US Consumers Unexpectedly Paid Down Their Credit Cards In November; Have “Uncharged” $115BN In 2020

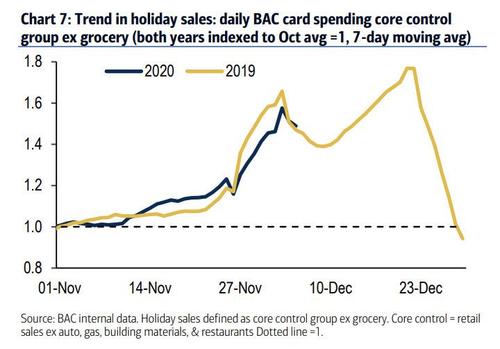

There appears to be a major discrepancy between BofA’s in house debit/credit card data, which showed a remarkable increase in the month of November…

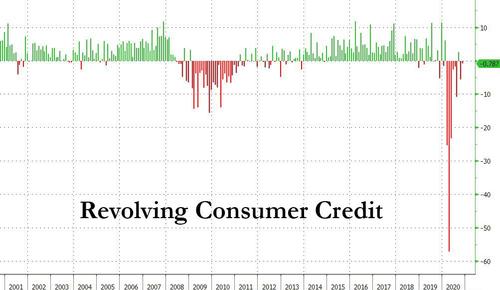

… and the Fed’s own consumer credit data aggregation, because according to the latest Consumer Credit (G.19) report, in November revolving debt, i.e., credit card debt, shrank for a second consecutive month declining by $787MM following the $5.5 billion drop in October.

This means that in the first 11 months of 2020, US consumers have paid down a record $115bn in credit card debt.

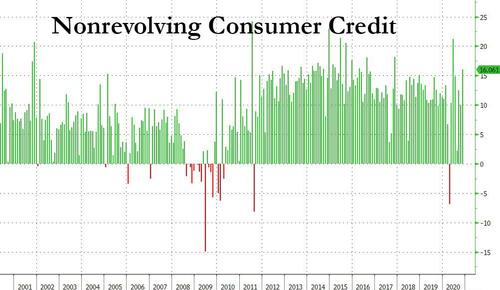

The flip side, however, is that as revolving credit dropped, non-revolving credit rose, and in November US consumers increased their student and auto loans – the two largest component of this category – by $16 billion…

… bringing the total November change to $15.3 billion, well above the $9BN increase expected by economists.

This means that even as Americans turned thrifty on their credit cards, they went to town on loans made where either the Federal Government has some implicit backstop, such as student loans which will likely be discharged in part or in whole by the Biden admin, or where they used the cash to buy cars, which is also understandable when one can take out a loan which maturity is well beyond the viable life of the actual (used) car being purchased. The implication in both is that nobody – neither the lender nor the borrower – expects that the loan will ever be repaid, something which can’t be said about credit card debt (at least for now).

Tyler Durden

Fri, 01/08/2021 – 15:18![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com