Goldman Warns Of “Substantial” Surge In Home Prices, Expects Bigger Housing Bubble Than 2007

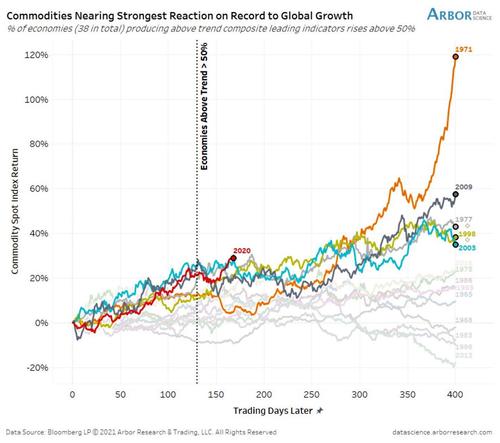

One week ago, we said that in what is increasingly a stagflationary burst (or, as BofA put it “transitory hyperinflation“) right out of the 1970s playbook (and that was even before the latest blistering hot CPI and PPI numbers printed a few days ago)…

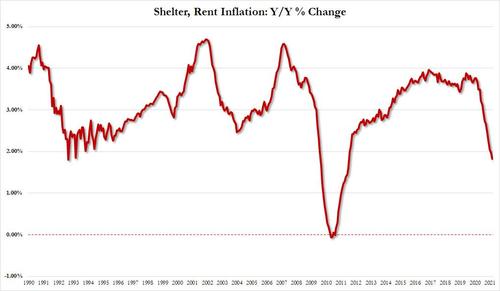

… amid this dismal “transitorily hyperinflationary” landscape where those whose incomes aren’t similarly hyperinflating find themselves at risk of being unable to afford a roof above their head, “there was one ray of hope: renting, with rent prices tumbling in recent months and according to the BLS’ monthly CPI metric, rent inflation had just dropped to the lowest in a decade, just below 2.0% annually…

… “which due to the way the CPI basket is weighted acted as a key anchor on overall CPI rates, and served to distort the broader inflationary picture. In short, the Fed would look at the relatively tame core CPI which was only tame thanks to “tumbling” rents and would conclude that there is nothing to worry about.”

The problem, as we cautioned, is that rents were about to soar, after American Homes 4 Rent, which owns 54,000 houses, increased rents 11% on vacant properties while Invitation Homes, the largest landlord in the industry, also boosted rents by similar amount. The other problem is that even without the rent hike, CPI has been undercounted by roughly 50% because if one actually uses house prices as an input in calculating shelter inflation instead of the politically accepetable owner-equivalent rent, core CPI would be about 8.5% (as discussed in “Biggest Rise In Consumer Prices In More Than A Decade Is Understated By Half.”)

Fast forward to today when in a note from Goldman’s economics team, the bank effectively echoed everything we said, and warns that in addition to all the other widely discussed inflationary pressures – most notably the surge in wages as the labor market collapses thanks to Biden’s trillions – it now expects that “a national housing shortage will fuel substantial home price appreciation for at least a couple more years.” To estimate the spillover to shelter inflation, Goldman then uses city-level data on home prices and rents and finds that 5%-15% of the rate of home price appreciation gets passed through to shelter inflation over a multi-year horizon.

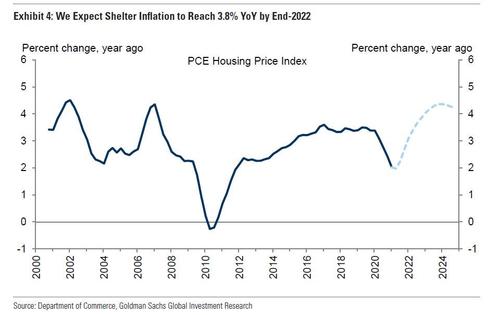

Extrapolating to the national PCE data, Goldman then projects that shelter inflation is likely to surge to 3.8% YoY by end-2022 — boosting core PCE by about 0.3% relative to today — and to exceed 4% in 2023 (!), a higher rate than at any point in the prior economic cycle. At that point anyone countering that (hyper)inflation is transitory will be laughed right out of the room.

