“Gen Y Is Out, Gen Z Is In”: Why One Bank Thinks Gen Z “Are The New Global Influencers”

Tyler Durden

Wed, 11/18/2020 – 22:50

It seems like only yesterday that Wall Street was writing massive research reports how the Millennials were going to “make a difference” in the world as a result of their “pent up” purchasing power which was just waiting to be unleashed. Unfortunately, in retrospect the Millennials were a huge disappointment, having made absolutely no “difference” in the world (the Fed decided to make if it for them) despite having created millions of ingeniously airbrushed Instragram posts. And so, with Wall Street desperate to pin its hopes on someone who will prove to be the spending dynamo that pushes the US economy out of the doldrums – which is Millennials were supposed to be – the street has shifted it attention to those next in line, namely…

Gen Z (i.e., 20-year-olds).

In one of its massive “thematic investing” primers which doubles as a paperweight thanks to its hundred + pages of recycled content (copy a chart, replace Millennials with Gen Z, paste) Bank of America writes that “Here come the Zillennials! Gen Y is out, Gen Z is in” (which is oddly reminiscent of a similar primer the bank wrote a few years back when it said virtually the same things about Millennials).

But we digress: in an intro that will hardly endear Bank of America to the millions of 20-year-olds who are supposed to change the world, now that Gen Y has been cast into the trash bucket of demographics, the bank writes that “despite having an attention span shorter than a goldfish’s (8 seconds) Gen Z is the most disruptive generation ever and sees themselves as ‘citizens of the world’.

It only gets funnier better: The bank next claims that the generation that was born online and is now entering the workforce “is compelling other generations to adapt to them, not vice versa.” We doubt any Gen Z employers actually agree with that laughable assessment in a labor market where they can hire far more experienced unemployed substitutes from Gen X, and even Boomers (while getting some actual work ethic in the bargain).

To make its recycled argument that Millennials Gen-Z will change the world, BofA argues that this generation “is set to grow incomes 5x to $33tn by 2030 and will surpass Millennials by 2031.” Right… maybe if the Fed deposits trillions into their digital dollar accounts.

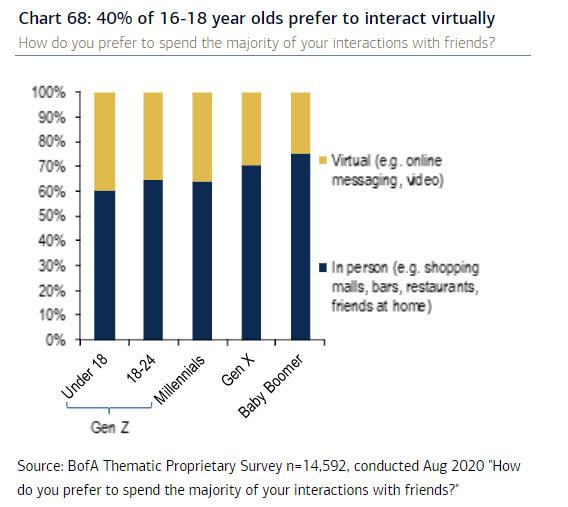

Sarcasm aside, and while there is much, much more in the full note, a quick recap of the points made by BofA analyst Haim Israel is that the “clicktivist” generation is “socially involved” that spend much of their time online, with 40% preferring to hang out with friends virtually rather than in person.

He adds that “having lived through the ’08 Financial Crisis and seeing its impact on their families, they are financially conservative and cautious about credit cards and taking on debt. Sectors that stand to benefit from Gen Z include eCommerce, payments, luxury, media and ESG while those structurally challenged include alcohol, meat, cars, shopping malls and old media.”

Below we present some of the more notable excerpts from the massive “generational” report:

Here come the Zillennials! Gen Y is out, Gen Z is in

They’ve never known a life without Google, 40% prefer hanging out with friends virtually than in real life, they will spend six years of their life on social media and they won’t use credit cards. They’re the ‘clicktivists’: flourishing in a decade of social rights movements, with 4 in 10 in our proprietary BofA seeing themselves as ‘citizens of the world’. The Gen Z revolution is starting, as the first generation born into an online world is now entering the workforce and compelling other generations to adapt to them, not vice versa. Thus, about to become most disruptive to economies, markets and social systems.

