“That’s How Crazy The Market Is” – A “Virtually Unheard Of Trade” Spotted In Lumber

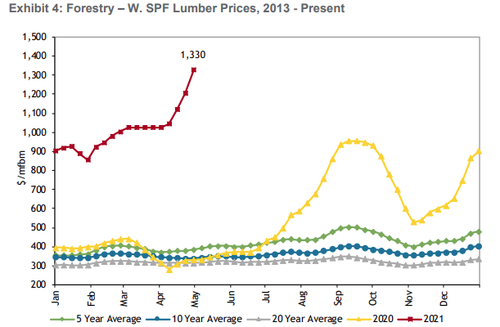

On Monday we highlighted a remarkable fact about the buying frenzy in the US lumber market: lumber futures were up for 16 consecutive days, a stretch without a down day since March 26, and while they did dip on Tuesday, the have more than recovered this latest decline, and are now up 19 of the past 20 days.

This surge in lumber prices to record highs, which was driven by an unprecedented shortages coupled with soaring demand by homebuilders…

… has also translated to unprecedented events in the supply chain, with Bloomberg today reporting a remarkable episode showing how extreme America’s shortage of lumber has become: For the first time in recent memory, a lumberyard was the one selling wood to a supplier.

Needless to say, this kind of trade – where a customer sells goods to its traditional supplier – is virtually unheard of.

MaterialsXchange, a Chicago-based digital trading platform for physical wood products, reports that the trade involved a lumberyard selling about 30,000 square feet of oriented strand board, or OSB ( a cheaper stand-in for plywood that is widely used to make house floors and walls).

“Building materials are moving from company to company in nontraditional flows,” said MaterialsXchange co-founder and CEO Mike Wisnefski. He added that prices have gotten so high that some homebuilders are being forced to cancel projects, leaving certain lumberyards with a little “excess inventory.”

On Wednesday, his company brokered another OSB sale involving a US East Coast lumberyard selling to another one in Arkansas at $1,500 per 1,000 square feet, surpassing a record $999 that was reached at the end of March, based on Random Lengths pricing.

For those confused, Bloomberg explains: in a normal world, wholesale distributors buy lumber from sawmills and sell that to the yards that homebuilders frequent. But lumber markets today are anything but normal with futures surging by more than 60% to record levels this year as the entire timber supply chain collapses under the weight of soaring demand from people renovating their homes and buying bigger ones. As a result, sawmills can’t keep up with orders. Truck shipments have been delayed. And distributors are running short on product.

“That’s how crazy the marketplace is,” said RCM Alternatives lumber analyst Brian Leonard, who has covered the industry for 35 years and had previously never heard of lumberyards selling to distributors. “Obviously it shouldn’t happen. You never push product back up the chain but you can today because of the volatility of the market.”

Furthermore, “reverse” trades like the one that occurred earlier this month will push wood prices even higher. Distributors buying back supply from yards will inevitably mark up prices to the customers they resell to, “potentially creating a vicious cycle that continues to stoke what has already proven to be an unrelenting lumber rally”, according to Bloomberg.

And, as we discussed earlier this week, soaring lumber prices are directly translating into much higher prices for new homes, making housing – where prices have already exploded thanks to the Biden stimulus and the Fed’s ZIRP – even more unaffordable.

Tyler Durden

Fri, 04/23/2021 – 20:40![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com