Yields Plunge After Spectacular 30Y Auction, Lowest Dealers On Record

If yesterday’s 10Y auction was blockbuster, one of the strongest benchmark sales on record, then today’s $24 billion offering of 30Y paper – the last coupon auction of the week – was nothing short of spectacular.

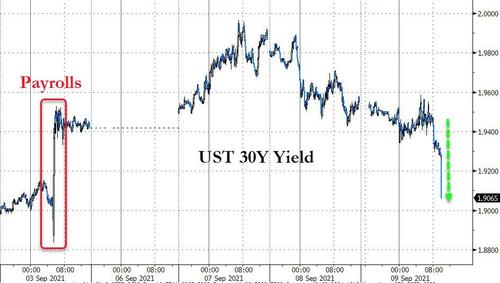

Printing at a high yield of just 1.910%, the auction not only stopped at the lowest yield since January’s 1.825%, but also stopped through the When Issued by a whopping 1.8bps, the most since April and ended 4 consecutive months of tails in the 30Y tenor.

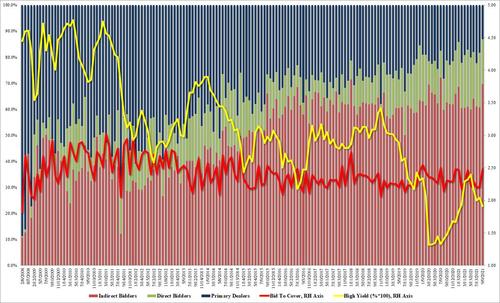

The bid to cover of 2.486 was not only a big jump from last month’s 2.208 but also the highest since the 2.500% in July 2020, and far above the six-auction average of 2.276.

The internals were stellar as well, with Indirects taking down a whopping 69.7%, 9bps above the 60.7% in August and also the highest since July 2020. And with directs taking down 17.2%, Dealers were left holding on to 13.1% of the auction, the lowest Dealer takedown on record!

Overall, an absolutely blockbuster auction perhaps helped by the fact that the ECB launched a dovish non-taper taper, but whatever the reason, at least the bond market remains convinced that after the current period of “transitory” inflation ends, the world will slide right back into deflation.

The auction was so strong, it sent 30Y yields to session lows..

… and sent the 10Y to new session lows, down over 3bps on the auction and last seen below 1.29%!

Tyler Durden

Thu, 09/09/2021 – 13:17![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com