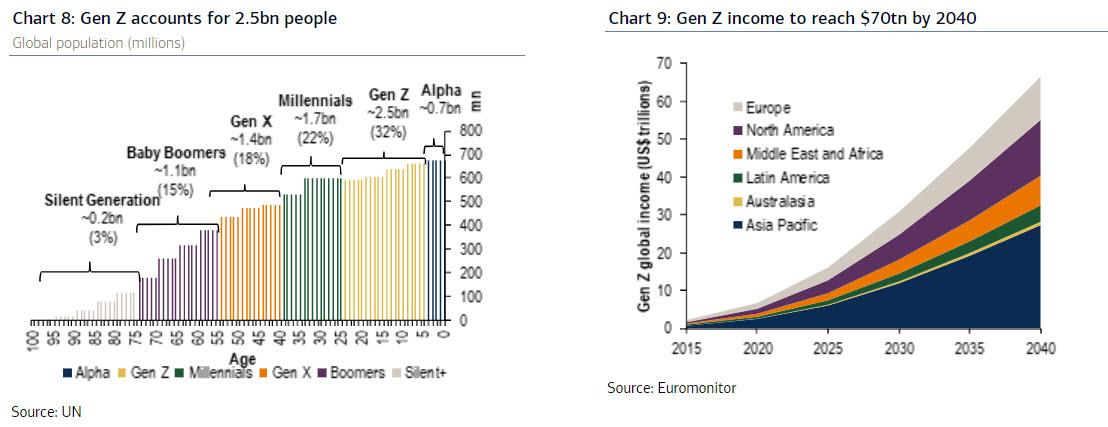

$33tn income by 2030, to pass Millennials by 2031

Gen Z’s economic power is the fastest-growing across all cohorts. This generation’s income will increase c.5x by 2030 to $33tn as they enter the workplace today, reaching 27% of global income and surpassing Millennials the year after. The growing consumer power of Gen Z will be even more powerful taking into account the ‘Great Wealth Transfer’ down the generations. The Baby Boomer and Silent generation US households alone are sitting on $78tn of wealth today.

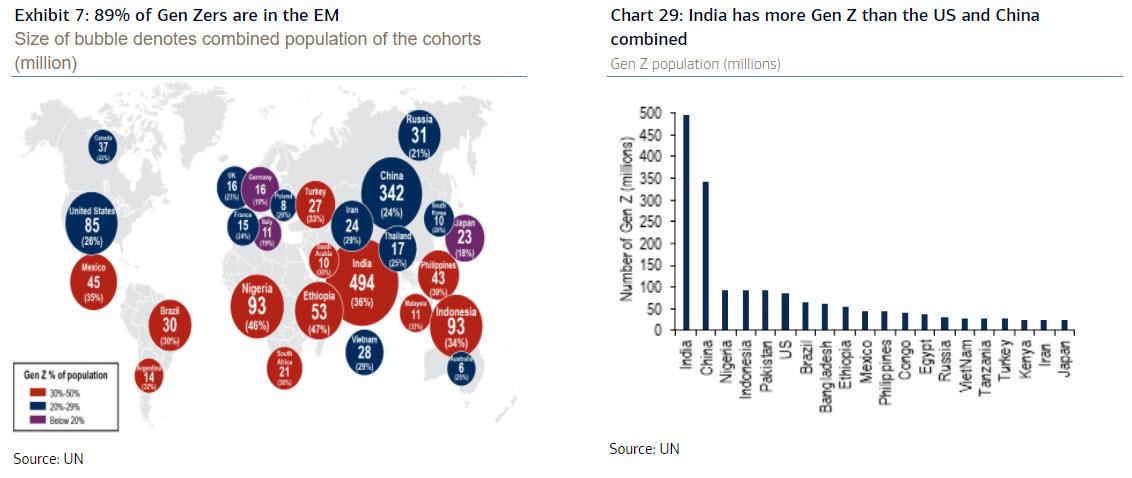

9 in 10 live in EM, while DM suffers from “peak youth”

Gen Z could be EM’s secret weapon. APAC income already accounts for over a third of Gen Z’s income and will exceed North American and European combined income by 2035. ‘Peak youth’ milestones are being reached across the developed markets – Europe is the first continent to have more over-65s than under-15s, a club North America will join in 2022. In contrast, India stands out as the Gen Z country, accounting for 20% of the global generation, with improved youth literacy rates, urbanisation, and rapid expansion of technological infrastructure. Mexico, the Philippines and Thailand are just a few of the EM countries that we think have what it takes to capitalize on the Gen Z revolution.

