2021’s Bond ‘Bloodbath’ Is The Worst In Decades

After stocks just saw their best 12-month performance since 1936, it should not be a total surprise that Treasuries have suffered… but the extent of the bond bloodbath is almost unprecedented.

After $17 trillion of liquidity was gushed across the global markets (raising all equity boats), the recent prospect of resurgent inflation has pushed government and corporate bonds around the world to their worst start to a year this century.

Source: Bloomberg

Bloomberg reports that the notes have lost over 3.7% so far in 2021, according a Bloomberg Barclays index of investment-grade securities across currencies going back to 1999. That’s worse than for similar periods in previous years, even after dip-buying in recent days.

Source: Bloomberg

Notably, while equity risk has tumbled, the last few months have seen uncertainty explode higher for rates.

Source: Bloomberg

As we recently noted, the surge in yields has put an end to the bull market in long-term U.S. Treasuries that began in the early 1980s. The Bloomberg Barclays U.S. Long Treasury Total Return Index, which tracks bonds maturing in 10 years or longer, has plunged more than 20% since its peak in March 2020, putting the market in bear territory.

Source: Bloomberg

This almost unprecedented carnage has strategists predicting large quarter-end rebalancing flows out of equities and into Treasuries. Bank of America strategists estimated that $88.5 billion could shift into U.S. fixed income, including $41 billion into Treasuries.

And we do now know who the most recent marginal seller was.

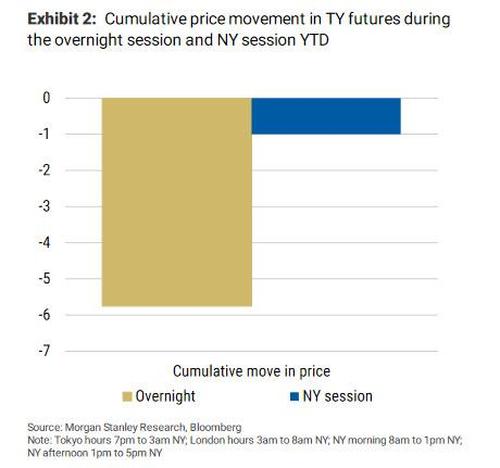

Since the start of the year, 85% of the cumulative decline in TY futures prices occurred in the overnight session, i.e., Japan is almost single-handedly responsible for the dump surge in yields this year!

Why does this matter?

Because if Morgan Stanley is right, and if the seemingly daily Treasury selling indeed originates out of Tokyo, there is finally good news for bond bulls: Hornbach writes that “we have good reason to believe the selling from Japan won’t last… into April.” That’s because the fiscal year in Japan ends on March 31.

“At that point, liquidation of non-yen bond holdings should stop, if not reverse at some point in the April-June quarter.“

And FX-hedged US Treasuries are the most attractive to foreigners in 7 years. 10Y Treasuries offer a Japanese investor over 105bps of yield pick-up…

Source: Bloomberg

Investors are likely to be tempted to reach for yield.

Source: Bloomberg

As we recently noted, an upward sloping yield curve is one of the few avenues remaining that provides an opportunity for fixed income investors to boost current cash flow. At the end of the day, taking on duration risk to get any reasonable return on cash will prove a temptation too great to resist. Guggenheim’s Scott Minerd said this week that:

The question investors face is whether the selloff has more room to run. Our analysis suggests it has largely run its course. The market is now pricing in a neutral rate of 2.35 percent, nearly in line with the Fed’s optimistic long run dots. The chart below shows that the bond market has had difficulty sustaining rates at or near the Fed’s neutral rate projection, and we see no reason to expect a different result this time.

Nor do we expect the Fed to revise up its neutral rate estimate.

So after the worst start to a year on record, bond investors may see a silver lining, catalyzed by quarter-end rebalance flows perhaps. As Minerd optimistically concluded:

“If the Fed is as patient as we expect it to be, total returns for core fixed income investors have the opportunity to be much better going forward than they have been in the recent past.”

Tyler Durden

Wed, 03/24/2021 – 05:45![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com