US Retail Sales Surprise To The Upside After Big Downward Revision, Auto Sales Slump

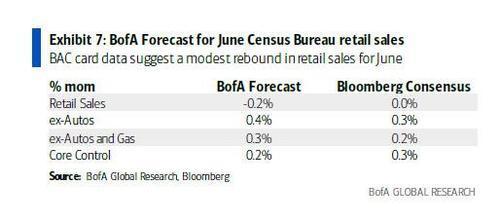

Having consistently ‘nailed it’ over the past few months, BofA’s forecast ahead of today’s retail sales data was ominous, suggesting a “marked slowdown”:

For the first time this year, they were wrong as headline retail sales rose 0.6% MoM (vs -0.3% exp). However, the big June jump is offset by a big downward revision in May to -1.7% MoM (from -1.3%)…

Source: Bloomberg

On a YoY basis, given the base effect is waning, headline and core sales growth is sliding fast…

Source: Bloomberg

Under the surface, motor vehicles sales (supply chain bottlenecks?), furniture (as good as it gets as the economy reopened) and building materials (crashing lumber prices? or demand?) were the biggest losers…

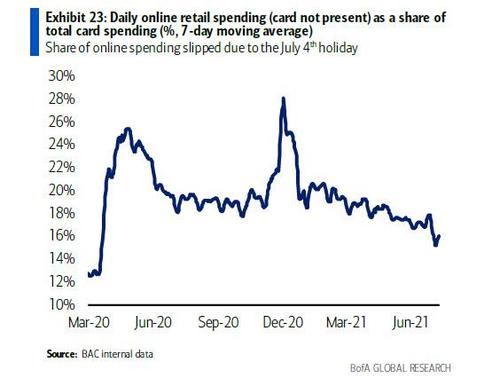

Notably, nonstore retailers (online retail) rebounded per Census, but according to BofA it has dropped to post covid lows…

Perhaps most ominous is that after being positive all year, the 3mo average of Retail Sales Ex Autos plunged to flat…

Source: Bloomberg

From a GDP perspective the control group looks positive at first glance (rising 1.1% MoM), but that ‘beat’ was eaten up almost entirely by a huge downward revision for May from -0.7% MoM to -1.4% MoM.

Finally, we note that retail inventories remain drastically low relative to retail sales, which suggests the ‘transitory’ inflation seen this week in CPI and PPI will be anything but…

Source: Bloomberg

But just keep believing Jay, because, on a long enough timeline, everything is transitory, right?

Tyler Durden

Fri, 07/16/2021 – 08:38![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com