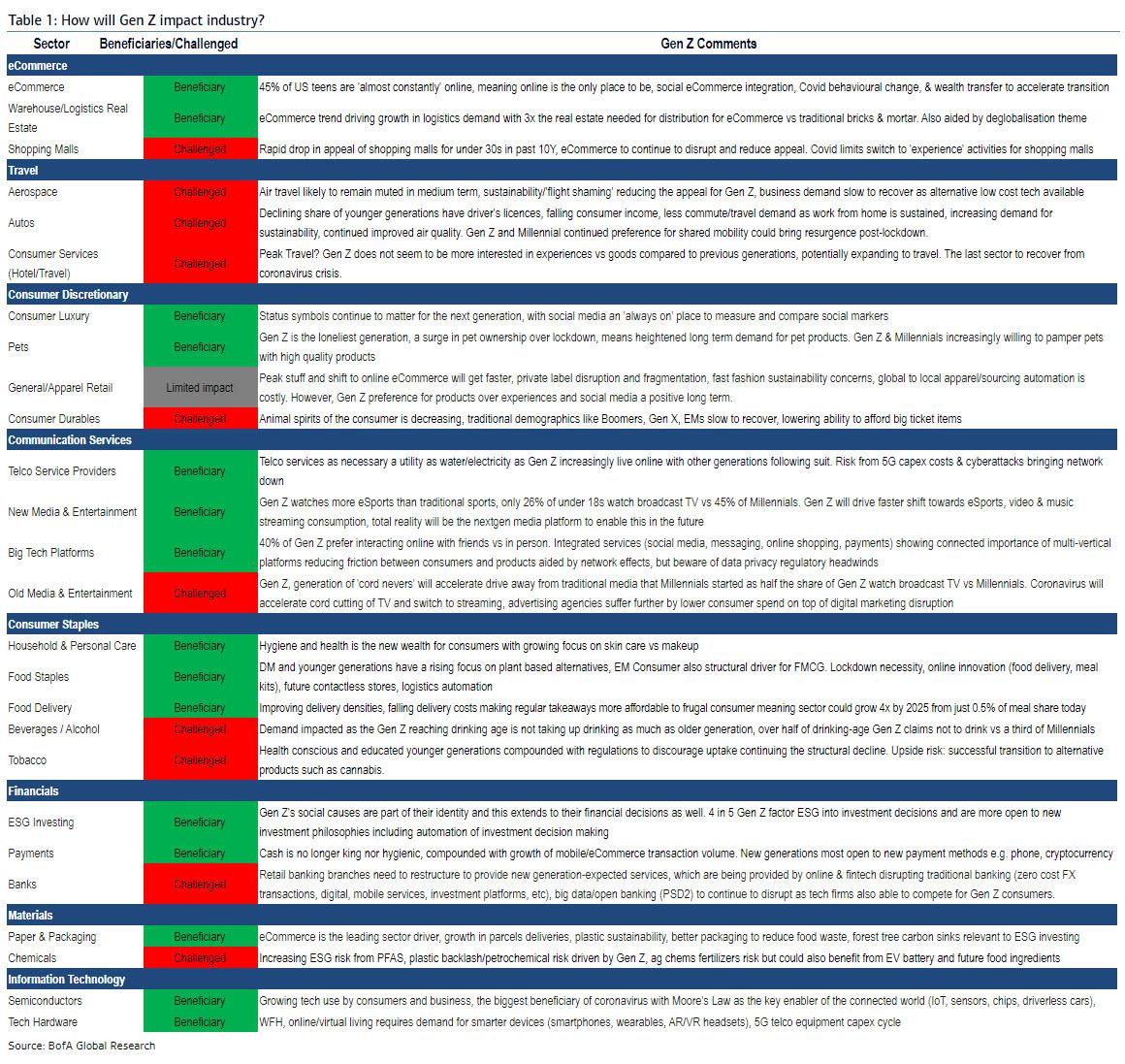

Beneficiaries: eCommerce, payments, luxury, media, ESG

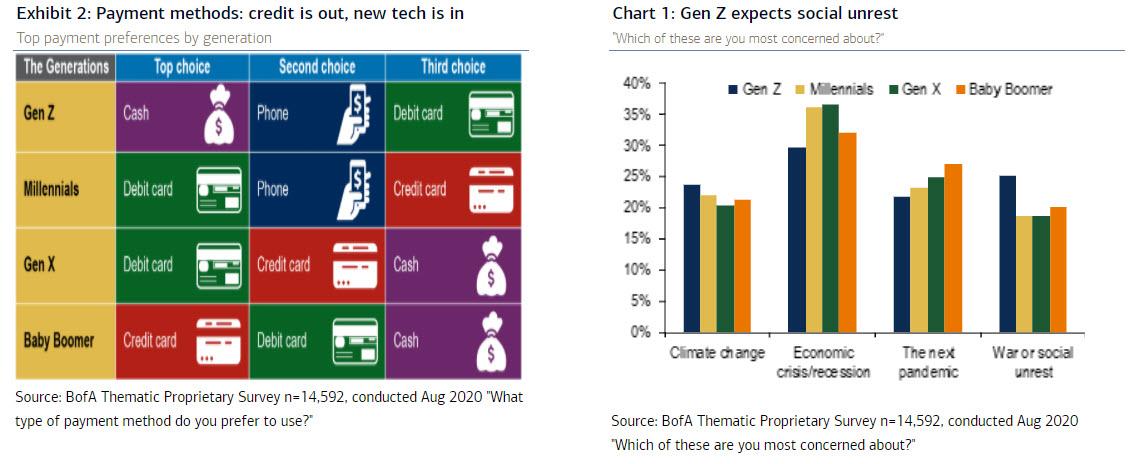

Gen Z is the online generation: nearly half are online ‘almost constantly’ and a quarter of them will spend 10+ hours a day on their phone. In our survey, over a quarter of Gen Z’s top payment choice was the phone, while credit cards weren’t even in their top 3. This generation is the least likely to pick experiences over goods, and values sustainable luxury – choosing quality over price as their top purchase factor.

“Peak” generation: alcohol, meat, cars, travel headwinds

Only half of US teens can drive, while our survey finds that less than half of Gen Z drink alcohol, and more than half have some kind of meat restriction. A third of them would trust a robot to make their financial decisions. Gen Z’s activist focus filters into their interactions with business, too – 80% factor ESG investing into their financial decisions, and they have also driven consumer-facing sustainability campaigns, such as single-use plastics. Harmful consumer sectors, such as fast fashion, may be the next focus.

