Rabobank: In Epic Flop-Flop The WHO No Longer Supports Lockdowns “Because They Make Poor People Poorer”

Tyler Durden

Mon, 10/12/2020 – 09:55

By Michael Every of Rabobank

Forget that it’s mid-October, or pretend you are in Sydney or Asia or the Med or the equivalent. Flip flops are so hot right now.

First into them, the PBOC. They had been happy to sit back and watch CNY power ahead vs. USD (and even vs. the CFETS currency basket it is actually pegged to). Partly that was just a weaker USD vs. major crosses and China wanting to show it was one too and not an EM. Partly it was the undeniable lack of tourist capital flight (I mean spending), a surge in Chinese exports of laptops and PPE, and a surge of capital inflows from a Wall Street incapable of reading the newspaper. Anyway, CNY had been gaining in a big way, including a 1.6% move on Friday as it resumed trading after a holiday.

Then over weekend, as is its wont, the PBOC removed a two-year old rule designed to prop CNY up, removing the 20% deposit required on FX forward trades. This makes it cheaper and easier to bet against CNY. That and a message from on high that the PBOC doesn’t want to see rapid appreciation, or one way bets, has seen CNY dip, helping USD vs. most other related crosses. It also underlines the message for the umpteenth time that this is not a free market: how many of the FX analysts saying CNY would keep moving towards 6.50 short term were unable to remember that key fact? Stability, stability, stability is always en vogue. The problem, like En Vogue, is that ‘You’re never gonna get it’.

As long argued here, the only way to impose an artificial stability on a currency with an economy so large is for everyone else globally to just accept the ‘externalities‘ – in this case the massive export surpluses China is once again running. Perhaps if CNY kept going to 6 or 5, these would resolve themselves (triggering other forms of instability in China, and hence undesirable). But with no sign of that happening, others are moving politically – and so are supply chains. We just don’t see it right not because of the Covid-19. Despite the ‘never gonna get them’ of prominent Pollyanna-lysts, supply chains are moving out of China: we are just in a holding phase ahead of the US election before the process either continues or accelerates rapidly, depending on the outcome. That’s a strategic flip-flop that will reshape the world as it happens.

Perhaps faster than one thinks too. As we flagged last week, today is the 90-day deadline from the passage of the US’ Hong Kong Autonomy Act to name all individuals responsible, in US eyes, for actions detrimental to that eponymous cause: which then starts a count-down of 30 days minimum to 60 days maximum, after which the financial institutions that have significant dealings with said individuals are named; and then sanctions can then be imposed on those banks; 12 months from 30-60 days from now, five of ten sanctions on those banks are obligatory; after 24 months, all ten, including loss of access to USD, are obligatory. Unless the US, which just cracked down hard with new Iranian sanctions, and where President Trump is talking about China “paying a huge price”, are about to flip flop and let that first legally-imposed deadline slip. One can see the argument for CNY slipping more, in other words, and again dragging other FX with it.

That’s also the case given that across the world, we see more signs of governments doing other flip flops and going back to what are in effect lockdowns. The UK is about to close more pubs, which is seen as a betrayal of Boris’s new Red Wall voters: who apparently all live and work in pubs(?) China has also seen a new outbreak in Qingdao, showing the virus just keeps popping back up again.

We also have news that it can last for weeks on some surfaces, such as bank notes, especially in cooler temperatures. So a wipe down might be in order too. At least our central banks will now have another excuse to dive headlong into the Brave New World of digital currencies. Don’t worry: this won’t be about replacing cash, or economic micro-management, or Orwellian control, or setting rates well below zero to force spending, or even imposing a balkanised global clearing system as in the 1930s. It will be to save us from Covid-19! Is there anything central banks can’t save us from? (Apart from a lack of inflation.)

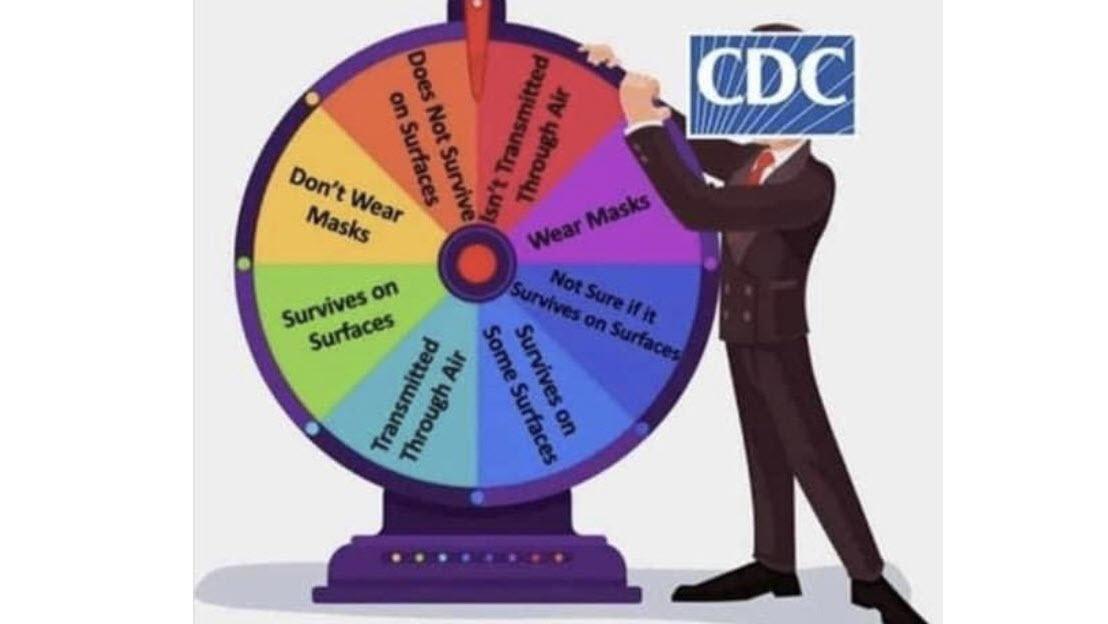

Except, ironically, that the WHO has just flip-flopped too and now no longer supports lockdowns ‘because they only make poor people poorer’. This is the same WHO which refused to call Covid-19 a global pandemic for weeks in the crucial early stages, and openly encouraged local and global travel, as it is doing again now. The same WHO which told us masks were not any use in the crucial early stages. The same WHO which supported lockdowns. Now it offers up the solution of generic platitudes: “Develop better systems…Work together and learn from each other.” This is not to advocate for or against lockdowns, but demanding a ‘better system’ is pretty loosey goosey from the body we are all supposed to be listening to. Yet one presumes some politicians will now opt to ‘follow the science’, which seems to be the political equivalent of an FX forecast that just chases spot, with all the inherent swings and roundabouts (and losses).

On which segue, this week has another deadline of course: Thursday is the date that the UK and the EU must agree the terms of departure or face the risk of a year-end Hard Brexit. It is unclear if or how BoJo will be able to agree to mutually acceptable terms on fish and on state aid, with France’s Macron apparently very insistent that the ‘level playing field’ argument is applied to the UK, broadly meaning that no industrial policy/levelling up can then be used. The eurosceptic Telegraph reports today that EU countries are apparently war-gaming scenarios for just that No Deal outcome,…which allegedly includes continuing to negotiate after the deadline has passed, rather taking some of the sting out of things if so. Except that the thinking seems to be that a period of “complete chaos” would then focus minds on what is the most logical thing to do next to resolve the problem properly.

Yet haven’t we seen from Covid-19 that this is not how politicians –or scientists– react in the face of or in advance of such chaos?

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com