How Will A 15% Global Minimum Tax Impact S&P500 Earnings?

Now that it’s confirmed that G7 officials are seeking to enacted a global minimum tax rate of at least 15% (which however is unlikely to be uniformly implemented, and may not even pass in the US where Reuters reports that Senate Republicans have rejected Janet Yellen’s G7 deal), the question on investors’ minds is what impact will such a policy – if ever implemented – will have on corporate earnings.

Answering this question, Goldman’s Ben Snider estimates that such a policy would have a small aggregate impact on S&P 500 earnings, noting that “the direct impact of a 15% global minimum tax on US corporate profits would depend on which other tax reforms, if any, become legislation later this year.”

The tax plans proposed by President Biden even prior to his 2020 election included a15% minimum book tax for US companies along with hikes to the tax rates on both domestic and foreign income. We

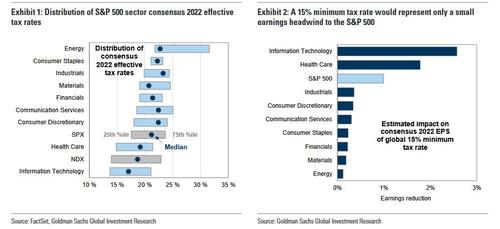

Specifically, Snider says that in his estimates a 15% minimum tax – in the context of a larger tax plan – would represent a headwind of less than 1% toS&P 500 earnings. To be sure, a minimum tax rate would have a larger impact absent other tax reforms, especially if implemented on a country-by-country basis as suggested by the G7 agreement. However, Goldman estimates that a 15% global minimum tax rate would represent downside of just 1%-2% relative to current consensus S&P500 2022 EPS estimates.

There are some exceptions: drilling down within the US equity market, Goldman cautions that industries with low current effective tax rates and high foreign income exposure face the greatest risk. At the sector level, InfoTech and Health Care would face the greatest earnings risk, but even those sectors appear to face aggregate downside of less than 5% relative to current consensus estimates

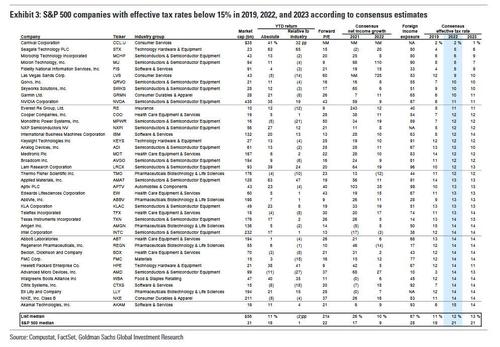

So if one wishes to short any particular sector as a hedge to the latest G7 tax policy, the best bet would be to focus on semiconductors, which account for the largest number of S&P 500 stocks with consensus effective tax rates below 15%. The table below shows 41 S&P 500 companies with 2019 and consensus 2022 and 2023 effective tax rates all below 15%. The overwhelming majority of these companies have reported greater than 50% foreign income exposure in recent years.

Tyler Durden

Tue, 06/08/2021 – 13:59![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com