China Stocks Tumble After Beijing Said To Plan Edtech Crackdown, Will Convert Tutoring Firms Into Non-Profits

Another day, another communist crackdown by Beijing on a booming private sector, another plunge in Chinese stocks as the facade of “socialism capitalism with Chinese characteristics” is slowly chipped away.

China’s government is planning a crackdown on the country’s booming off-campus tutoring industry, in one of the biggest overhauls of the education sector that sent dozens of publicly listed stocks tumbling in Shanghai and Hong Kong, as part of a sweeping set of constraints that could decimate the country’s $100 billion education tech industry, sending shares crashing.

According to SCMP, in one of the biggest overhauls in local edtech industry, local authorities will ask companies that offer tutoring on the school curriculum to go non-profit; they will also ban the provision of holiday and weekend tutoring, “and will no longer approve the establishment of new tuition centres, according to sources briefed on a newly released policy document promulgated by the State Council.”

As part of this non-profit conversion, companies that operate edtech platforms, or services that provide online education, will not longer be allowed to raise capital through initial public offerings. Listed companies and overseas investors will be barred from investing, or acquiring stakes, in education firms that teach school curriculum, according to the rules.

Bloomberg adds that local regulators will also stop approving new after-school education firms seeking to offer tutoring on China’s compulsory syllabus and require extra scrutiny of existing online platforms, the people said. Vacation and weekend tutoring on school subjects will also be banned, they said. Changes may still occur as the rules haven’t been published. The 21st Century Business Herald earlier reported the bans on IPOs and investments by listed firms.

The new set of regulations, devised and overseen by a dedicated branch set up just last month to regulate the industry, could wipe out the enormous growth that made stock market darlings of TAL Education Group and Gaotu Techedu Inc. The regulatory assault mirrors a broader campaign against the growing heft of Chinese internet companies from Didi Global Inc. to Alibaba Group Holding Ltd.

Beijing is coming down hard on the sector as “excessive tutoring anguishes young pupils and burdens parents with expensive tutoring fees” according to Bloomberg. It’s also regarded as an impediment to one of the country’s top priorities, boosting a declining birth rate. Last month, China said it will allow a couple to have three children and released a slew of support measures to encourage births and lower child expenses.

The booming industry – estimated at 811 billion yuan (US$125 billion) in 2021 by Frost & Sullivan – has added to the costs of young households, contributing to a financial burden that has dissuaded families from having more children, even as the government abandoned its one-child policy population control. – SCMP

“The motivation behind the government’s move to ease the burden for students is that many people are not willing to have children due to the huge cost of raising kids,” said Li Qingshan, research director at EqualOcean. “There are fewer and fewer newborns in recent years. And that’s the problem the government needs to solve as the top priority.”

The latest rules are details that added to the edict by Chinese President Xi Jinping during a May 21 meeting, during which he instructed the government to rein back on runaway investments in the education industry, and promulgated a set of rules to ease the burden of homework and after-school training for primary and secondary school students.

Beijing has taken issue with for-profit companies for stressing out kids while enriching investors and startup founders. In May, President Xi Jinping chaired a meeting with top officials where they approved a new set of rules to ease the burden of homework and after-school training for primary and secondary school students. Last month, China’s education ministry created a dedicated division to oversee all private education platforms for the first time. That followed a plethora of restrictions, including caps on fees firms can charge and time limits on after-school programs. Regulators have fined two of the biggest startups for false advertising: Alibaba-backed Zuoyebang and Tencent-investee Yuanfudao. A new law on minor protection, which went into effect June 1, also bans kindergarten and private institutions from teaching the primary-school curriculum to pre-schoolers — not uncommon previously.

Making the whole sector go non-profit “would make being a listed entity meaningless,” said Justin Tang, head of Asian research at United First Partners. “Investors are selling out first and asking questions later. It’s all being done to reduce cost of education and motivate citizens to raise kids.”

Others agreed: “Making the sector non-profit is just as good as eradicating the industry all together,” said Wu Yuefeng, a fund manager at Funding Capital Management (Beijing) Co. “The regulations on financing are a major surprise and shows that to the authorities, this is a matter of no small importance. In the short term for the sector, any news will be bad news.”

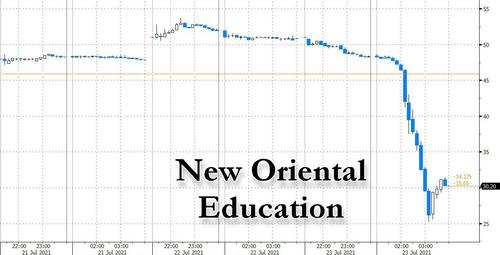

In response, Gaotu Techedu, TAL Education and New Oriental Education & Technology Group all plunged by at least 50% this morning while Koolearn Technology Holding Ltd. tumbled 28%, also its biggest-ever single day loss.

It wasn’t just techedu stocks that got crushed: shares of some of the biggest US-listed Chinese firms also dropped in premarket trading Friday as concerns surrounding further regulatory scrutiny deepen. Didi shares sink as much as 12%, extending their losing streak to a second straight day and taking their post IPO losses to 35% in just three weeks! The ride-hailing giant fell more than 11% on Thursday after Chinese regulators were said to be considering “unprecedented penalties” for the firm after its disastrous IPO last month. Chinese tech-giants, which have been under pressure amid China’s ongoing crackdown of the sector, are also lower in premarket: Alibaba falls 3%, Pinduoduo slides 3.9%, JD.com slips 3.7%, NetEase declines 3.1%, Nio loses 2.8%, Baidu drops 2.5%, Xpeng is down 2.4% and Li Auto falls 3.2% as of 8:05 a.m. in New York.

As Bloomberg adds, shares of China’s largest private education companies are among the world’s worst performers in recent months, with New Oriental Education, TAL Education and Gaotu Techedu together shedding nearly $100 billion of value from their highs reached earlier this year. Gaotu hasn’t received official notification of the rules, the company said in an email.

As much as $10 billion of venture capital poured into China’s edtech sector last year alone, spawning hundreds of start-ups, apps, and edtech platforms that provided everything from K-12 tutoring to elementary mathematics, language skills and music. Alibaba, Tencent Holdings Ltd. and ByteDance Ltd.all entered the arena, seeking to capitalize on Chinese parents’ desires to give their children every academic advantage. A spokesman from the education ministry said relevant polices are still being formulated and declined to provide more details.

Several high-profile startups in the sector including Yuanfudao, which at $15.5 billion is the most valuable of the lot, are likely to have to put initial public offering plans on hold because of the crackdown.

Tyler Durden

Fri, 07/23/2021 – 08:38![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com