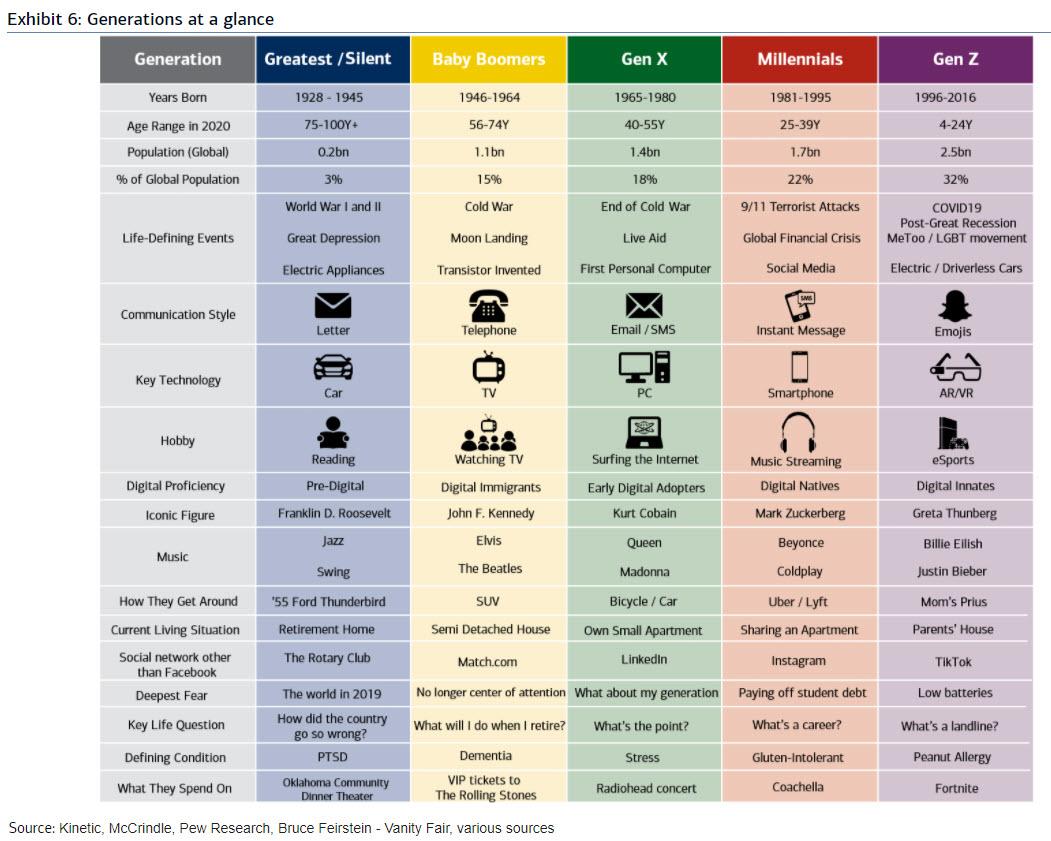

When were you born?

- Silent Generation (born 1928-1945, current age 92-75)

- Baby Boomers (born 1946-1964, current age 74-56)

- Generation X (born 1965-80, current age 55-40)

- Generation Y or Millennials (born 1981-1995, current age 39-25)

- Generation Z or Centennials (born 1996-2016, current age 4-24)

- Generation Alpha (born 2017-present, current age 3)

