Quad-Witch Quandary: How Will Friday’s $2 Trillion Gamma Expiration Impact Markets

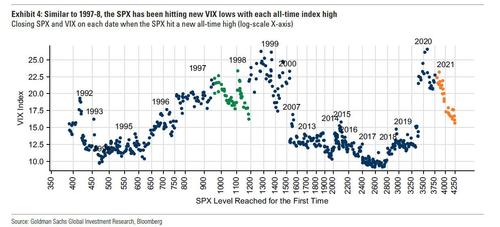

Last week, when discussing the bizarre summer doldrums in the market which pushed the VIX to the lowest level since the onset of the covid pandemic, we said that this period of abnormal market quiet is likely to last until this Friday’ quad-witch, when a massive amount of gamma and delta expire and are de-risked, in the process eliminating one of the natural downside stock buffers (see “4 Reasons Why The Market Doldrums End With Next Friday’s Op-Ex“).

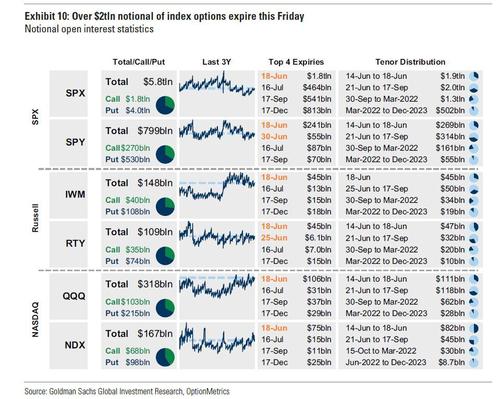

So picking up on the topic of Friday’ potentially market-moving opex, Goldman’ in-house derivatives expert, Rocky Fishman, previews June’s upcoming expiration which he dubs as “large – comparable to a typical quarterly.” Specifically, there are $1.8 trillion of SPX options expiring on Friday, in addition to $240 billion of SPY options and $200 billion of options on SPX and SPX E-mini futures.

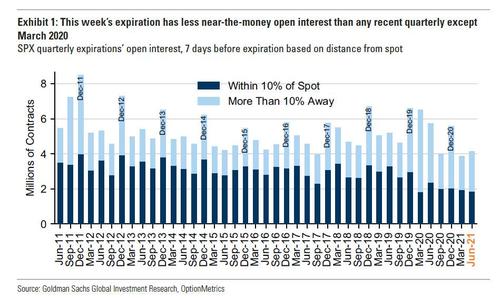

Yet while these totals are massive, when adjusted for the index’s size the amount of expiring options within 10% of current spot is smaller than just about any quarterly over the past decade.

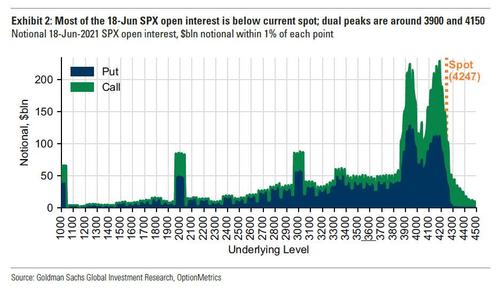

It’s worth noting that according to Goldman estimates that combos account for 15-20% of SPX options, so an adjusted open interest total would add up to $1.5tln, still much larger than total expiring single stock open interest ($775bln). Furthermore, with stocks at all time highs, it is to be expected that most of the June open interest is below the current SPX spot price. As shown in the chart below, the dual peaks are at 3,900 and 4,150. This means that after Friday, there may be a certain “anti”-gravity around those spots until gamma is refilled.

