Is The Biggest “Consensus Trade” Of 2021 About To Blow Up

Suddenly the single most “consensus”, not to mention crowded trade of 2021 (as profiled earlier this week), looks like it is on the verge of blowing up.

We touched on this earlier, laying out how a dollar correction higher – which while welcome with both arms by China – is perhaps the one single development that could spoil the market party. Also touching on the possibility for a dollar short squeeze, is SocGen FX strategist Kit Juckes, whose Thursday note was aptly titled “Short-Squeeze for the Dollar”, in which he writes that “Valuations and relative rates suggest dollar weakness has some way to go this year, but there are plenty of reasons to be long here.” He explains below:

The chart is an update of one in theFX Outlook and shows DXY against a weighted average 2y interest rate of the constituents. Since we published the outlook last month, the rate differential has widened by 8bp in the dollar’s favor and the DXY has fallen by 2%. The gap is still there, but the two – rates and currency – have been moving in opposite directions. The tide of valuation is still dragging the dollar lower as it remains expensive relative to rates, but the prevailing wind, in the form of the direction those rates are moving, is going the other way. When the wind and tide go in opposite directions, the sea gets choppy – sometimes very choppy. With the added chaos caused by US politics, I can imagine that some of the holders of short dollar trades are feeling a bit seasick.

One final thought on the risk of a substantial dollar squeeze comes from Bloomberg’s Garfield Reynolds who writes that “markets could face a very disruptive 1Q because one of the most-crowded trades — USD shorts — is looking wobbly” and lays out the reasons it as follows:

This week has brought two powerful positive drivers for the dollar. Fed taper talk is enhancing the spike in yields. And the end of the Trump presidency could lower political uncertainty and market volatility, removing a deterrent for conservative investors to put money to work in the U.S.

Traders are busy pricing in buckets of Blue-Wave stimulus to drive stocks and yields higher. The re-acceleration of Covid-19 cases and deaths is being looked through, perhaps on anticipation that the authorities will become sufficiently focused on vaccines and other preventative measures to start bringing the pandemic under control in the current months.

While Reynolds concedes that it is possible a risk-on surge will once more drive the dollar down – especially if central banks have made long-term allocation switches away from the greenback – the overwhelming certainty for U.S. currency declines suddenly “looks far less ironclad.” That, the macro strategist concludes, “opens the door toward sustained gains that could end up driving a very rapid unwind.”

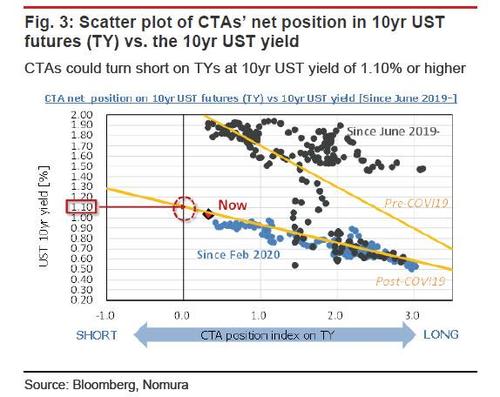

Throw in the risk of a chaotic surge in 10Y yields, which have already been rising but could explode higher if and when CTAs go short once the 10Y hits 1.10%…

… instead of merely selling long positions, and suddenly a stock market that steamrolled over virtually every risk or adverse development could be facing a perfect storm of epic proportions…

Tyler Durden

Fri, 01/08/2021 – 07:32![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com