Generations at a glance

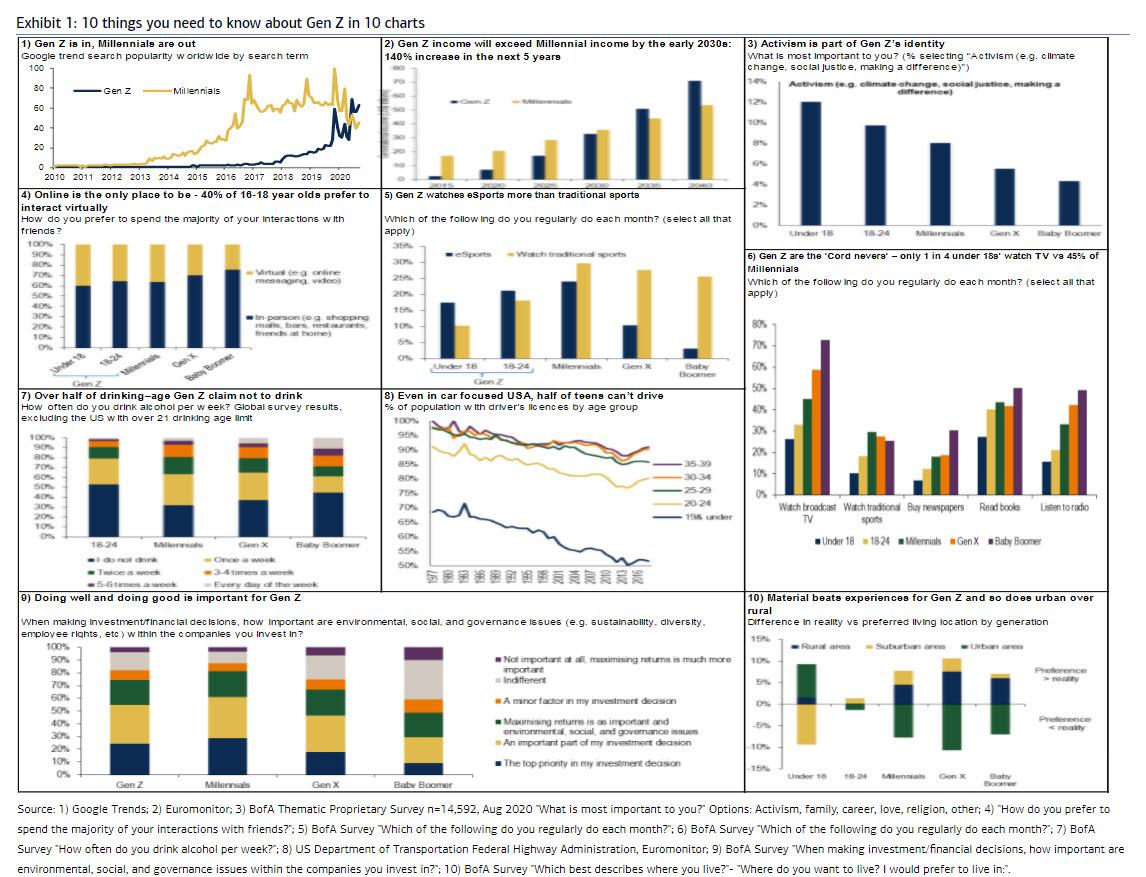

10 things you need to know about Gen Z in 10 charts

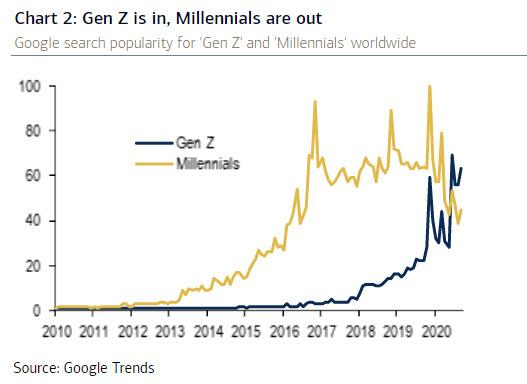

Millennials are old news: Gen Z searches are skyrocketing

Interest in Gen Z continues to grow, surpassing Millennials, as the new generation of consumers, workers, entrepreneurs and activists start to make their mark. We argue that businesses and investors need to start adjusting their strategies to reflect the growing political, social, and economic influence of this generation.

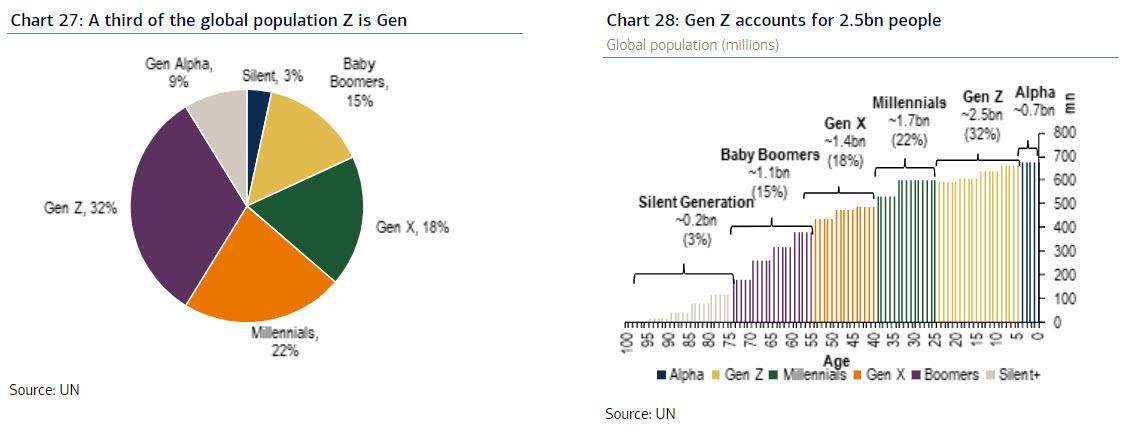

The largest generation: 2.5bn globally

Gen Z, born between 1996 and 2016, just entering the workforce, is the largest at 2.5bn individuals, accounting for 32% of the global population (source: Euromonitor, UN).

Five largest Gen Z countries account for 44% of Gen Z population

Of the 2.5bn Gen Z worldwide, 89% live in emerging and developing markets vs 72% in 1950. India, China, Nigeria, Indonesia, and the US are the five largest, accounting for 44% of the total Gen Z population. Specifically, India and China make up 19.8% and 13.7% of the global Gen Z population, respectively, while all other countries individually account for less than 4% each (source: UN, Euromonitor).

