Morgan Stanley: The US Consumer Is Headed For A Double-Dip Recession

Two weeks ago, well before most banks slashed their GDP forecasts (most notably Goldman who took a machete to its Q3 GDP estimate of 8.5% and now sees just 5.5% growth in Q3), we noted that “a sudden negative change” had taken place in the economy, predicting (correctly) that retail sales would be a big miss (they were). Specifically, we looked at the latest ominous trend in consumer spending which was notably inflecting lower at a time when the latest UMich survey found that reactions to market prices on purchases for homes, vehicles, and household durables were the most negative ever recorded in the long history of the surveys, with a record number of respondents remarking on the bad buying conditions for virtually every product category.

And while most banks have been quick to attribute the sudden freeze in consumer spending to covid fears, one analyst agreed with our view that something more fundamental had changed: as Morgan Stanley’s chief equity strategist Michael Wilson writes this morning, “disappointing retail sales and consumer sentiment suggest the US consumer is fading” and while Wilson shares our view that most blame Delta he, like us, thinks this is more about a payback in demand.

This is how Wilson – who just last week was tapped on the shoulder and hiked his year-end S&P price target – lays out his typically contrarian view:

There is an old adage that says never bet against the US Consumer’s willingness to spend. In fact, it was one of the primary reasons we led the charge on recommending consumer cyclicals back in April 2020 at the depths of the COVID recession. Indeed, with Congress expeditiously providing record amounts of fiscal stimulus last year, the table was set for a major consumer stand against the downturn. Fast forward 16 months and it’s fair to say the US consumer has not disappointed. But, after a year of remarkable resilience from the US consumer, it begs the question: “Is it sustainable?” While there is little doubt about the US consumers’ willingness to spend, the other key variable to consider is their ability to spend.

To be sure, this isn’t the first time Wilson has turned bearish on the US consumer: back in April, after riding one of the best periods of outperformance for consumer discretionary stocks in history, Morgan Stanley downgraded the sector given the bank’s view for an eventual payback in spending during the pandemic.

The reasons were twofold:

- first, there wasn’t much of a recession at all when looking at Real Personal Consumption over the last 18 months.

- second, It’s the same story when looking at nominal retail sales which tells us we should expect a reversion to trend now that the stimulus is behind us.

These observations have not been lost on the market: since April, consumer discretionary stocks have underperformed and it’s accelerated over the past few weeks as consumer confidence and retail sales numbers disappointed (Exhibit 3 and Exhibit 4).

The relative underperformance has been even worse for Amazon, the king of retail during the pandemic. With the company suggesting there will be payback on demand, Wilson warns that “this seems like a pretty good leading indicator of what to expect for consumer discretionary more broadly” adding sarcastically that last time he checked, “consumption is 70% of the economy and that’s a big number to overcome, even if investment comes back strongly next year as our economists expect.”

And yet, with all of this very clear writing on the wall with respect to potential payback in consumption, Wilson was surprised to see the consensus shrug off the recent collapse in the UMich consumer confidence survey. In fact, even with his increasingly bearish view on consumption, he were a bit “shocked” by just how dramatic of a fall the survey produced:

- First, the headline plunged to new cycle lows, below the levels witnessed during the worst of the lock downs and when it really did feel like a recession.

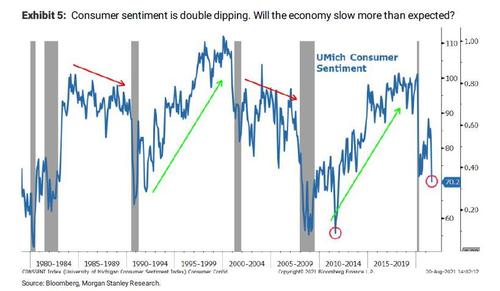

- Second, it’s not unprecedented for consumer sentiment to fall to new lows post a recession. In fact, we saw the same thing in the prior two recessions (red circles on Exhibit 5). In the 2001- 2009 and 1982-89 expansions, consumer sentiment never really recovered and both of those cycle proved to be less exciting for consumer oriented stocks and the economy. Contrast that with the 1990-2000 and 2009-2020 expansions where the consumer sentiment continued to climb and fueled the longest and strongest recoveries on record.

