Bonds & Bullion Suffer Worst Month In 5 Years As Commodities & Crypto Soar

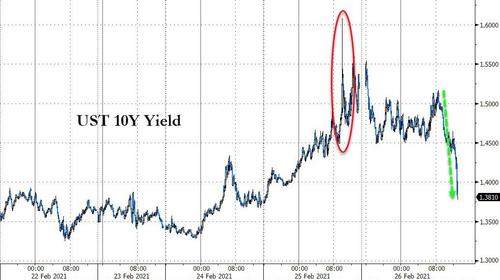

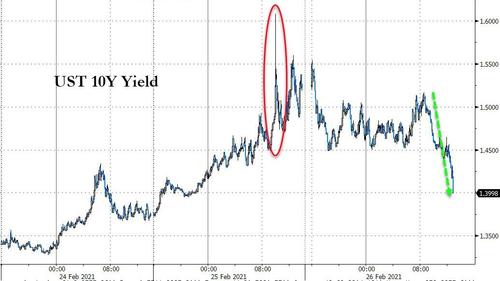

Update: Into the close, bonds were panic-bid with 10Y Yields plunging 14bps – the best day for bonds since March 2020

Source: Bloomberg

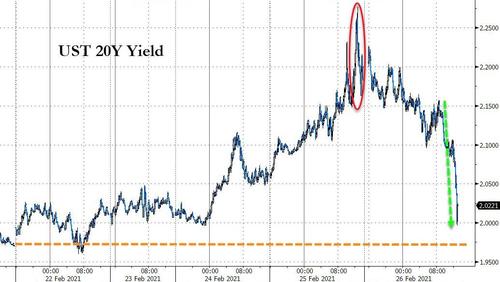

And 20Y Yields crashed over 20bps, almost erasing the entire week’s losses…

Source: Bloomberg

* * *

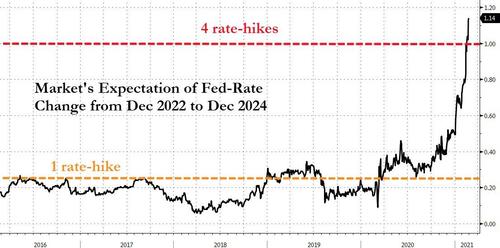

February saw a massive shift in the market’s perception of The Fed’s rate-hike trajectory… now pricing in more than 4 rate-hikes between 2022 and 2024…

Source: Bloomberg

Bitcoin surged for the 5th straight month in February, despite some late weakness…

Source: Bloomberg

As bonds and bullion puked (while the dollar trod water)…

Source: Bloomberg

US equities were very mixed in February with Trannies and Small Caps outperforming as Nasdaq lagged (basically breaking even)…

Source: Bloomberg

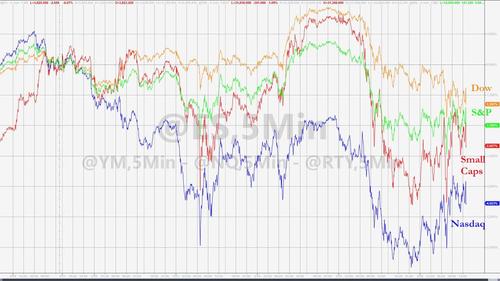

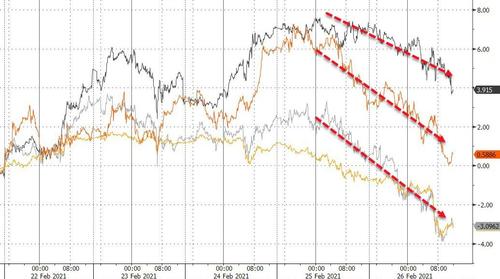

February ended ugly however, with Nasdaq’s worst week since October (down for 2nd week in a row)…

This is the 4th straight week that Small Caps have outperformed Big-Tech, erasing all of the relative outperformance of Nasdaq over Russell 2000 since March…

Source: Bloomberg

The S&P 500, Nasdaq, and Dow all tested their 50DMAs this week…

IPOs and SPACs suffered their biggest weekly loss since March 2020…

Source: Bloomberg

Value outperformed growth in February by the most since March 2001…

Source: Bloomberg

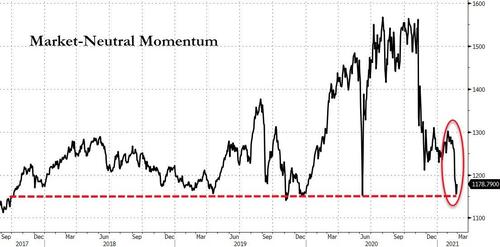

Momentum was down for the 3rd straight week (biggest weekly drop since November) to its lowest close since Jan 2020…

Source: Bloomberg

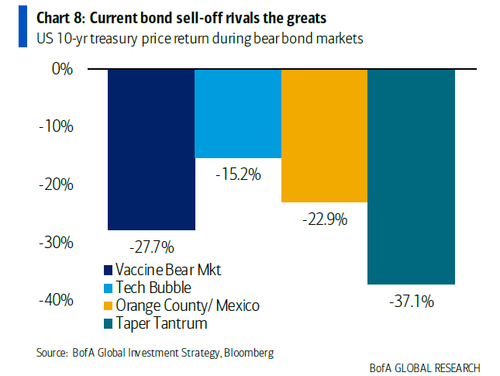

Bonds bloodbath’d in February…

Source: Bloomberg

…with 5Y thru 30Y up between 35 and 40bps…

Source: Bloomberg

In fact this is the biggest bond bear market since the Taper Tantrum…

With the last week the worst for the belly of the curve since Sept 2019…

Source: Bloomberg

Notably, 10Y Yields pushed significantly lower today, now down over20bps from yesterday’s spike highs…

Source: Bloomberg

All of which made us think that many market participants may need some ‘honest meditation’…

Corporate bond land was battered also with IG bond prices seeing the worst month since March 2020 (and HY worst week since October 2020)

Source: Bloomberg

Thanks to the surge in the last few days, the Dollar ended February very marginally higher (after bouncing off unch for the year)…

Source: Bloomberg

Bitcoin outperformed its crypto peers in February, up 45%…

Source: Bloomberg

But, Crypto ETFs tumbled to record discounts to spot…

Source: Bloomberg

Gold and Silver’s worst week since Nov 2020 as copper managed to cling to gains and crude outperformed…

Source: Bloomberg

But on the month, the reflation/growth commodities roared higher as PMs were pummeled…

Source: Bloomberg

As the surge in real yields weighed on gold…

Source: Bloomberg

Finally – and perhaps most importantly – February saw the biggest monthly plunge in COVID cases, hospitalizations, and deaths since the crisis began…

Source: Bloomberg

Tyler Durden

Fri, 02/26/2021 – 16:00

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com