Gen Z 101: The global influencers: a population of 2.5bn and 140% growth in economic power over 5Y

Gen Z, born between 1996 and 2016, is the largest population at 2.5bn accounting for a third of the global total. Already, Gen Z has $7tn of income. In addition, this influential generation has the fastest-growing income, set to increase 140% in the next five years to $17tn in 2025 and $33tn by 2030. Gen Z is set to overtake Millennials’ total income by the early 2030s. The largest Gen Z markets by income are the US and China at $1.2tn and $1.1tn, respectively, followed by India, Japan, Germany, the UK and France. The influence of this generation is set to grow further as the great wealth transfer from Baby Boomers and Silent generation, who own $78tn in the US alone, is about to begin.

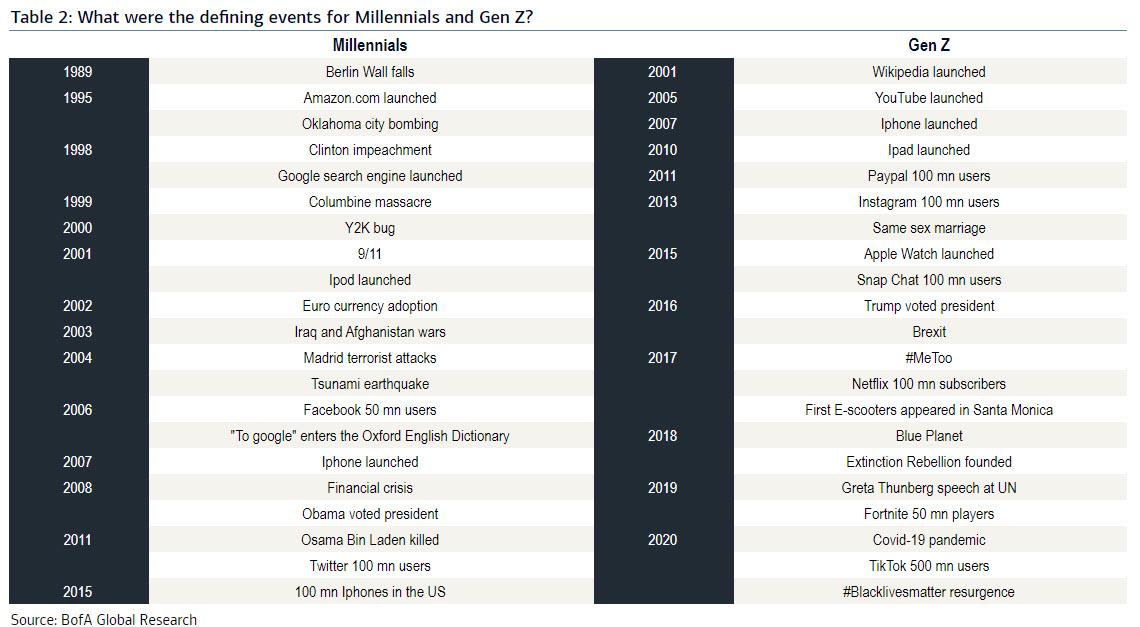

Gen Z is not Millennials 2.0: fiscally conservative, socially activist, materialistic

In contrast to Millennials, Gen Z have grown up in the shadow of the Great Financial Crisis in 2008-09 and during a decade of social activism. Social issues form part of Gen Z’s identity. They are digital dependents rather than Millennial digital pioneers. Also, the generation is more fiscally conservative than Millennials. However, some demographic factors remain similar for the two generations; both are delaying marriage, children, and homeownership, as well as postponing other traditional consumer purchases.

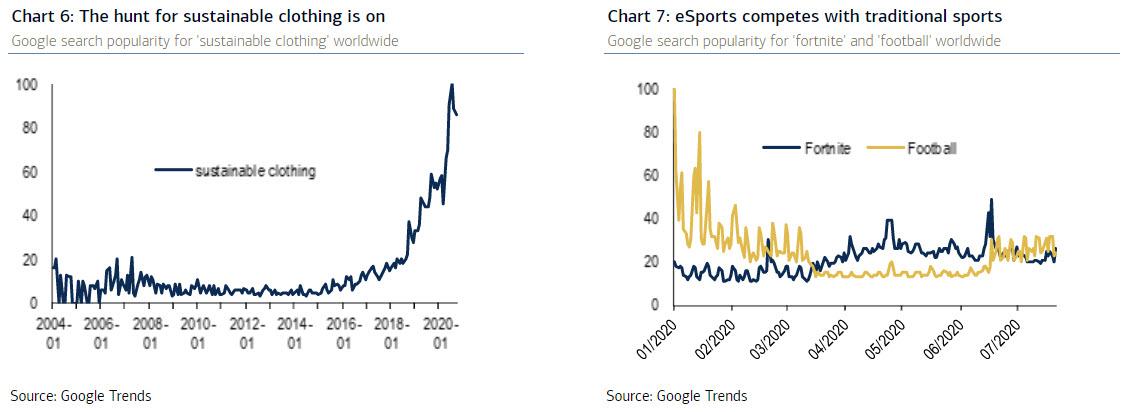

What’s Trending

Gen Z are not Millennials 2.0

Gen Z are different from Millennials. They don’t know a life without Google. They grew up in the aftermath of the financial crisis and flourished as social rights for LGBTQ+ and movements such as #metoo came to the fore. Also, they have experienced the brunt of the effects of the pandemic on their prospects as they enter the workforce. These experiences have shaped Gen Z to be a very different generation from Millennials – key activists on climate change, fiscally cautious, valuing luxury/quality over quantity, and better skilled for an automated world. We think financial markets often underestimate these differences, assuming Gen Z to be the same as their predecessors, missing the distinctions that help understand the changing new consumer.

