Plunging Coinbase Steamrolls Shareholders Even More With $1.25BN Convertible Offering

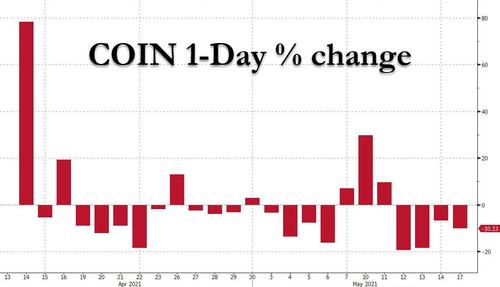

As if the pain for Coinbase longs, some of whom were stupid enough to buy the stock above $400 on the day the company went public, wasn’t enough with COIN stock today closing below its $250 IPO reference price for the first time, and down 42% from its post-IPO high on April 14…

… having been up just 7 of the 24 days since it went public…

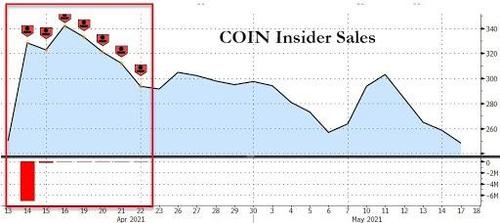

… moments ago the Coinbase management team, which has been engaged in a furious dumping of its stock without regard for outside shareholders, decided to suckerpunch all those who were dumb enough to believe in the cryptoexchange by announcing a $1.25BN convertible offering due 2026 sold pursuant to Rule 144A to qualified institutional buyers.

According to prospectus, “this capital raise represents an opportunity to bolster Coinbase’s already strong balance sheet with low cost capital that maintains operating freedom and minimizes dilution for Coinbase’s stockholders.” Which is wonderful since the company went public just one month ago!

Coinbase said it intends to use the net proceeds from the offering for general corporate purposes, which may include working capital and capital expenditures, and to pay the cost of the capped call transactions.

If the initial purchasers exercise their option to purchase additional notes, Coinbase expects to use a portion of the net proceeds from the sale of such additional notes to enter into additional capped call transactions. Coinbase may also use a portion of the net proceeds to make investments in and acquisitions of other companies, products or technologies that Coinbase may identify in the future.

The offering comes just days after Coinbase said it brought in $1.8 billion in total revenue for the first quarter of 2021.

The news sent the stock, which was already down 4% for the day, sliding another 3% lower after hours as investors are left wondering what cruel and unusual ways the management, which has been furiously dumping its stock…

… has in mind to push the price to zero in what appears to be the modern version of the Hudsucker Proxy.

Tyler Durden

Mon, 05/17/2021 – 16:31![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com