Bank of England Is Latest Central Bank To Taper QE As It Suprcharges Economic Outlook

First it was the Bank of Canada, now Bank of England has also joined the taper bandwagon, announcing that it would cut its weekly bond buying (i.e. QE) from GBP4.44BN per week to 3.441BN, while keeping its overall rate and quantiative easing policy unchanged, in a 8-1 split vote with chief economist Andy Haldane voting to cut the BOE’s Gilt purchases by GBP50BN to GBP825BN (however, since this is his last month at the BOE, his view is being discounted by the market).

The Monetary Policy Committee voted unanimously to keep interest rates at 0.1% and by a majority of 8-1 to maintain the amount of quantitative easing at £895bn.https://t.co/QWJDoHlg4v #MonetaryPolicyReport #BankRate pic.twitter.com/9LenVPxvpe

— Bank of England (@bankofengland) May 6, 2021

The bank also drastically upgraded its GDP outlook and now sees 2021 growth at 7.25% and 5.75% in 2022, while predicting that the economy will return to pre-Covid levels over the course of this year, and that inflation will accelerate above target before easing to 2%.

🚨 BoE will slow weekly pace of bond buying. Haldane wanted to stop buying much earlier (strange but will be ignored as he’s leaving). Big upgrade to 2021 GDP as well (7.25%). This is on the more hawkish end of the spectrum but given what’s priced into UK rates seems fair $GBP pic.twitter.com/BJ1ZSHSFYr

— Viraj Patel (@VPatelFX) May 6, 2021

Looking at the monetary policy committee statement, the BOE was kind enough to provide a breakdown of its key considerations for dummies:

Some more details:

- MPC will continue to monitor the situation closely and will take whatever action is necessary to achieve its remit.

- Does not intend to tighten monetary policy at least until there is clear evidence that significant progress is being made in eliminating spare capacity and achieving the 2% inflation target sustainably.

- In the central projections of the MPC’s May Report, the economy experiences a temporary period of strong GDP growth and a temporary period of modestly above-target CPI inflation, after which growth and inflation fall back, with inflation around the target two and three years ahead.

GDP growth:

- 2021 GDP: 7.25% (prev. 5.00%)

- 2022 GDP: 5.75% (prev. 7.25%)

- 2023 GDP: 1.25% (prev. 1.25%)

CPI Inflation:

- 2021 CPI: 2.5% (prev. 2.00%)

- 2022 CPI: 2.0% (prev. 2.25%)

- 2023 CPI: 2.0% (prev. 2.00%)

- BOE Sees Consumer Spending Rising 5.25% in 2021, 9.25% in 2022

- BOE Says Projected Inflation Rise Likely to Be Temporary

- Inflation Likely Above Target Before Easing to 2%

Unemployment Rate:

- 2021 Unemployment : 5.00% (prev. 6.50%)

- 2022 Unemployment 4.50% (prev. 5.00%)

- 2023 Unemployment 4.25% (prev. 4.50%)

But the most notable highlight of today’s meeting is that the BOE has also jumped on the taper train by cutting the pace of QE to 4.4 billion pounds a week at which rate the program would reach its overall target at the start of November. Now it will buy 3.4 billion pounds a week, meaning purchases will finish around the end of the year. Today’s taper will run to the next quarterly assessment in August, when it is likely to trim again if growth lives up to raised expectations.

Paradoxically, despite tightening (because that’s what a taper is), the BOE said it does not intend to tighten until there’s clear evidence of rebound. Ok then.

That said, despite the taper there was a dovish signal in the BOE message, namely the BOE’s lack of appetite to hike rates despite expectations for a strong UK recovery in 2021 which as Viraj Patel notes, “Wouldn’t be surprised if we see a ‘sell the news’ reaction in $GBP on this.”

💥 Mixed signals overall from May BoE meeting. Tapering offset by no appetite to hike rates despite expectations for a strong UK recovery in 2021. Doubt we’ll get clarity on policy sequencing before Aug. Wouldn’t be surprised if we see a ‘sell the news’ reaction in $GBP on this pic.twitter.com/WkdsN8oDYr

— Viraj Patel (@VPatelFX) May 6, 2021

Here is a look at the sole vote holdout, Andy Haldane who voted to reduce the stock of asset purchases to 825 billion pounds, and who is set to leave the bank and buy a boatload of bitcoin as soon as he is out:

Haldane as he leaves the BoE pic.twitter.com/HUiejZx7FD

— Adam Linton (@Adamlinton1) May 6, 2021

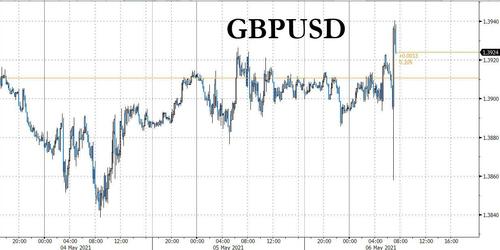

In response to the announcement, assets were jittery with cable first jumping then sliding, in a 80 pip range.

Commenting ont he move, Bloombergv notes that the pound’s round trip seems to be another case of algo trading on the headlines. The slowing of the pace of asset buying and Haldane’s vote to reduce the total amount of target stock made a case to reverse the dip. We could yet see fading interest on the opposite side as the pound hits fresh day highs around $1.3940. Gilts are little changed for the day.

And now the question is whether the Fed will join the BOC and BOE in announcing a taper next month.

Tyler Durden

Thu, 05/06/2021 – 07:31![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com