Time To Short Melvin’s Longs? Citadel To Pull $500 Million From Embattled Hedge Fund

Late January was a memorable time for traders because that’s when some of the most profitable trades – perhaps in a generation – appeared suddenly, when names shorted by Melvin Capital suddenly exploded higher in the most devastating short squeeze in years, forcing the fund to liquidate its short book consisting of dozens of puts, and quickly seek a bailout after suffering billions in losses in days if not hours. Will late August be just as memorable for shorting Melvin’s longs?

We ask because Bloomberg reports that just 7 months after Citadel swooped in to rescue Melvin Capital, Ken Griffin’s fund will redeem about $500 million from its $2 billion January infusion into Gabe Plotkin’s hedge fund after the investment turned just barely positive.

And since Citadel plans to withdraw the money at the end of the third quarter, according to the Bloomberg source, it means that the cash-strapped Melvin will now have to obtain the needed liquidity to satisfy the cash call, which could well mean it has to sell a substantial portion of its longs.

As a reminder, Citadel made the investment, along with $750 million from Point72 Asset Management, in late January when Melvin’s short positions soared, leading to billions in margin calls. In exchange, the two hedge funds received a three-year minority piece of its revenue. Citadel’s redemption won’t affect that arrangement; Point72’s capital will remain unchanged Bloomberg notes.

The reason why Citadel is partially cashing out is because the January infusion from Plotkin’s former bosses, billionaires Steve Cohenand Ken Griffin, has finally turned profitable: after being down 3% at the end of June, Melvin gained 5.4% in July, capping off a six-month advance of 25%. That said, cashing out a quarter of one’s money simply because it is in the money is hardly a vote of confidence by Citadel in Melvin’s abilities.

Sure enough, Melvin which manages about $11 billion in assets, is still down about 43% this year as it claws back from a loss of almost 55% in January. The firm raised new funds in March and April and has continued to hire and add office space.

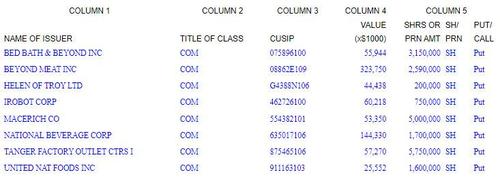

Last week, Melvin released previously confidential documents which showed that it held put options on numerous additional stocks at the end of December, setting the stage for the January rout of his hedge fund that day traders orchestrated through social media. Prices of heavily shorted shares like GameStop soared, forcing Plotkin to close out his short positions.

Meanwhile, Citadel’s Wellington hedge fund is up 8.8% through Aug. 13, according to a person familiar with its performance. Of course, all this excludes the money printing machine “market maker” that is Citadel Securities which pays Robinhood hundreds of millions for first dibs on its entire retail orderflow so it know faster than anyone else on Wall Street which way the retail crowd is trading, effectively assuring it of risk-free trades.

Which brings us to the initial point: is it time to start shorting Melvin’s positions for a change, betting on a liquidation squeeze?

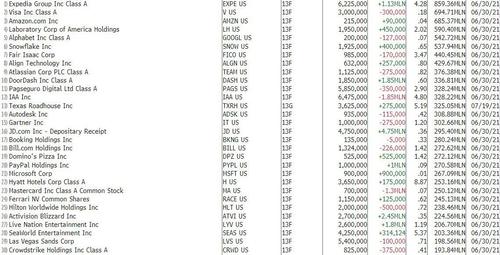

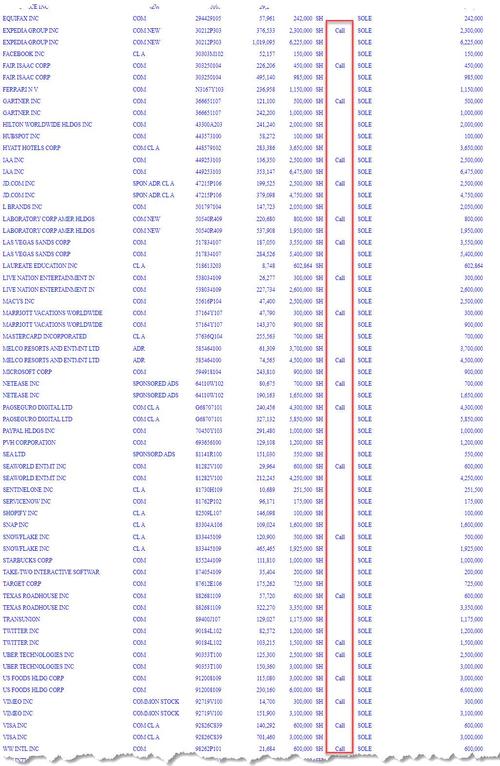

A quick Bloomberg screen for Melvin’s top holdings shows the usual suspects…

… but what we find more fascinating is that having “learned” from its mistakes, instead of all puts, Melvin is now entirely calls. And the funny thing about gamma is that it works both ways – should names where the fund have outsized call exposure suddenly tumble, it would be a disaster for the hedge fund forced to rapidly unwind its book for the second time in 7 months. It would also make repaying Citadel rather challenging…

Tyler Durden

Sat, 08/21/2021 – 13:00![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com