Powell Changes The Rules On QE

Authored by Lance Roberts via RealInvestmentAdvice.com,

The markets took a tumble to start this week as rising interest rates and inflationary pressures begin to weigh on outlooks. Those worries quickly diminished as Jerome Powell changed the rules to reassure Wall Street that “QE” is here to stay.

In his speech, he committed to reaching maximum employment and the “average” inflation rate. To wit:

“I’m confident that we can, and that we will, and we are committed, to using our tools to achieving that. The three-year time frame is actually arbitrary and chosen by us. And you know, we’re just being honest about the challenge.

We live in a time where there are significant disinflationary pressures around the world. Essentially all major advanced economies’ central banks have struggled to get to 2%. We believe we can do it, we believe we will do it. It may take more than three years, but we’ll update our assessment every quarter. We’ll see how that goes.”

Even Fed Governer Lael Brainard echoed Powell’s statement:

“The economy remains far from our goals in terms of both employment and inflation, and it will take some time to achieve substantial further progress.”

The markets immediately interpreted these statements correctly. The Federal Reserve will not be tightening monetary policy any time soon.

The Constraints To Policy

If you re-read Powell’s statement, you should realize that he has changed Fed policy’s benchmarks.

When Ben Bernanke initially launched QE, the “constraints” around ultra-accommodative monetary policy were price stability and full employment. Those “guideposts” were 2% inflation and 5% unemployment as measured by the U-3 report from the Bureau of Labor Statistics.

Over the last decade, the Federal Reserve stated that an “accommodative policy” was necessary to achieve 2% annualized inflation. Unfortunately, inflation ran well below the target level the majority of the time.

When it came to reaching the goal of “full employment,” the Fed achieved that goal for only a brief period between 2016-2018. At this juncture, the Federal Reserve did try to lift interest rates and reduce their balance sheet. Unfortunately, as we warned, the outcome was not positive.

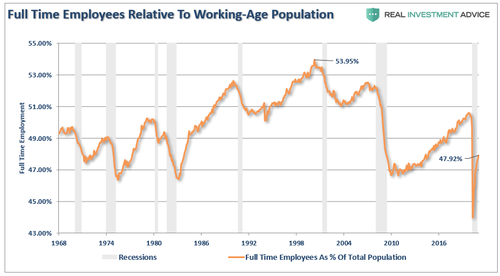

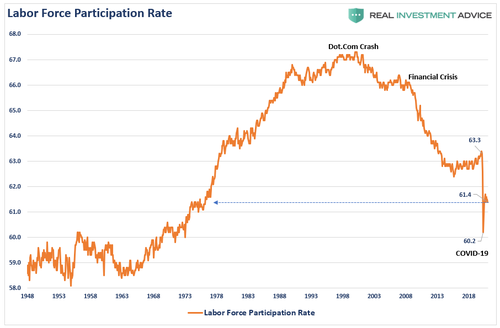

The issue with the U-3 report following the “Financial Crisis” was that it only “appeared” the economy regained full-employment. In reality, such was merely a function of a shrinking “labor force.” To wit:

“Furthermore, employment, which is the backbone of consumer confidence, has not increased strong enough to create sustainable economic growth above 2%. Notably, the number of full-time jobs, which are critical to sustaining a family, has continued to decline.”

“Notably, that number remains skewed due to the ‘labor force’ calculation. Even though the economy may approach ‘full-employment,’ much of that is an illusion created by the labor force’s shrinkage.”

The reality is that both inflation and “full-employment” fell well short of the promises of “monetary accommodation.”

The Fed now realizes their constraints are a trap.

Changing The Benchmarks

Very subtly, the Federal Reserve has changed their benchmarks to allow the continuation of “monetary policy” indefinitely.

I have updated the two charts above to include their two new measures of:

-

A 3-year average inflation rate of 2%; and,

-

Full-employment (assuming a 5% unemployment rate) using the U-6 measure from the BLS.

From a historical perspective, the charts below show when the Federal Reserve would have achieved either measure over the last decade.

When it comes to achieving a 3-year average inflation rate above 2%, the Fed has only temporarily achieved that goal since monetary policy implementation.

In other words, by changing the benchmark, the Fed has now assured itself excess flexibility never to tighten monetary policy in the future.

If we assume the economy does grow at a rate fast enough to generate a 3-year average inflation rate above 2%. The switch to the U-6 employment report to measure “full-employment” provides cover to dismiss the inflation hurdle. Under this new benchmark, the Federal Reserve will never achieve full-employment. Even when the U-3 rate was at an all-time low of 3%, the U-6 rate was still closer to 7% unemployment.

For stock market bulls, the good news is that “QE-Forever” is now “a thing.”

QE Won’t Fix What’s Broken.

