again on global trade and the U.S. economy in these unusual circumstances.

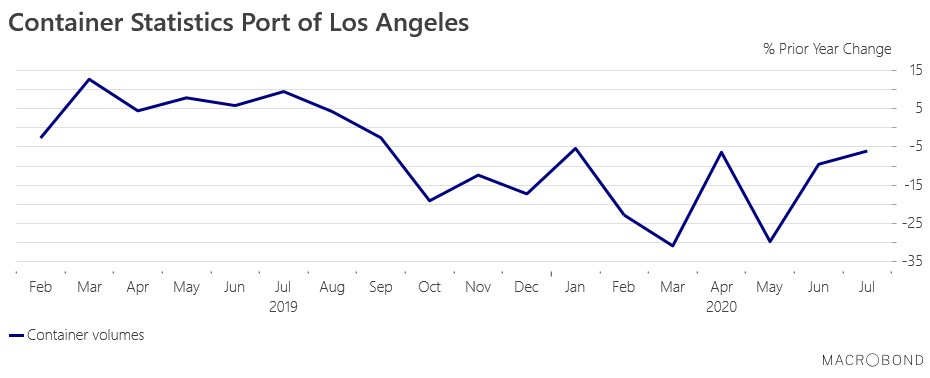

One of our favorite coincident trade indicators is the evolution of container volumes at the Port of Los Angeles. As it is the number one port in the U.S. in terms of container volume and value and the busiest entryway for ocean trade with China, any major change in data could be of great significance for the global and U.S. outlooks.

The least we can say is that the economic panorama has hardly improved in recent months if we rely on shipping data.

YoY statistics about container volumes are still in contraction with the latest figure for July out at minus 6.11% after a lowest point reached at minus 30.94% at the start of the outbreak in March. If we look at the below chart, there is no V-shaped or U-shaped recoveries in sight for the shipping industry but rather a W-shaped recovery.

Despite the effective containment of the outbreak in China, the global supply chain has not fully-recovered and global trade remains hampered by the resurgence of the virus in many countries, notably in some U.S. states, and related economic uncertainty.

The shipping industry will certainly take years to recover from coronavirus. Statistics for the month of August, that should be released around September 15, should confirm the Port of Los Angeles is not out of the woods yet and the economic recovery has reached a plateau in many developed countries, including the U.S., in August, as pointed out by numerous high-frequency data.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com