Key Events In The Coming “Huge Week” For Global Markets

Tyler Durden

Mon, 11/02/2020 – 09:17

The coming week will be the busiest and most important 5 days of the year, if not decade. It is a “huge week” for investors with the election, a Fed decision, 128 S&P earnings, October payrolls, ongoing pandemic lockdowns and a ton of economic data all due.

“Whichever way you look at it, this coming week will be huge for U.S. and global markets,” said Simon Ballard, chief economist at First Abu Dhabi Bank PJSC. “We see the potential for a sharp rise in volatility around these events — and all in the context of a still deteriorating Covid-19 situation across much of the U.S., Europe and elsewhere.”

Starting with the pandemic, as DB’s Jim Reid writes this morning, Europe is facing up to a harsh winter ahead. The question to be asked to all the European countries is can they come out of these measures in some form towards the end of November/early December as is hoped or will they be extended further. The hit to the U.K. economy which just announced a new round of lockdowns will be softened by an extension of the furlough scheme but that will only add more to the debt. The hope everywhere is that well before the winter/spring peak virus season is over we’ll have the start of a vaccine program or more realistically in the near term a huge advance in rapid result testing. The latter has to be the greatest hope of restrictions being eased before a vaccine has mass rollout. Meanwhile, overnight Bloomberg reported that Italy might tighten restrictions further today with PM Conte wanting more localised curbs depending on virus transmissions – something some regional authorities are resisting.

Covid aside, of course the top event this week be tomorrow’s US election off the front pages for the next few days: 93.29 million have already voted so far, which is 67.7% of 2016’s total, and as Reid notes, “It’s fair to say markets could look very different on Wednesday morning as a “Blue Wave”, if it happens, should get the stimulus junkies hungry to buy and a divided government could remind people of the long winter ahead. So a very big week.“

While it is possible that we will not know the winner tomorrow night, due to the high number of mail-in ballots and the various state procedures around them, we will likely have some indication of how the race is leaning, according to DB. Florida and North Carolina could give a firm signal on the state of the race early on, as both have seen large numbers of early voters and are able to process and count mail-in ballots ahead of tomorrow’s poll closures. Without either of those states, President Trump’s path to re-election narrows. Polling averages continue to show a consistent lead for former Vice President Joe Biden, who is ahead by +8.5pts in the FiveThirtyEight national average, and by +7.2pts in the RealClearPolitics average. However, he leads by a lesser +3.3pt margin in RCP’s average of top battleground states. There will also be a big focus on the Senate races, with the FiveThirtyEight model giving Democrats a 76% chance to win control as we type.

Looking forward, attention will also be back on central banks for a second straight week, with both the Federal Reserve and the Bank of England announcing their latest monetary policy decisions on Thursday. Starting with the Fed, the central bank is expected to remain in a holding pattern this meeting but may lay groundwork for action at future ones. We are also likely to hear even more on the need for fiscal stimulus, as the minutes from the last meeting showed that many central bankers had included it in their outlooks. It could also be interesting to hear how the election results, if we have them, alter that outlook. For the Bank of England meeting that’s also on Thursday, our economists expect (link here) a dovish committee, with the November Monetary Policy Report highlighting further downside risks to the UK and the external growth outlook. They also see the majority of the MPC voting for additional stimulus, with £60bn added to the Bank’s Asset Purchase Facility. The latest lockdown could easily see this increased or see the probability of greater action.

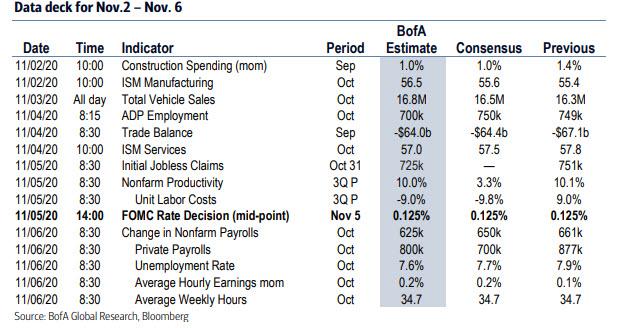

On the data front, the final October global manufacturing PMIs continue today in addition to the US ISM reading, before we see services and composite PMIs on Wednesday and Thursday. Also on Wednesday, we will see October inflation data for the Euro area. The week will end with US October payrolls and unemployment data on Friday. Never has payrolls been so far down the pecking order.