Not surprisingly, with an implicit guarantee by the Federal Reserve of continuous “monetary accommodation,” the market rallied back strongly on this week. The problem, however, is the stock market is now thoroughly detached from the underlying economy.

Over the last decade, monetary policy inflated asset prices to more extreme levels while the real economy struggled. The Market-Cap best characterizes this detachment to the economy. Since corporations derive their revenue from economic activity, there is a logical assumption of fair valuation.

The indicator shows us that when “disconnects” between market participants and the underlying economy occur, outcomes are poor. Significantly, QE does not improve corporate profits. The correlation between the market and corporate profits as a percentage of GDP, not surprisingly, is high. With a 88% correlation, the ratio confirms the detachment from the economy.

There is additional confirmation with an 85% correlation between the S&P 500 and corporate profits growth.

Since corporate profits are a function of economic growth, the correlation is not unexpected.

Notably, the data shows the promise of “monetary policy” to boost economic growth never occurred. Economic prosperity worsened over the last decade.

A Massive “Wealth Transfer” Policy

As with all things, there are always the unintended consequences of policies that are not well thought through and ignores basic economics.

After more than a decade of monetary interventions, the results are clear.

The “rich got vastly richer.”

However, for the vast majority of Americans:

-

Housing did not become more affordable.

-

Wall Street converted wealth from the poor to the rich by buying properties at distressed prices (which they caused) and turning them into rentals.

-

Many Americans, after a decade, are still unable to obtain financing.

-

Wage growth has been nascent and has not kept up with the real costs of living.

-

Lower corporate bond rates didn’t lead to more investment but instead increased share repurchases, which benefited “C-Suite” executives at the working class’s expense.

Instead, as discussed previously, the Fed’s policies led to a growing divergence between the stock market and the economy. To wit:

“The one lesson that we have clearly learned since the 2008 “Great Financial Crisis,” is that monetary and fiscal policy interventions do not lead to increased levels of economic wealth or prosperity. These programs acted as a wealth transfer system from the bottom 90% to the top 10%.

Since 2008 there have been rising calls for socialistic policies such as universal basic incomes, increased social welfare, and even a two-time candidate for President who an admitted socialist.

Such things would not occur if “prosperity” was flourishing within the economy. “

Such is simply because the stock market is not the economy.

Since It Didn’t Work, Do More.

The Fed’s interventions and suppressed interest rates have continued to have the opposite effect intended. I have shown the following chart below previously to illustrate this point.

From Jan 1st, 2009 through the end of 2020, the stock market rose by an astounding 200%, or roughly 18% annualized. With such a large gain in the financial markets, one would expect a proportional growth rate in the economy.

After bailouts, QE programs, interventions, monetary and fiscal programs totaling more than $37 billion, cumulative real economic growth was just 21.52%.

While monetary interventions are supposed to be supporting economic growth through increases in consumer confidence, the outcome has been quite different.

Low to zero interest rates have incentivized non-productive debt and exacerbated the wealth gap. The massive increases in debt have harmed growth by diverting consumptive spending to debt service.

However, the hope is that while it didn’t work over the last decade, maybe doing more will be “different this time.”

A Continuation Of Boom/Bust Cycles

While the Fed has found cover in its new “benchmarks” to continue monetary policy nearly without restriction, the outcomes are unlikely to be any different.

The Keynesian view that “more money in people’s pockets” will drive up consumer spending, with a boost to GDP being the result, has been wrong. It hasn’t happened in 40-years.

As Joseph Carson, former Chief Economist at Alliance Bernstein, concluded:

“Given the scale of fiscal stimulus, one would expect the Fed to be thinking of ‘leaning against the wind.’ But not this Fed–the Fed is using the same playbook from the Great Financial Recession, providing unneeded stimulus to a red-hot housing market.

What’s the economic and financial endgame? It’s hard to see anything but a ‘boom-bust’ scenario playing out with fast growth and rising market interest rates in 2021 and early 2022, followed by a bust in late 2022/23 when the fiscal stimulus/support dries up.

The US experienced mild recessions following the sharp drop in government military spending after the Korean and Vietnam wars—-and back then, the scale of military expenditures amounted between 2% and 4% of GDP. The ‘sugar-high’ today is unprecedented, raising the odds of a harder landing.

While mainstream economists believe more stimulus will create robust economic growth, no evidence supports the claim.

More importantly, while the Federal Reserve may not raise interest rates any time soon, the bond market may well take care of that problem for them. As shown below, that is a process already well underway with an adverse event likely closer than many expect.

The Fed’s problem comes when a burst of inflation and rising rates collide with the massive debt levels overhanging the economy.

As Joseph Carson notes, the next “boom/bust” cycle is likely already in the works.

Tyler Durden

Fri, 02/26/2021 – 14:34![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com