Morgan Stanley Asks What To Do When Everything Is Expensive

By Vishwanath Tirupattur, global head of Quantitative Research at Morgan Stanley

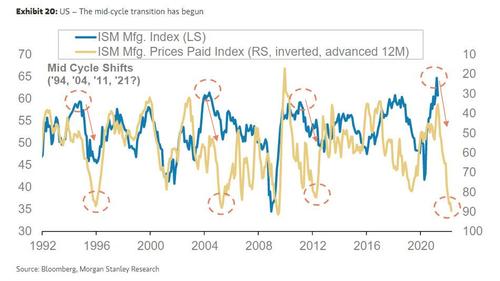

The title of our recently published mid-year outlook – Now the Hard Part – captures the conundrum market participants face: early-cycle timing, mid-cycle conditions and late-cycle valuations.

It is unusual to see this confluence, especially because it was only a little over a year ago that global risk markets were reeling and recording cyclical lows. Thus, despite our economists’ call for strong global economic growth supported by the largest fiscal stimulus, the largest monetary easing and the highest consumer savings rates in post-war history, the investment recommendations from our strategists have a more subdued tone. Over the next 12 months, we see single-digit upside in global equities, a modest steepening of the yield curve and thus a neutral stance in government bonds. We have downgraded corporate credit to neutral and expect flat returns in emerging market fixed income.

Our strategists’ restraint is really driven by the conviction that current valuations across risk markets already reflect a lot of positivity about economic growth. That said, our outlook also points to attractive return potential in asset classes not often in the limelight because of the perception of complexity associated with them. In today’s Sunday Start, we will highlight a few such opportunities. We argue that these are not nearly as complex as perceived and are driven by the same economic narrative that underlies broader risk markets. Equally interestingly, the opportunity set includes both long and short ideas.

The first opportunity we want to highlight is in collateralized loan obligations (CLOs), which are first-order securitizations of corporate loans. With over US$800 billion of outstanding, CLOs are no longer a niche market. The structural leverage in CLOs makes the equity tranches well suited for current conditions as CLO liability tranche spreads have tightened at a faster rate than spreads of CLO assets, thus creating conditions for attractive returns. The strong fundamental backdrop, leading to lower loan default rates, along with upside from Libor floors and other embedded options convince our CLO strategists, Charlie Wu and Vasu Goel, to expect CLO equity tranche returns to be in the mid-to-high teens over the next 12 months.

As we have noted on these pages before, the US housing market has been on fire in the months since the onset of the pandemic. Even though we expect the rate of growth in home prices to slow from current levels, the US housing market sits on a healthy foundation. As our securitized credit strategists, Jim Egan and Som Basu, have highlighted, the growth in home prices, and the consequent increase in the equity that borrowers have in their homes, has been a boon for the fundamental performance of the mortgage credit market in two ways – lower delinquencies and higher prepayments, both of which benefit securitized mortgage credit markets. Over the next 12 months, we see single-digit upside in global equities, a modest steepening of the yield curve and thus a neutral stance in government bonds. We have downgraded corporate credit to neutral and expect flat returns in emerging market fixed income.

Contrary to the old adage, what’s good for the goose is sometimes not good for the gander. Strong housing fundamentals are a positive for securitized credit but not necessarily so for Agency RMBS. The elevated purchase volumes that come with a healthy housing market just mean a continuation of an endless supply of Agency RMBS. Prepayment risk, which is a negative for Agency RMBS, continues to run high. At or close to their all-time tights, valuations in Agency RMBS are notably richer than other comparable asset classes. For example, the spread on the mortgage index is 15bp through its post-GFC tights, whereas the spread on the investment grade corporate credit index is merely at its post-GFC tights. Jay Bacow and Zuri Zhao, our Agency MBS strategists, note that Agency RMBS have already priced in all the optimism that accompanies demand from a supportive Fed and deposit-rich domestic banks. Thus, they recommend a longer-term structural underweight in MBS. Not only do negative option-adjusted valuations give minimal room for further spread tightening, but the steepness of the belly of the Treasury curve means that being long five-year Treasury notes against Agency RMBS is a positive carry, positive convexity steepener. It is not often that investors can be short a risk asset at the tights and get paid to do it.

The three ideas we discuss are not plain vanilla. There is indeed a degree of complexity associated with CLOs, CRT and Agency RMBS, and fully harvesting the risk premia embedded in these ideas does require an investment in digging into the nuances of these products. What we are arguing is that understanding the complexity is worth the effort, given the potential for returns in this opportunity set.

Enjoy your Sunday.

Tyler Durden

Sun, 05/30/2021 – 21:05![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com