The S&P Hasn’t Closed Below Its 200 DMA Since June 2020: What Does This Mean For The Second Half

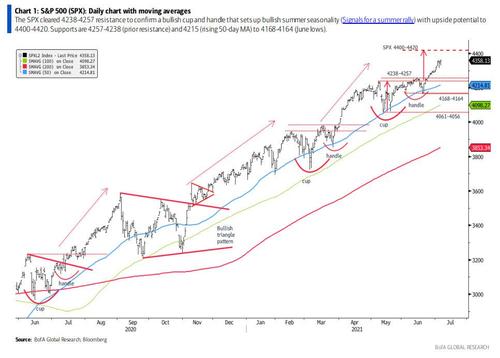

In a year when tens of trillions in central bank liquidity have translated into a constant bid for stocks, the SPX has not had a daily close below its 200-day moving average in 2021, and in fact since June 2020.

But according to BofA’s chief market technician Stephen Suttmeier, this streak may be in jeopardy in the second half. That’s because while there have been 35 out of 93 years (38% of the time) between 1929 through 2021 when the S&P traded constantly above its 200DMA in the first half of the year, this streak gets precarious in the second half – according to Suttmeier, the S&P stayed above its 200-day MA for an entire calendar year only 13 times (or 14% of the time) going back to 1929.

This means that the S&P revisited its 200-day MA in the second half (2H) of the year in 21 out the 35 years in which the S&P did not close below its 200-day MA during the first half of the year. In other words, statistically there is a 60% chance that the S&P will catch down to its 200DMA (SPX 3,863) which at last check is about 17% lower than the spot price in the index, which just hit a new all time high at 4,362.

Here are some more details from the BofA strategist:

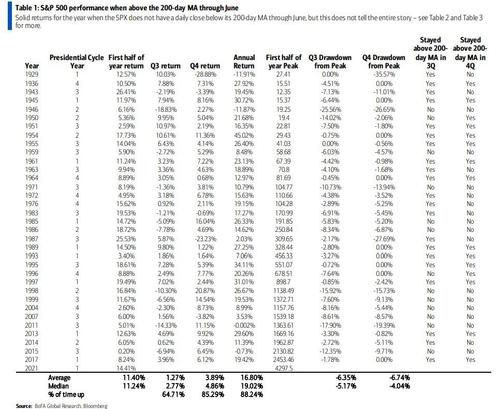

- The SPX has not had a daily close below its 200-day moving average (MA) in 2021. This has happened through June in 35 out of 93 years (38% of the time) from 1929-2021. For years that the SPX did not have a daily close below its 200-day MA through June, the average first half (1H) return is 11.40% (11.24%), which extends to an average annual return of 16.80% (19.02% median) with the SPX up 88% of the time for the year. But, SPX above 200-day MA for entire year only 13 times

- The SPX stayed above its 200-day MA for an entire calendar year only 13 times (14% of the time) going back to 1929. This means that the SPX revisited its 200-day MA in the second half (2H) of the year in 21 out the 35 years in which the SPX did not close below its 200-day MA during the first half of the year. The 200-day MA on the SPX stands at 3853 (11% below current levels) and is rising about five points per session.

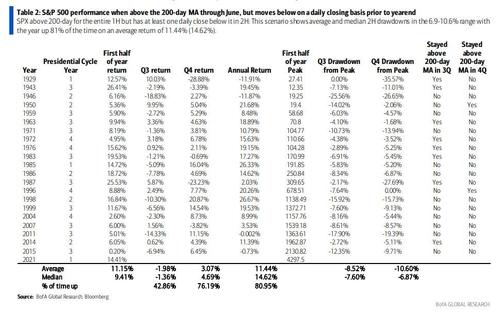

- SPX more likely to revisit its 200-day MA in 2H 2021: History reveals that it is difficult for the SPX to stay above its 200-day MA for an entire calendar year. BofA analyzes the scenario of the SPX spending some time below its 200-day MA on a daily closing basis in 2H, which has happened during 21 out of the prior 35 years when the SPX stayed above its 200-day MA through June. This scenario shows average and median 2H drawdowns in the 6.9-10.6% range with the year up 81% of the time on an average return of 11.44% (14.62%). This means that the SPX could end 2021 near current levels if a move below the 200-day MA occurs prior to the end of the year.

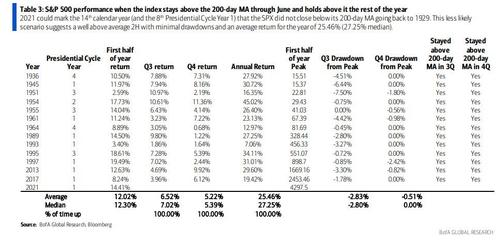

Of course, it is very possible that the trillions in central bank liquidity will keep the S&P elevated and above its 200 DMA for the rest of 2021. That is BofA’s best scenario.

According to Suttmeier, if the SPX stays above its 200-day MA for the rest of the year, 2021 would mark the 14th calendar year that the SPX did not close below its 200-day MA going back to 1929. This “less likely” scenario suggests a well above average 2H with minimal drawdowns and an average return for the year of 25.46% (27.25% median). Pres Cycle Year 1 has held above 200-day MA seven times 2021 is Presidential Cycle Year 1. Prior to 2021, we have had 23 Presidential Cycle Year 1s going back to 1929. Nine of these years (39%) had the SPX holding above its 200-day MA through June, and seven of these nine years (78%) saw the SPX stay above its 200-day MA for the entire year. Seven out of the 13 calendar years in which the SPX did not have a daily close below its 200-day MA were the first year of the Presidential Cycle. 2021 could mark the eighth Year 1 to hold above the 200-day MA. The last two first years of the Presidential Cycle in 2017 and 2013 did not see the SPX trade below its 200-day MA for the entire year.

Tyler Durden

Fri, 07/09/2021 – 12:40![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com

…and you were right! Thanks for the article!