Here is some more detail from the Goldman note, first starting with why shelter inflation is arguably the most important component of the core CPI basket, and why it is also the one which politicians do everything in their power to manipulate… lower.

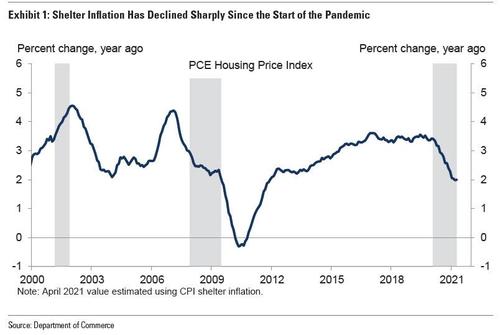

First, as Goldman’s Ronnie Walker reminds us, shelter inflation is a critical part of core inflation for two reasons:

- First, its weight is substantial, with rent and owners’ equivalent rent (OER) accounting for almost 20% of the core PCE price index and 40% of the core CPI index.

- Second, shelter inflation is among the most reliably cyclical components of the core and empirically is a significant driver of the Philips curve. As a result, it would be hard to get core PCE inflation to run sustainably above the Fed’s 2% inflation target without a helping hand from shelter inflation: over the last two decades, PCE housing inflation has averaged 3.0% YoY when core PCE is above 2%.

Now, as we have reported over the past year, shelter inflation dropped sharply since the start of the pandemic — with PCE housing inflation currently +2.0% YoY vs. +3.4% just before the pandemic…

… in part because the sharp decline in employment has reduced the ability of hard-hit households to afford rental payments and in part because of unique pandemic factors (not to mention the great urban-to-suburban exodus thanks to soaring taxes and militant gangs roaming the streets of liberal cities). Additionally, widespread eviction moratoriums have convinced some landlords to forgive rent for some tenants, which counts as a “zero” when calculating the average cost of shelter in the official statistics. According to Goldman calculations, those forgiven payments are weighing on year-over-year shelter inflation by about 25bp. These special factors will fade, however, as eviction moratoriums are lifted.

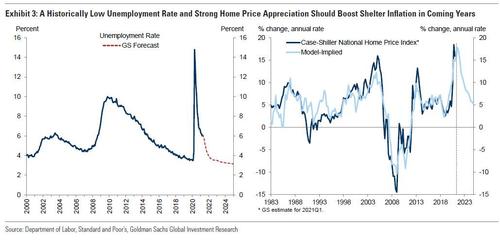

Next, Goldman looks at how cyclical improvement and the boom in home prices that it expects, will affect shelter inflation. To do this, it combines metro area-level CPI data with local-level data on unemployment rates, vacancy rates, and home price appreciation. While home prices do not directly enter the inflation statistics, the bank’s analysis suggests that home price appreciation does spill over into rent inflation and OER with some delay. Across a number of specifications, 5%-15% of the rate of home price appreciation gets passed through to shelter inflation over a multi-year horizon.

What does this imply for the long-term shelter inflation outlook? Well, once the unique pandemic factors are behind us, a rapidly improving labor market and a booming housing market should drive a significant increase in shelter inflation. The next chart shows that Goldman expects the unemployment rate to eventually fall into the low 3s, below the 50-year low reached last cycle, and expects a persistent imbalance between supply and demand in the housing market to generate double-digit home price appreciation this year and next.

Putting all this together, Goldman’s model projects that the front-loaded labor market recovery coinciding with historically high home price growth will boost shelter inflation to 3.8% YoY by end-2022 and to exceed 4% YoY in 2023, followed by a moderation as home price growth slows down.

For those confused, Goldman just predicted that by 2024 home prices will be rising at a pace far faster than the widely recognized 2006-2007 housing bubble, and that the spillover from this surge in prices will make the coming hyperinflation anything but transitory.

Tyler Durden

Sun, 05/16/2021 – 16:30![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com