Stocks Soar To All Time High As Bonds, Bullion And Bitcoin Bounce

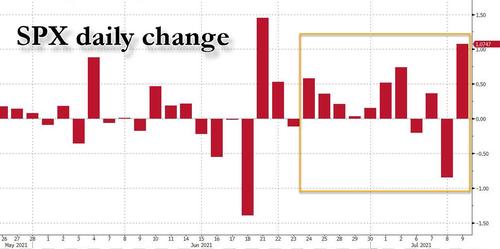

Thursday’s mini rout, which started with one of the ugliest market opens in history in the form of the 4th lowest NYSE TICK print in history…

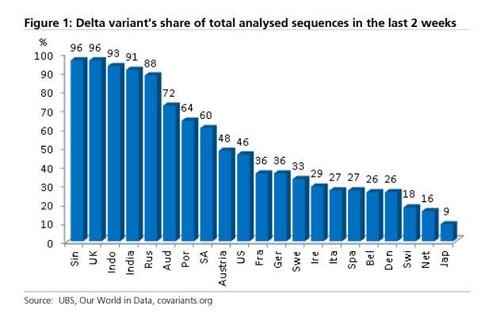

… as traders freaked out over fresh covid pandemic fears due to the soaring number of delta cases around the globe…

… was completely forgotten come Friday, when spoos rose to a new all time high…

… and the 9th in the past 11 days…

… as a buying program hit shortly before midnight and lifted stocks to a new record high.

A big reason for the surge in stocks was the rebound in 10Y yields, which after tumbling sharply earlier in the week to right on top of their 200 DMA, has since moved some 10bps higher to 1.3561%, closing the week where they were just after the OPEC+ nondeal news.

The culprit behind the move in 10Y: breakevens, breakevens, which jumped tracking oil almost tick for tick as they normally do.

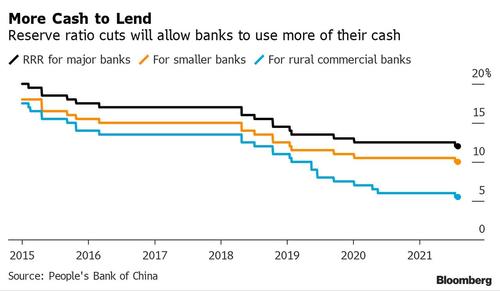

The move in stocks was also helped by China’s dovish capitulation with Beijing announcing early on Friday morning that the PBOC would cut RRR by 0.50bps, injecting 1 trillion yuan into the system, which while not nearly enough to push Chinese stocks sharply higher was enough to offset fears of continued deleveraging.

The backstop from China’s central bank eased volatility concerns, and the VIX tumbled back to 16 after briefly topping 21 on Thursday.

Virtually all vol indicators dropped today, tracking the VIX’s sharp slide.

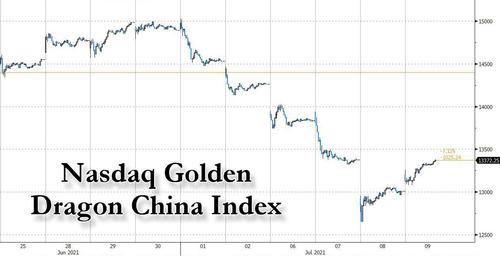

Also thanks to China’s RRR cut – the first since Jan 2020 – shares of Chinese firms listed in the U.S. rebounded strongly on Friday after the Nasdaq Golden Dragon China Index, the benchmark for these ADRs, fell for six straight days.

Even the posterchild of China’s latest crackdown on tech giga-caps, Didi, was up 8% after falling for four days

After an ugly start to the week, when oil tumbled after the UAE refused to join the rest of OPEC+ in agreeing on gradual output hikes which prompted the market to freak out over another imminent OPEC cartel collapse, oil has manged to recover much of its losses and is now where it was before the fireworks started on Monday.

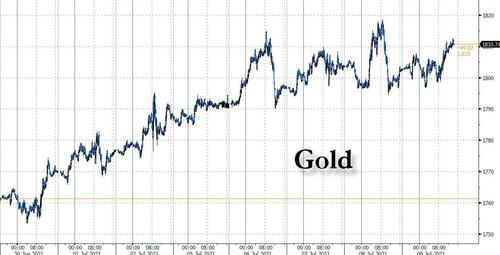

After failing to break above $1800 on three tries earlier in the week, Gold finally rose above the key resistance level, although it remains questionable if it will be able to sustain this advance.

Meanwhile, in the land of digital gold, cryptos recovered some of their recent losses, but remains well below level hit earlier this week, not to mention around 50% below their May highs.

Tyler Durden

Fri, 07/09/2021 – 16:00![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com