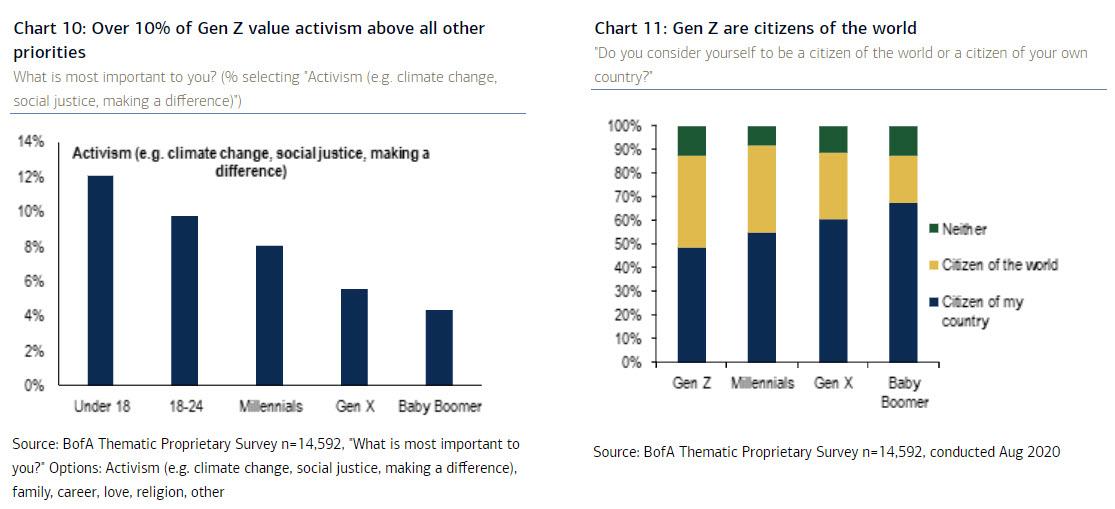

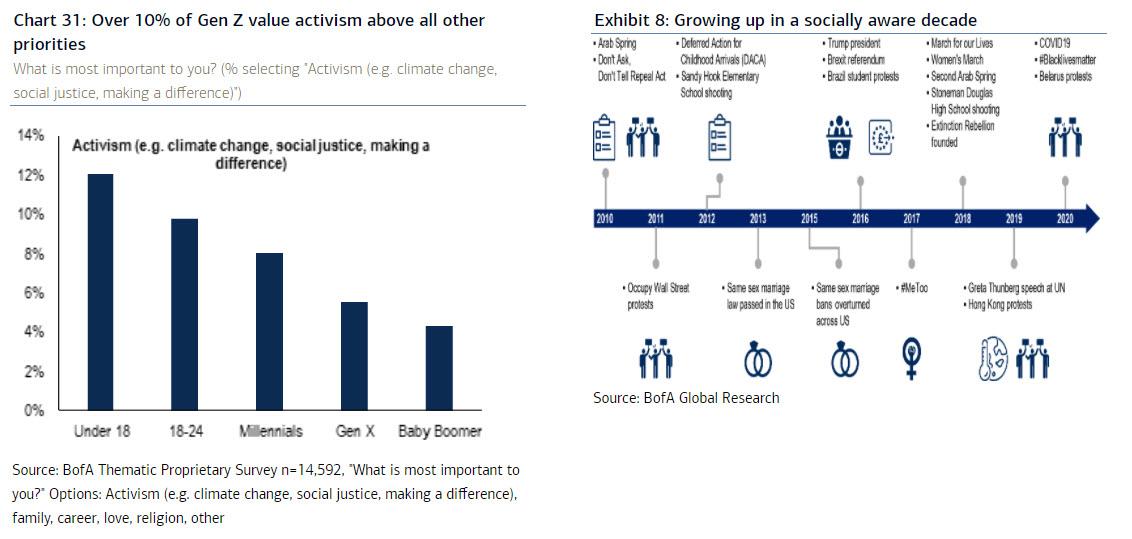

The political agenda: Gen Z are social champions

Activism forms part of Gen Z’s identity. Over 10% of Gen Z and 12% of under 18s surveyed claimed that activism was their priority over all other options, such as family, love, career, etc. This compares with 8% of Millennials and 4% of Baby Boomers. This activism will influence Gen Z’s decisions across sectors, from consumption of goods to education, work choices and financial investments.

