Ethereum 2.0 Will Supercharge Staking Industry By Tens Of Billions, JPMorgan Estimates

It’s hardly a secret that the Wall Street/central bank establishment is not a fan of energy-intensive proof of work (PoW) crypto tokens in general and bitcoin in particular. Even Elon Musk infamously U-turned in his support for bitcoin after he – gasp – discovered that electricity electricity is involved in the creation of cryptocurrencies (coincidentally, right around the time China made it abundantly clear that for the digital yuan to flourish and for Tesla cars to keep selling in China, Musk would have to turn his back on the largest cryptocurrency).

But what about far more energy efficient proof-of-stake (PoS) tokens such as Cardano, Polkadot, Tezos, Polygon, and – soon – Ethereum 2.0? Here things get a little confusing because unlike the rest of the crypto space which is almost universally loathed by Wall Street analysts, when it comes to the PoS subspace, the sellside appears to have developed a bit of a soft spot.

Take JPMorgan analyst Ken Worthingon and Samantha Trent who in a lengthy primer on staking, meant to identify where the biggest growth opportunities are in the crypto space (for companies like Coinbase which they cover), they not only disagree with the most famous crypto skeptic of all, their own boss Jamie Dimon, who 4 years ago said he would fire anyone caught trading bitcoin, but by extrapolating current growth trends in the PoS space, conclude that as bitcoin and ethereum increase in popularity, staking – the process of pledging one’s cryptos to pocket interest – will gain traction as a source of revenue for institutional and retail investors alike, and that once ethereum merge happens into ethereum 2.0, JPM estimates that staking, which is currently a $9bn business for the crypto economy, “will grow to $20bn following the Ethereum merge, and could get to $40bn by 2025 should proof-of-stake grow to the dominant protocol” (at which point the duo expects Coinbase to get a $500mn staking revenue run rate).

A quick aside for novices: currently the bitcoin and ethereum blockchains use an energy-demanding process called proof-of-work to ensure all transactions on the network are valid and that the network’s distributed record is accurate. It is this Proof of Work process that is the basis for all criticism that bitcoin and various other cryptos, are energy inefficient as they require brute force “mining” to maintain the system.

However, in order to create a more scalable and energy-efficient system, blockchain development teams, including the decentralized finance movement, ethereum (which Goldman recently called the “Amazon of Information” in a lengthy report in which it panned bitcoin as a “one trick pony” and praised ethereum as the next big thing in crypto), are switching from proof-of-work to proof-of-stake, where investors lock-up their funds on the blockchain in exchange for rewards.

While we have discussed it at length previously, staking is an essential part of maintaining the integrity of the cryptocurrency ecosystem for proof-of-stake tokens. In order to record cryptocurrency transactions, the blockchain needs to be updated and validated. Two protocols are used for this validation, proof-of-work (the current dominant blockchain validating protocol, used by Bitcoin and currently by Ethereum) and proof-of-stake (the emerging and faster growing protocol that is the core of staking.) Both the PoS and PoW protocols incentivize blockchain validation by issuing (generally in-kind) rewards, with Bitcoin miners rewarded in Bitcoin and Ethereum 2.0 minters rewarded in Ethereum 2.0, for example.

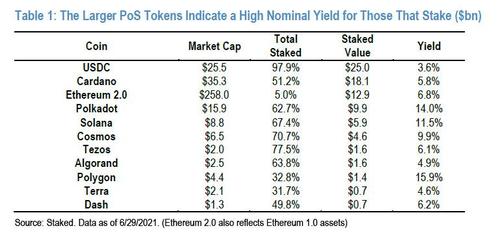

A selection of the largest PoS tokens is shown below.

Staking cryptocurrencies like SOL or BNB earn yields ranging from 4% to as high as 15.9% annually, according to data from staked. The Winklevoss crypto exchange Gemini currently advertises to investors the chance to earn annual yields up to 7.4% by holding on to their stablecoin.

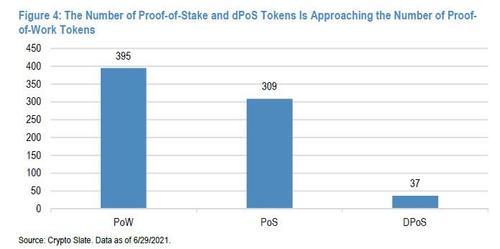

The report also says that as the volatility of cryptocurrencies declines, the ability to earn a positive real return will be an important factor in helping the market become more mainstream. That’s why, JPM projects that the number of tokens utilizing the proof-of-stake protocolwill continue to grow faster than the number of tokens using the proof-of-work protocol. Here, the greater the number of PoS tokens, the greater the market cap associated with PoS, the greater the investment income opportunity for token holders in the staking process and for companies that facilitate staking.

The JPM analysts also echo what we said over a month ago, namely that in their view, “the PoS protocol is becoming increasingly popular and is benefiting from concerns about the energy consumption and resource utilization for tokens using the PoW protocol. When combined with a proof-of-stake system that better aligns token holders and their blockchain validation together with enhanced security, we see new tokens increasingly adopting the PoS protocol, driving the staking opportunity higher over time.”

This is important for companies that JPM’s analysts cover such as Coinbase, because the analysts predict that staking will become a growing source of income for cryptocurrency intermediaries like Coinbase, especially after Ethereum 2.0 which is scheduled to be complete in 2022. JPMorgan estimates that staking presents a $200 million revenue opportunity for Coinbase in 2022, up from $10.4 million in 2020.

As for the demand side, as cryptos mature and volatility declines, a key driver of investor interest will be yield PoS tokens generate:

Individuals or institutions are incentivized to stake their cryptocurrencies to earn passive income rewarded in-kind from the network. Nominal yields can be high from staking and are contingent both on the design of the token as well as the participation rates in the staking pools. While not the main draw for individual or corporate participants in the cryptomarkets at this time in our opinion, yield earned through staking can mitigate the opportunity cost of owning cryptocurrencies versus other investments in other asset classes such as US dollars, US Treasuries, or money market funds in which investments generate some positive nominal yield. In fact, in the current zero rate environment, we see the yields as an incentive to invest.

In other words, while most focus on the explosive capital appreciation (and depreciation) qualities of cryptos where bitcoin went from $30K to $60K and then back again to 30% just this year alone, a growing area of interest for less aggressive investors will be the yield they can generate on their various crypto tokens and stablecoins.

To be sure, this transformation from PoW to PoS will take a while, and will require the successful conversion of the PoW Ethereum 1.0 into PoS Ethereum 2.0. Meanwhhle, as shown in the chart below, the cryptocurrency market remains dominated by proof-of-work, which accounts for roughly 70% of the cryptocurrency market capitalization. This is largely driven by the two largest tokens, Bitcoin and Ethereum, which are both (currently) proof-of-work, although it is critical to note that Ethereum is due to migrate to proof-of-stake protocol in the coming months (Ethereum 2.0 was originally supposed to launch in January 2020, and is now expected to enter its final launch phase in 2022.).

Of course, there are risks, and the potential ability to earn consistent positive yield through staking cryptocurrencies is dependent on market volatility. For example, ethereum competitor Solana lets investors take the native SOL cryptocurrency, currently valued at $32.76, and earn SOL rewards. If the value of the SOL token were to tank, there would be no real gains. This is true of any staking cryptocurrency.

That said, JPM is confident that as the crypto market matures and volatility decreases, staking will likely become a more reliable source of revenue (much more in the full JPM report).

Tyler Durden

Mon, 07/05/2021 – 20:15![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com