Lastly, it’s another big week on the earnings side too, with a total of 128 companies in the S&P 500 reporting over the week, along with a further 96 from the STOXX 600. In terms of the main highlights, today we’ll hear from Siemens, Clorox, Estee Lauder, PayPal Holdings and SBA Communications. Then on Tuesday, we’ll get releases from BNP Paribas, Bayer, Ferrari, Johnson Controls International, Humana, and Eversource Energy. Wednesday then sees reports from Danske Bank, Consolidated Edison, Vestas Wind Systems, QUALCOMM, MetLife, Allstate Corp and Public Storage. Then on Thursday, releases include Bristol-Myers Squibb Co, Zoetis, Linde, AstraZeneca, Regeneron Pharmaceuticals, Microchip Technology, Electronic Arts, American International Group and T-Mobile US. Lastly, on Friday, there’s Hershey, Allianz SE, CVS Health Corp and Marriott International.

Day-by-day calendar of events, courtesy of Deutsche Bank:

Monday

- Data: Final October manufacturing PMI in Japan, China, Spain, Italy, France, Germany, Euro area, UK, and US, US ISM manufacturing and new orders, and September construction spending

- Earnings: Siemens Healthineers AG, Clorox, Waste Management Inc, Estee Lauder Cos, PayPal Holdings Inc, SBA Communications Corp, Mondelez International Inc

Tuesday

- Data: France September budget balance, US September factory orders, durable goods, durables ex-transportation and October total vehicle sales

- Central Banks: Minutes of Bank of Japan September Meeting

- Earnings: BNP Paribas SA, Sinch AB, Bayer AG, Eaton Corp PLC, Emerson Electric Co, Sysco Corp, Ferrari NV, Johnson Controls International, Exelon Corp, Humana Inc, WEC Energy Group Inc, Securitas AB, Eversource Energy

- Politics: Voting ends in the US Election

Wednesday

- Data: Final October services and composite PMIs for China, Spain, Italy, France, Germany, Euro area, UK and US, Euro area PPI, US ADP employment change, trade balance and ISM services

- Earnings: Danske Bank, Consolidated Edison, Vestas Wind Systems, QUALCOMM Inc, MetLife Inc, Allstate Corp, American Water Works Co, Public Storage

Thursday

- Data: Final October services and composite PMIs for Japan, October construction PMIs for Germany and the UK, Germany September factory orders, UK October new car registrations, Euro area September retail sales, US weekly initial jobless claims, continuing claims and preliminary Q3 nonfarm productivity

- Central Banks: Federal Reserve rate decision and Fed Chair press conference, Bank of England rate decision and BoE Governor press conference

- Earnings: Bristol-Myers Squibb Co, Zoetis, Linde, AstraZeneca, Regeneron Pharmaceuticals, Dominion Energy, Ball Corp, Parker-Hannifin Corp, Cigna Corp, Duke Energy Corp, General Motors Co, Microchip Technology, Electronic Arts, American International Group, T-Mobile US Inc

Friday

- Data: Germany September industrial production, France 3Q private sector payrolls, September trade balance, current account balance, preliminary wages data, US October change in nonfarm payrolls, unemployment rate, average hourly earnings, final September wholesale inventories and consumer credit

- Earnings: Hershey Co, Allianz SE, CVS Health Corp, Marriott International Inc

Finally looking at just the US, where Goldman notes that the key economic data releases this week are the ISM manufacturing report on Monday, ISM non-manufacturing report on Wednesday, jobless claims on Thursday, and the employment report on Friday. The November FOMC meeting is this week, with the release of the statement at 2:00 PM ET on Thursday followed by Chair Powell’s press conference at 2:30 PM. There are no other scheduled speaking engagements from Fed officials this week reflecting the FOMC blackout period. Election Day is on Tuesday, and states will report results over the course of the night.

Monday, November 2

- 10:00 AM ISM manufacturing index, October (GS 56.1, consensus 55.8, last 55.4): We expect the ISM manufacturing index to edge up by 0.7pt to 56.1 in the October report, reflecting strength in regional manufacturing surveys and foreign PMIs.