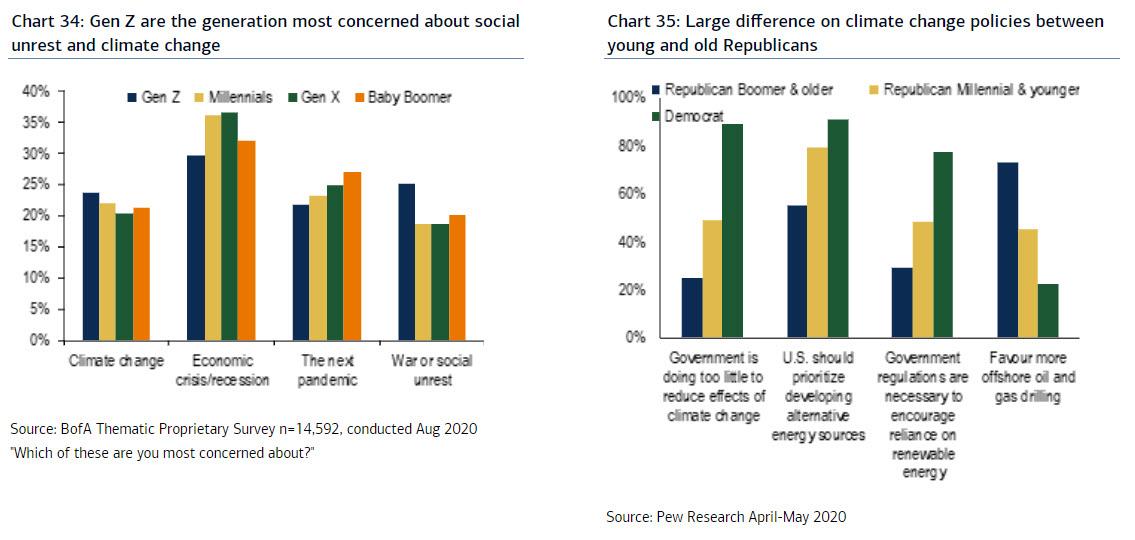

Gen Z is most concerned about climate change and social unrest

Gen Z’s passion for social causes directly translates into their major concerns. All generations are concerned about the economy and recession. However, Gen Z are the most concerned when it comes to social unrest and climate change. Even among Millennial and Gen Z Republicans, there is a much greater openness to clean energy and progressive climate change policy. 79% of Millennials and Gen Z that are Republican or Republican leaning think the US should be prioritising alternative energy sources compared with 55% of Baby Boomer Republicans and 91% of Democrats. 49% of young Republicans believe the government is doing too little to reduce the effects of climate change, double the share of Baby Boomer Republicans (source: Pew Research 2020).

BofA Generation Survey results

The BofA Thematic Demographics Survey polled over 14,500 consumers aged 16 and over across the US, UK, France, Germany, Japan, South Korea, China, India, Mexico, and Brazil. The survey was undertaken in late August 2020 and was an internet-based survey. A few key results:

- Gen Z would rather use cash than pay by credit card

- 45% of Millennials, the ‘cord cutter’ generation, still watch broadcast TV. In contrast, only a third of 18-24 year olds and just a quarter of under 18s do

- Teetotal generation: Over half of Gen Z does not drink alcohol at all, vs a third of Millennials

- 40% of 16-17 year olds prefer hanging out with friends virtually than in person

- c.1 in 3 Gen Z and Millennials would trust a robot to make their financial decisions

- More than four out of five Gen Zers factor ESG into their investing

- Four in 10 Gen Zers see themselves as ‘citizens of the world’ vs just two in 10 Baby Boomers

- “Generation rent”, Gen Z, is the only generation that does not want to move to the suburbs or countryside

- eSports is watched more often by Gen Z than traditional sports

- Only 14% of Gen Z expect their banks to have physical branches versus 40% of Baby Boomers

Did you know?

- $10tn of lifecycle earnings could be lost by today’s students due to Covid lockdowns.

- 9 out of 10 of Gen Z thinks it’s appropriate to use their phone in the bathroom, and 36% think it’s appropriate to use it in a place of worship

- Gen Z & Millennials have a much weaker handshakes than other generations

- Gen Z will spend nearly 6 years of their life on social media… that’s more time spent than eating, studying & socializing combined4

- Young surgeons are losing the dexterity to stitch up patients because they’re spending too much time swiping smartphone screens5

- Gen Z have a shorter attention span than goldfish, at 8 seconds

- Millennials are 5x more willing to share their clothes and 2x share their toothbrush than smartphone with their friends

- 55% of surgeons recently reported having patients mention social media as their primary reason for plastic surgery – up from 42% in 2015

- Gen Z must emit 8x less carbon than Baby Boomers to stay within 1.5C of warming

- The majority of US women no longer have children in their 20s10

- Over half of teenagers admit to sitting in silence on their phones, while hanging out with friends for long stretches of time

- Clicktivists: 72% of Gen Z believe they can be part of a social movement even if they participate only through social media

- Gen Z is the first cohort where the majority has some kind of meat restriction in their diet

- 58% of Gen Z said they can’t be without internet access for more than four hours before becoming uncomfortable

- 70% of Millennials would consider a lab-grown diamond, when getting married, which costs around a third less than a mined one

- Americans placed a cannabis order every 8 seconds in 2018…

- …But it’s a Baby Boomers industry, as they spend on average 53% more than Gen Z on marijuana in the US

How will Gen Z impact industry?

For much more, contact your local BofA sales coverage for the full report.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com