Booze And Chocolate May Be Set For A Comeback

By Michael Msika and Albertina Torsoli, Bloomberg commentators and reporters,

Since equity markets hit their pandemic lows in March 2020, all talk has been of recovery. And with bond yields on the rise, cyclical stocks have left defensives toiling in their wake, a theme that continues to play out. The latter’s underperformance has been particularly marked among consumer staples, and for investors seeking quality names, that may present opportunity.

According to Bernstein analyst Bruno Monteyne, the rotation away from staples provides “good entry points” to names such as cosmetics leader L’Oreal and chocolatier Lindt & Spruengli. It’s also a “great moment” to buy into the Swiss food giant Nestle, he says.

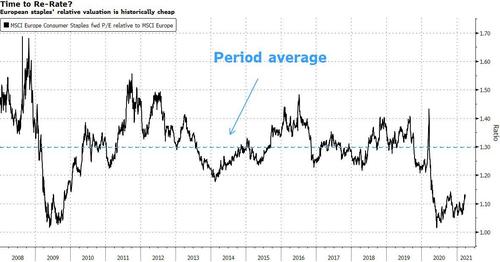

One of the main attractions is that relative valuations are well below historic norms. On a price-to-earnings basis, the MSCI Europe Consumer Staples Index’s premium to the broader market has fallen to 10% versus an average of 30% since 2008. The current premium is similar to that last seen in the aftermath of the global financial crisis.

In addition to being cheap, Goldman Sachs analysts say staples are set to benefit from the re-opening of economies and the resilience of earnings fueled by strong pricing power. Their buy-rated names include L’Oreal, Pernod Ricard, Carlsberg, Lindt, BAT and Nestle.

Donny Kranson, European equities portfolio manager at Vontobel Asset Management, is among the optimists. The rebound in consumer demand could be bigger than in previous crises, he said, noting that lockdowns hurt sales of items from deodorant and shaving products to ice cream. “All these things will come back,” he said. “People have been locked up a long time. There’s people with money in their pockets and lockup fatigue. You combine these two things and you should see pretty strong growth in everything people missed.”

Even if a rebound doesn’t happen immediately, any delays to vaccine rollouts or fresh lockdown measures, as seen recently in some European countries, could boost the investment case for defensives.

Investors like Michel Keusch, a portfolio manager at Bellevue Asset Management, favor a selective approach. Keusch sees bigger value-creation potential with mid-sized firms, particularly Lindt and Aryzta. He pointed to the Swiss baker’s so far successful turnaround after years of difficulties and Lindt’s “top” brand equity in food staples.

Several staples stocks figure in Morgan Stanley’s best ideas this year. Reckitt Benckiser is a growth-at-reasonable-price story, while in an inflationary environment, companies with strong pricing power like Nestle are to be favored, Morgan Stanley strategists say. A broader rotation back into defensives may happen later in the year, when a peak is expected on global growth momentum and yield curve, they add.

Not everyone is so optimistic.

RBC analyst James Edwardes Jones remains “cautious despite significant recent underperformance.” While he expects sales of consumer staples to rebound rapidly in a post Covid-19 world, Edwardes Jones says margin recovery will probably be only moderate as the sector absorbs additional costs linked to investment in areas such as supply chains and ESG.

Higher bond yields may weigh on staples in the short term, but after a few quarters companies with strong brands can pass on rising prices to customers and get stronger volumes from increased economic activity, Bernstein’s Monteyne said. “The strong brands will benefit from those things that are driving up yields. So get into the quality names now.”

Tyler Durden

Wed, 04/07/2021 – 06:30![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com