Market Pleasantly Surprised By Unexpectedly Solid 7Y Auction

After two mediocre auctions on Monday, when both the 2Y and 5Y sales saw tepid market interest, some rates traders were worried that today’s 7Y auction would be ugly. Not February 2021 ugly, mind you, which we remind readers was the closest the US has had to a failed auction and sparked the furious dump across the curve which spilled over into stock, but still ugly.

Well, besides the smallest possible tail of 0.1bps, it actually was a pretty solid 7Y auction.

Yes, the high yield of 1.306% was the highest since January 2020, rising just above the 1.300% in March, and yes, it did tail the 1.305% When Issued (just barely), but the other indicators were relatively solid.

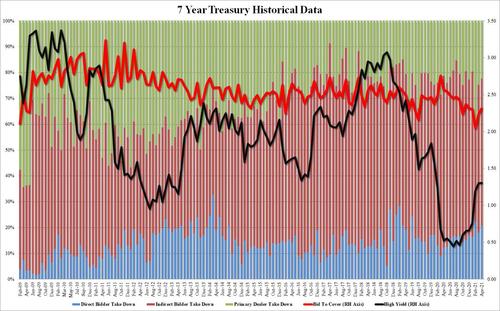

The Bid to Cover rebounded from last month’s 2.230 to 2.314, the highest since December and well above the catastrophic 2.045 in February.

The internals were similarly solid, with Indirects of 57.1%, in line with last month’s 57.3% and while this was below the 57.7% six-auction average, it was well above the record low 38.1% hit in February. Furthermore, in keeping with recent trends in other tenors, the Direct takedown rose to 20.6%, well above both the March 18.0% and the recent average of 17.1%, leaving Dealers with 22.3%, the lowest since January and below the recent average of 25.2%.

Overall, this was a surprisingly solid auction, and the market reacted accordingly, with the 10Y dipping from session highs of 1.60% just before the auction to 1.59%, in line with yesterday’s highest yield.

Tyler Durden

Tue, 04/27/2021 – 13:18![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com