Beige Book: Majority Of Contacts Say Inflation Not Transitory Amid Record Shortages Of Everything

There were no big surprises in the latest Fed Beige Book, at least at the token summary level: the July 14 edition of the Fed’s assessment of the economy starts with the following summary of the national economic situation: “The U.S. economy strengthened further from late May to early July, displaying moderate to robust growth.” With the economy still overheating we’d hate to see what less than moderate is these days.

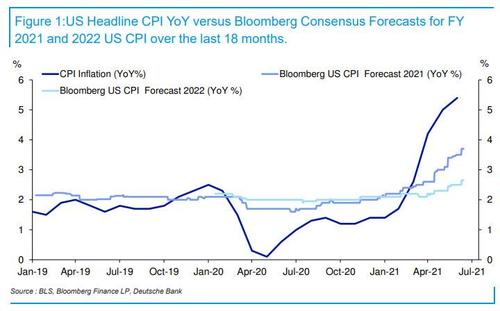

But while the boilerplate verbal assessment was to be expected, what we found especially interesting is that the Beige Book itself contradicted the Fed’s own contention that inflation is transitory.

Specifically, in the Beige Book section discussing pricing pressures, we read that:

- prices increased at an above-average pace, as seven Districts reported strong price growth and the rest saw moderate gains.

- Pricing pressures were broad-based and grew more acute in the hospitality sector, as the reopening of hotels and restaurants confronted limited supplies of materials and workers.

- Construction costs remained high, but lumber prices reportedly eased a bit.

- Container prices returned to very high levels after having moderated in the spring.

- Some contacts reported that high end-user demand enabled them to increase their prices and others said that input price pressures had reduced their profit margins.

And the punchline: “While some contacts felt that pricing pressures were transitory, the majority expected further increases in input costs and selling prices in the coming months.”

Translation: only “some” believe inflation is transitory; the “majority” expect non-transitory inflation, as in longer and higher for much longer. Which is generally in line with the even Wall Street analysts are now telling us.

Prices aside, here are the other highlights in the Beige Book on overall econ activity, and on employment and wages:

- Sectors reporting above-average growth included transportation, travel and tourism, manufacturing, and non-financial services.

- Energy markets improved slightly, and agriculture had mixed results.

- Supply-side disruptions became more widespread, including shortages of materials and labor, delivery delays, and low inventories of many consumer goods.

- Strained car inventories resulted in somewhat lower car sales despite steady demand, and home sales rose slightly despite limited supply.

- Non-auto retail sales grew at a moderate pace on balance, and tourism was buoyed by the further abatement of pandemic-related concerns.

- Residential construction softened in several Districts in response to rising costs, while commercial construction was mixed but up slightly on balance.

- Bank lending activity increased slightly or modestly in most Districts. The outlook for demand improved further, but many contacts expressed uncertainty or pessimism over the easing of supply constraints.

- Three-quarters of Districts reported either slight or modest job gains and the remainder reported moderate or strong increases in employment.

- Healthy labor demand was broad-based but was seen as strongest for low-skilled positions.

- Wages increased at a moderate pace on average, and low-wage workers enjoyed above-average pay increases.

- Labor shortages were often cited as a reason firms could not staff at desired levels, with firms in three Districts delaying expansion or scaling back services due to understaffing.

- Higher than average turnover and lower retention rates were reported in three Districts.

- All Districts noted an increased use of non-wage cash incentives to attract and retain workers.

- Firms in several Districts expected the difficulty finding workers to extend into the early fall.

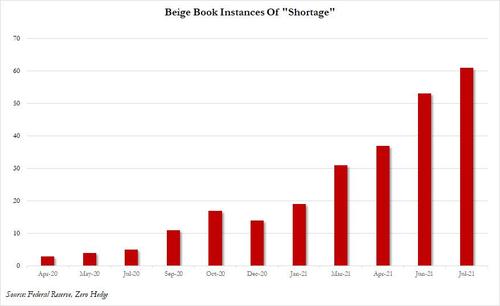

As for the primary driver behind the continued stagflation chaos in the US economy, it is the ongoing supply-chain shock which has led to total confusion in what until recently was a “just in time” economy, resulting in record Beige Book mentions of “shortages.”

Tyler Durden

Wed, 07/14/2021 – 14:37![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com