Biggest Shorting Of Tech Stocks By Hedge Funds In 5 Years: Goldman Prime

Last week we noted that one of the clear trends to emerge as a result of the recent horrific price action in tech stocks, was the continued aggressive selling – and shorting – of tech stocks by hedge funds. The latest weekly report from Goldman’s Prime Brokerage confirms this.

Starting at the macro level, Goldman Prime writes that the GS Prime book “was net sold for the first time in three weeks (-1.3 SDs), driven by short sales outpacing long buys 2.4 to 1. Single Names saw the largest net selling in two months, while Macro Products (Index and ETF combined) saw the largest net buying in seven weeks. Nearly all regions were net sold led by North America and EM Asia, while Europe was net bought for a 7th straight week and saw the largest $ net buying since Feb ‘18. 7 of 11 global sectors were net sold led by Info Tech, Consumer Disc, Financials, and Comm Svcs, while Health Care, Industrials, and Utilities were the most net bought.”

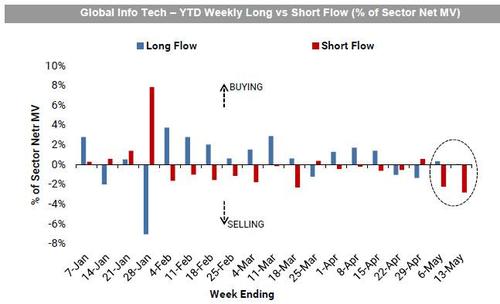

As noted previously, however, the real action was in the tech sector, with GS Prime noting that “Info Tech was net sold for a 4th straight week and saw the largest $ net selling in more than 5 years, driven entirely by short sales.”

Far from a one-off event, the report then notes that “the sector has seen increased shorting in 4 of the past 5 weeks (8 of the past 10), which is in contrast to long flows which have seen buying in 7 of the past 10 weeks.“

Drilling down, the Goldman Prime desk reveals that 4 of the 6 Info Tech subsectors were net sold on the week, led in $ terms by Semis & Semi Equip, Tech Hardware, and IT Services, while Software and to a lesser extent Comm Equip were net bought.

As a result, and as the latest batch of 13F filings reveals, “hedge funds are now U/W Info Tech stocks by 1.5% vs. the MSCI World, the lowest level since last November and in the 2nd percentile vs. the past five years. By industry group, hedge funds are still O/W Software & Svcs by 4.7% (28th percentile) and U/W Semis & Semi Equip and Tech Hardware by 1.7% (8th percentile) and 4.4% (18th percentile), respectively.”

What is remarkable is that even as the HF sector is now positioned uniformly bearish in the tech sector, the GS Equity Fundamental L/S Performance Estimate fell for a second straight week by -1.83% between 5/7 and 5/13 (vs MSCI World TR -1.96%),

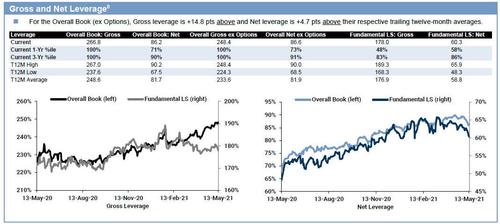

driven by beta of -1.44% (from market exposure and the market sensitivity factor combined) and to a lesser extent alpha of -0.39%. In fact, as shown in the chart below, hedge funds are now once again underperforming not only broader market indexes but are down on the year…

… while being levered to the hilt: according to GS Prime, overall book Gross leverage rose another 1.3% to 248.4% – the highest on record – while Net leverage fell -1.7 pts to 86.6% (73rd percentile one year) as a result of continued pressing of tech shorts.

In short, we are now at max pain levels for the hedge fund sector.

And in light of the recent rebound in the FAAMG sector which has moved higher in the past 3 days amid a reassessment of reflation concerns with the “transitory” camp now winning, the question – as we asked a week ago – is when will this massive one-sided short position push max levered funds over the edge, and lead to a powerful squeeze higher in the tech sector.

Tyler Durden

Mon, 05/17/2021 – 19:35![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com