Real US Investment Grade Yields Hit A Record Negative 35bps

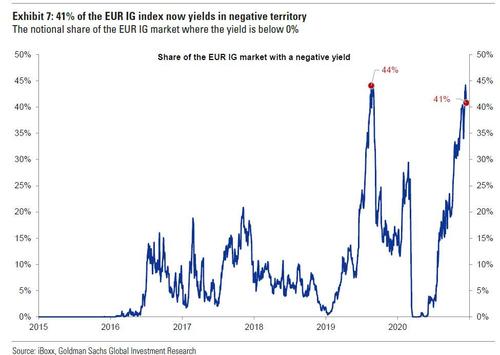

In late December, in our recap of a “year like no other” for credit markets, we showed a stunning chart which perhaps best summarized the “insanity unleashed by central banks.” The chart in question showed that a record-high number of European IG (investment grade) bonds were trading with negative yields. To wit, as of December 15, 41% of the EUR IG iBoxx index yields in sub-zero territory; a level that matches the previous record in August 2019.

Even more impressive: more than 10% of the index now yields below -0.25%, and as Goldman concluded, “negative yields are likely remain a fixture of the EUR IG corporate bond market in 2021, even if bund bond yields back up in response to solid growth next year. Combined with the decent demand tailwind from ECB purchases, this would keep search for yield motives strong.”

Then, a few weeks later, we learned that it wasn’t just the EU where the corporate bond market was trading at absurd levels.

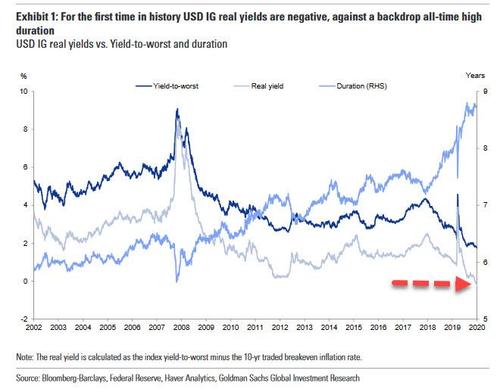

Specifically, Goldman’s credit strategists noted one month ago that real yields on USD IG corporate bonds had turned negative for the first time in history, against a backdrop of all-time high duration.

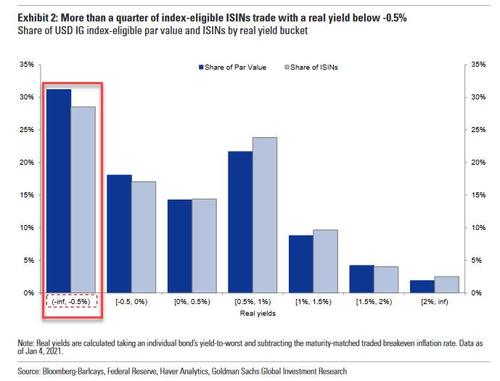

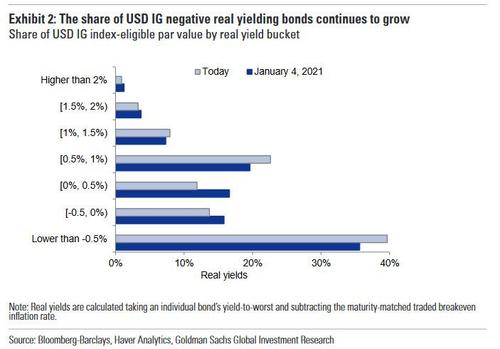

As Goldman elaborated at the time, the relentless march lower of real yields to negative territory “reflects the combined effects of the material decline in nominal corporate bond yields and the back-up in inflation expectations.” The next chart showed how widespread negative real yielding corporate debt in the USD market is, with more than 25% of issues, representing more than 30%of index-eligible par value, priced with a real yield below -0.5%.

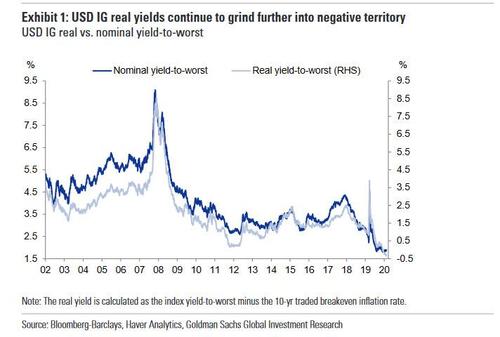

So fast forward to today when in its latest credit update, Goldman writes that the move in credit has extended further to new absurd levels and IG real yields across the US corporate sector just made new (negative) lows. Earlier this week, US breakeven inflation rates made new multi-year highs, pushing real yields in the USD IG market further into negative territory, at a staggering -35bp.

More granularly, 40% of the index total par value now trades with a real yield lower than -0.5%, up from 30% one month ago.

In line with its previous observations, Goldman continues to see two implications from this paradigm shift:

The first is a higher risk of active balance sheet re-leveraging, particularly among high-quality firms. Simply put, the average IG-rated firm is now expected to be paid back in real terms in order to borrow today, which strengthens incentives for more shareholder friendliness (and in light of recent news, we could we see some “uses of funds” going to purchases of bitcoin).

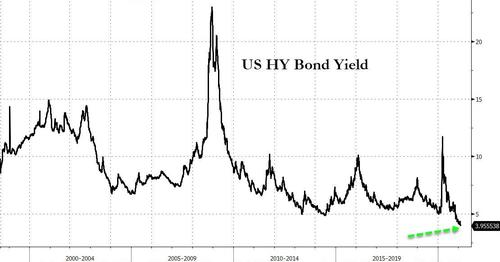

The second is the reduced ability of corporate bond portfolios to absorb even a mild inflation shock, which means a spike in realized inflation could unleash a credit market crash, forcing the Fed to step right back in and backstop both the IG and junk bond sector, where as a reminder, last week we saw the average HY issue yield at an all time record low, below 4%.

Here Goldman notes that breakeven inflation rates do embed a risk premium component, and are therefore not perfect predictors of realized inflation, however “any increase in realized inflation, above what is currently priced in, could prove damaging for real total returns.” In short, the more the Fed pushes for a reflationary outcome, the closer it is to having to bail out credit once again.

Tyler Durden

Sun, 02/14/2021 – 14:07![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com