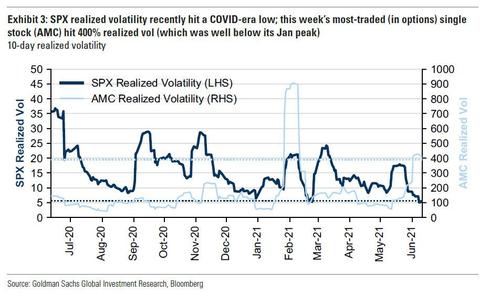

The Goldman strategist then explains what he believes is below the abnormally low level of realized market vol, noting that – as we discussed last week – it is consistent with long gamma positioning. Consider that SPX realized volatility over the past 13 trading days has been just 5.1% – the lowest 13-day realized vol since 2019.

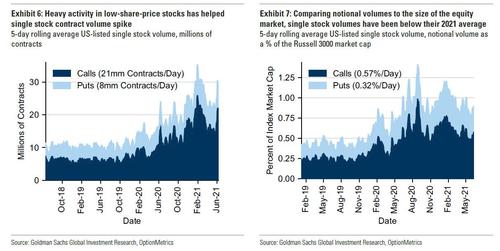

This contrasts with extreme volatility in pockets of the single stock market; AMC, which had the highest contract volume among single stocks last week (but far less notional volume at$7bln/day than AMZN’s leading $120bln/day), has had close to 400% realized vol over the same period.

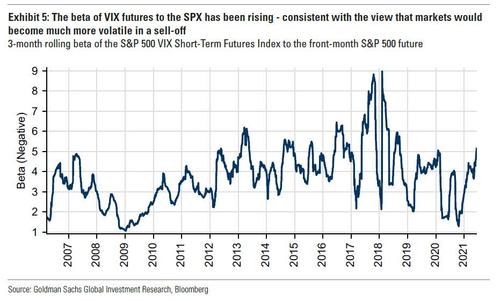

Then, as Nomura’s Charlie McElligott first noted last week, Goldman’s derivatives team agrees that the extremely low SPX realized volatility is consistent with the possibility that 18-Jun has left “the street” long index gamma, in which case Fishman echoes what we said last week, namely that “realized volatility could pick up once positions are cleaner. ” Meanwhile, the rising beta of VIX futures to the SPX indicates that investors expect short gamma dynamics to pick up should markets sell off. Translation: the market will become much more volatile in a selloff.

Meanwhile, and in keeping with the latest memo stock squeeze, Goldman also notes that while single stock option volumes continue to be high, it is well short of Q1 peaks. The large percentage of all single stock option activity driven by retail, and the predictive value of retail activity, have both heightened the attention on the single stock option market in recent weeks. Recent growth in single stock option activity has been concentrated in low-share-price stocks, leaving a shar prise in contract-volume over the past two weeks that has not been matched by notional volume. When adjusting notional volume for the size of the equity market, Goldman finds that single stock volume has actually been on the low of its 2021 range over the past two weeks which means that the latest ramps had little to no gamma squeeze components to them.

One final point which we discussed recently and which is in keeping with the growing retail participation in trading, is Goldman’s observation that the trend toward shorter-dated SPX options (weeklies) and away from quarterlies, continues. That also is one of the reasons why Friday’s SPX expiration is smaller than many recent quarterlies, and why as it as approached expiration, its trading volume has been falling.

As Goldman explains, investors have been increasingly adopting the full calendar of SPX expirations, including expirations every Monday and Wednesday, as they tailor their views around events. In fact, the percentage of SPX option volume happening in 3rd Friday expirations is at an all-time low, and is now smaller than the percentage happening in Monday and Wednesday expirations. One explanation for heightened ultra-short-dated volumes is the strong single stock volumes: and here an interest suggesting from Goldman – “to the extent market makers are unable to cover the short single stock gamma generated by retail investors’ call buying, they may be actively trading long positions in strips of ultra-short-dated SPX index options to offset this gamma.”

Why is this important? because if this trend is large enough, it directly contributes to low implied and realized correlation. Ironically, by ramping single name, “most-shorted names”, retail investors are ushering a period of unorthodox calm across the rest of the market!

Tyler Durden

Mon, 06/14/2021 – 15:24![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com