Labor Shortage Hits Epic Levels: Record 48% Of Businesses Can’t Fill Job Openings

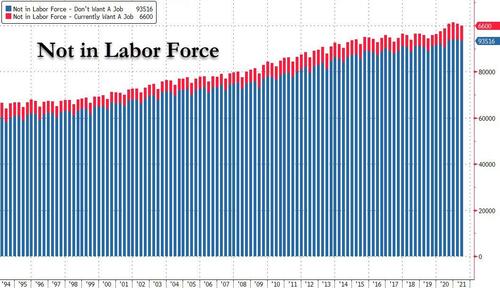

Joe Biden’s Universal Basic Income is making the unprecedented labor shortage and general chaos in the labor market worse by the day. Two months ago we first made a remarkable observation: despite some 100 million Americans not in the labor force (of which 94 million do not want a job)…

… there is now a full-blown labor shortage in the US, for one simple reason – trillions in Biden stimulus are now incentivizing potential workers not to seek gainful employment, but to sit back and collect the next stimmy check for doing absolutely nothing in what is becoming the world’s greatest “under the radar” experiment in Universal Basic Income.

Consider the following striking anecdotes :

- Early in the Covid-19 pandemic, Melissa Anderson laid off all three full-time employees of her jewelry-making company, Silver Chest Creations in Burkesville, Ky. She tried to rehire one of them in September and another in January as business recovered, but they refused to come back, she says. “They’re not looking for work.”

- Sierra Pacific Industries, which manufactures doors, windows, and millwork, is so desperate to fill openings that it’s offering hiring bonuses of up to $1,500 at its factories in California, Washington, and Wisconsin. In rural Northern California, the Red Bluff Job Training Center is trying to lure young people with extra-large pizzas in the hope that some who stop by can be persuaded to fill out a job application. “We’re trying to get inside their head and help them find employment. Businesses would be so eager to train them,” says Kathy Garcia, the business services and marketing manager. “There are absolutely no job seekers.”

Even more amazing: a stunning 91% of small businesses surveyed by the NFIB said they had few or no qualified applicants for job openings in the past three months, tied for the third highest since that question was added to the NFIB survey in 1993.

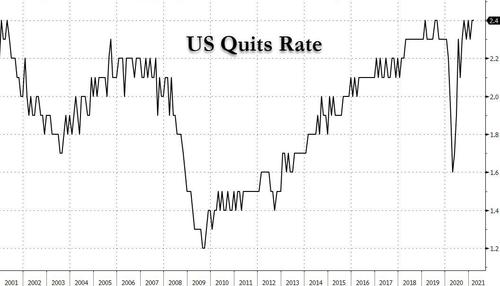

One of our favorite labor market metrics, the so-called “take this job and shove it” indicator- or the “Quits” rate from the JOLTS survey – is the latest confirmation of how empowered workers feel: in March the number of people quitting jobs hit 2.4% of overall employment in January, matching the record going back to 2001.

But what is most striking is the context on these figures: recall that just one year ago, the unemployment rate was a depression-era 14.8%. And while it has since dropped to 5.8%, it remains well above the 3.5% rate of February 2020, before the pandemic. So judging from the jobless rate – which the Federal Reserve tracks closely – there’s still lots of slack in the labor market (and as long as that slack persists, the Fed will continue injecting trillions of liquidity into the market, making the already record wealth inequality even bigger with every passing month).

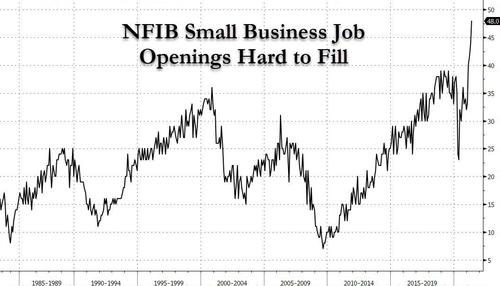

Fast forward to this week when we got the results of the latest, May NFIB Small Business jobs report.

Unfortunately, it confirms that the labor market is going from bad to worse, as a record-high 48% of small business owners in May reported unfilled job openings, up from 44% in April, and the fourth consecutive month of record-high readings for unfilled job openings and is 26 points higher than the 48-year historical reading of 22%.

“Small business owners are struggling at record levels trying to get workers back in open positions,” said NFIB Chief Economist Bill Dunkelberg. “Owners are offering higher wages to try to remedy the labor shortage problem. Ultimately, higher labor costs are being passed on to customers in higher selling prices.”

Yes, that means even more inflation is coming.

Sixty-one percent of owners reported hiring or trying to hire in May. Owners have plans to fill open positions with a seasonally adjusted net 27% planning to create new jobs in the next three months.

The key quote from Dunkelberg was “Main Street is doing better as state and local restrictions are eased, but finding qualified labour is a critical issue for small businesses nationwide.” And the explicit admission that BIden’s “trillions” in stimulus are behind this predicament:

“Small business owners are competing with the pandemic and increased unemployment benefits that are keeping some workers out of the labor force.”

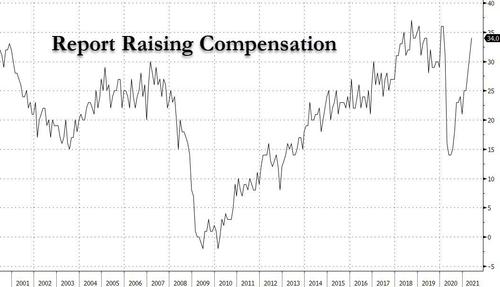

For those readers quick to bash potential employers for being stingy and not simply raising wages to find qualified employees, that’s no longer the case: a net 34% of owners reported raising compensation (up four points) and the highest level in the past 12 months, while another 22% plan to raise compensation in the next three months.

Still, with the labor shortage well ahead of wage hike plans one things is clear: profits margins – if only for small businesses – are about to collapse, making the big megacorporations winners once again.

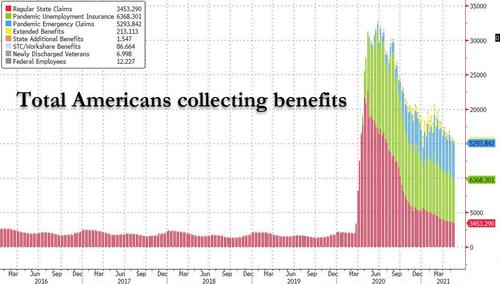

As for wages, while owners are still kicking and screaming, the Universal Basic Income so generously doled out by the government has reset the minimum practical wage so high that companies will have no choice but to hike compensation, the Fed just may get the benign, “non-transitory” inflation it has been so desperately seeking for so long… at least as long as the government continues to print welfare checks for some 15 million Americans.

Summarizing the data, Rabobank’s Michael Every writes “so unemployment benefits are ironically helping to push up wages, at least temporarily – which I am sure nobody intended, but underlines just how radical policy has to get in the US to make it happen.”

His conclusion: ”the problem is that small businesses trying to get past Covid are least well placed to lead this socio-economic charge; and if this points to a wage-price spiral –which is still unlikely– then the bond market will soon be pointing its finger at the Fed.”

Tyler Durden

Fri, 06/04/2021 – 15:30![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com