- 10:00 AM Construction spending, September (GS +1.2%, consensus +1.0%, last +1.4%): We estimate a 1.2% increase in construction spending in September, with scope for increases in private residential and public construction.

Tuesday, November 3

- Election Day: Results for 435 House elections, 35 Senate elections, and the presidential election will be reported over the course of the night.

- 10:00 AM Factory orders, September (GS +0.9%, consensus +1.0%, last +0.7%); Durable goods orders, September final (last +1.9%); Durable goods orders ex-transportation, September final (last +0.8%); Core capital goods orders, September final (last +1.0%); Core capital goods shipments, September final (last +0.3%): We estimate factory orders increased by 0.9% in September following a 0.7% increase in August. Durable goods orders rose by 0.8% in the September advance report, and core capital goods orders rose by 1.0%.

Wednesday, November 4

- 08:15 AM ADP employment report, October (GS +575k, consensus +650k, last +749k); We expect a 575k gain in ADP payroll employment, reflecting jobless claims declining at a slower pace in October.

- 08:30 AM Trade balance, September (GS -$63.6, consensus -$63.9, last -$67.1bn); We estimate the trade deficit decreased by $3.5bn in September, reflecting a decline in the goods trade deficit.

- 10:00 AM ISM non-manufacturing index, October (GS 57.0, consensus 57.5, last 57.8); We estimate the ISM non-manufacturing index declined by 0.8pt to 57.0 in October, reflecting sequential weakness in retail, leisure, and hospitality. In addition, the index appears elevated compared to regional surveys.

Thursday, November 5

- 08:30 AM Initial jobless claims, week ended October 31 (GS 745k, consensus 735k, last 751k); Continuing jobless claims, week ended October 24 (consensus 7,350k, last 7,756k): We estimate initial jobless claims decreased to 745k in the week ended October 31.

- 08:30 AM Nonfarm productivity, Q2 preliminary (GS +5.3%, consensus +5.0%, last +10.1%); Unit labor costs, Q2 preliminary (GS -10.5%, consensus -10.0%, last +9.0%): We estimate nonfarm productivity grew by 5.3% in Q3 (qoq saar), reflecting a relatively larger increase in business output than in hours worked. We expect Q3 unit labor costs—compensation per hour divided by output per hour—to decrease by 10.5% qoq ar.

- 02:00 PM FOMC statement, November 4-5 meeting: As discussed in our FOMC preview, we expect the FOMC to eventually provide a timeline for asset purchases, but not at the November meeting. Without further discussion of policy changes, the meeting should be fairly quiet, and we expect few changes to the FOMC statement.

Friday, November 6

- 08:30 AM Nonfarm payroll employment, October (GS +500k, consensus +600k, last +661k); Private payroll employment, October (GS +600k, consensus +700k, last +877k); Average hourly earnings (mom), October (GS +0.1%, consensus +0.2%, last +0.1%); Average hourly earnings (yoy), October (GS +4.5%, consensus +4.6%, last +4.7%); Unemployment rate, October (GS 7.7%, consensus 7.7%, last 7.9%): We estimate nonfarm payrolls rose 500k in October after +661k in September. The smaller number of workers on temporary layoff (4.6mn in September, down from 18.1mn in April) reduces the scope for the rapid job gains seen in the summer, and the virus resurgence and softer Big Data employment signals are consistent with a deceleration in underlying job growth. While continuing claims declined sharply during the payroll month, much of the drop reflected the expiration of program eligibility (as opposed to reemployment). Our forecast also reflects a decline in retail payrolls due to the accelerating shift to ecommerce in the upcoming holiday season. We also expect another weak education reading due to virtual schooling (the October seasonal factors assume half a million support staff returning to work). We also expect a 125k drop in Census jobs in Friday’s report. We estimate the unemployment rate declined by two tenths to 7.7%, reflecting an increase in household employment partially offset by higher labor force participation. We estimate average hourly earnings rose 0.1% month-over-month, lowering the year-on-year rate by two tenths to 4.5%. This forecast reflects a continuing unwind of the composition shift from lower – to higher-paid workers.

- 10:00 AM Wholesale inventories, September final (consensus -0.1%, last -0.1%)

Source: Deutsche Bank, BofA, Goldman

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com