Yields Slide After One Of The Strongest 10Y Auctions On Record

While there was no way today’s 10Y auction could surpass last month’s stunning, blowout, record 10Y auction, today’s sale of $38BN in ten-year paper (down from $41BN last month) was not that much worse.

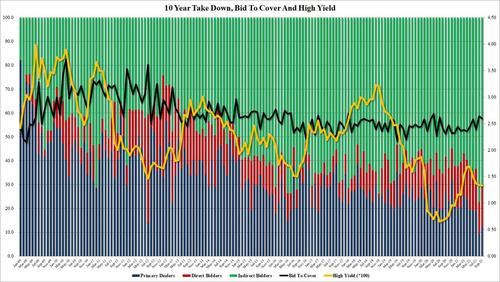

The auction priced at a remarkable 1.338% – remarkable not only because the yield was a drop from last month’s already stellar 1.34%, making it the lowest 10Y yield since February’s 1.155%, but because the auction stopped through the When Issued 1.352% by a whopping 1.4 bps, making this the fifth consecutive stopping through auction, the longest such stretch in recent history.

While the bid to cover of 2.59 was a modest drop from last month’s blockbuster 2.65, excluding the August blowout auction it was the highest BtC since July 2020. Naturally it was far higher than the six-auction average of 2.47.

The Internals were also rock solid, with Indirects taking down 71.1% and while that wasn’t a record high – that honor is reserved again for the blockbuster August auction – it was not much lower and would would have to go all the way back to Nov 2018 to get a higher Indirect take down. And with Directs taking down 16.6%, or modestly above last month’s 13.1% it left Dealers holding 12.3%, well below the recent average of 19.5%.

Overall, this was another blockbuster auction which while not nearly as strong as last month’s sale of 10Y paper was very close.

And indeed, the market reaction confirmed just how strong the auction was with 10Y yields tumbling to session lows of 1.3350%, having hit 1.375% earlier in the session.

Tyler Durden

Wed, 09/08/2021 – 13:15![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com