So all else equal, just looking at the chart below one would conclude that the US consumer is headed for a double-dip recession even as stocks make new all time highs.

Needless to say, it will be important to see if consumer sentiment can recover in the months ahead as it will determine what kind of economy cycle we are likely to experience both in terms of its duration and what leads.

Wilson’s take of this troubling development is that this lines up with his view for “a hotter but shorter cycle” as demand was pulled forward in this cycle like never before. The problem is what happens next: payback is likely in the near term as consumption reverts back toward trend as illustrated earlier. This spells trouble for the consumer discretionary sector and any sector that is over reliant on an ebullient consumer.

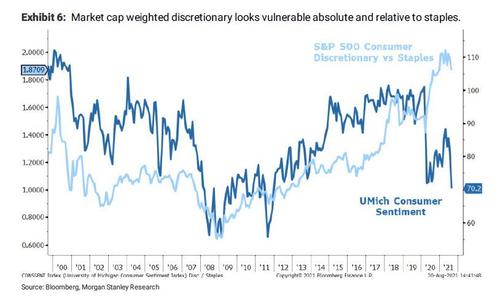

Bottom line, Morgan Stanley continue to recommend long consumer staples over discretionary, preferably equal-weighted as shown in Exhibit 3but market cap weighted should work, too.

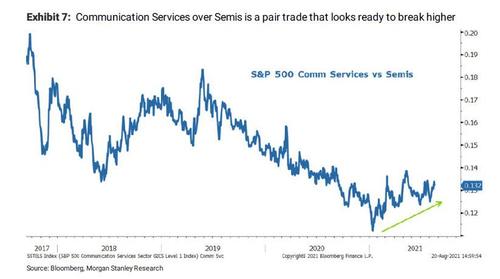

Separately, and in keeping with the bank’s recent downgrade of the semiconductor sector, Wilson adds that consumer electronics is another area which looks especially vulnerable which is one reason Morgan Stanley remains cautious on semiconductors and parts of Tech hardware. Here the strategist notes that “another trade we continue to like is communication services over semiconductors which has been working this year but has been trading in a range lately and looks ready to break higher if we are right about our payback in demand thesis and a consumer that is less optimistic.”

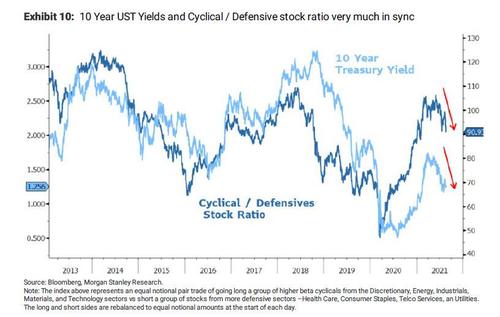

Outside of equities, Wilson also believes that the recent consumer weakness also explains why bond yields have remained so stubbornly low even in the face of high inflation readings and a Fed that is moving ever closer to tapering (aside from the fact that the bulk of the selling appears to originate during Tokyo hours suggesting that it may be far more flow based than fundamental). The fact that Morgan Stanley’s cyclicals/defensive stock ratio broke to new lows last week is a sign that yields may soon follow.

Ironically, if the Fed were to talk more aggressively about tapering at this week’s Jackson Hole meeting, Wilson thinks it would lead to lower yields in the near term as the bond market may view that as a mistake as growth is decelerating and the Consumer is fading. Such a move would further support the bank’s more recent defensive tilt and while it may weigh on the bank’s preferred financials position, Wilson is keeping that side of the barbell in the case it is wrong about growth decelerating more than expected and rates rip to the upside.

Tyler Durden

Mon, 08/23/2021 – 14:40![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com