Yields Hit Session High After 20Y Auction Tails Most Since February

Just days after a handful of ugly (if not that ugly) coupon auctions hit the tape, moments ago the Treasury sold the last coupon issuance of the week when it priced another $24BN in 7 year paper in the form of a 19Y-10M reopening of Cusip SY5.

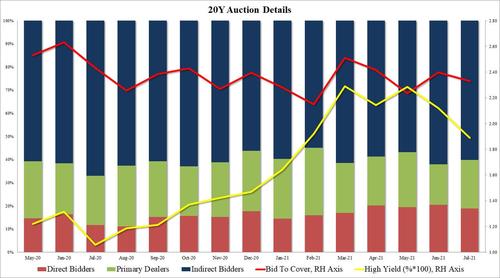

The auction was ugly: with a high yield of 1.890%, it was lower than last month’s 2.12% which is to be expected following the recent plunge in yields, but despite today’s continued move wider in yields, the auction still tailed the When Issued 1.878% by 1.2bps, the biggest tail since Feb.

The bid to cover dropped from 2.40 in June to 2.33, right on top of the six-auction average. The internals were average: Indirects took doown 60.2%, down from 62.1% last month, if above the recent average. And with directs also sliding from 20.4% to 18.9%, Dealers were left holding 20.9%, which was above June’s 17.5% but below the average of 20.9%

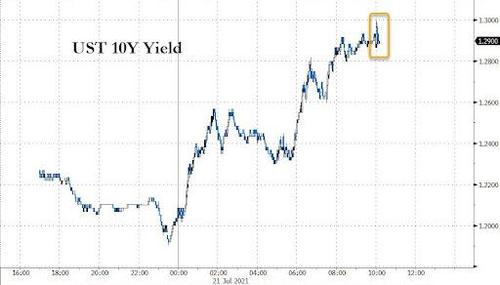

Overall, a slightly disappointing auction if hardly catastrophic, and while 10Y yields hit session highs right after the details printed, the benchmark has since retraced its losses and was unchanged since before the auction.

Tyler Durden

Wed, 07/21/2021 – 13:15![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com