Funds Are Simply “Rebranding” As ESG And Watching The Inflows Pour In

No one has been more skeptical of the ESG movement than we have, consistently noting that the virtue signaling term, when appended to most investment vehicles, still winds up giving investors exposure to the same old energy, oil and gas and tech names they would normally be buying with any other index fund.

Most “ESG” funds still include companies that have been accused of poor environmental and/or labor practices and other companies that wouldn’t normally fall into the “warm and fuzzy” bucket people think they’re investing in when they see the green term, we’ve pointed out.

And now the Wall Street Journal is helping making our case, pointing out this week that funds are simply “rebranding” as ESG and watching inflows pour in. Just last year alone, 25 funds were rebranded as sustainable, according to data from Morningstar. The Journal points out three examples:

The American Century Fundamental Equity Fund is now the Sustainable Equity Fund, the USAA World Growth Fund is the USAA Sustainable World Fund and the Putnam Multi-Cap Growth Fund is now the Putnam Sustainable Leaders Fund.

“You have big fund companies with an inventory of funds, a lot of which aren’t really attracting assets anymore, saying ‘OK, here’s this new investment trend happening; what do we do,'” said Morningstar Head of Sustainability Research Jon Hale.

35 of 64 rebranded funds since 2013 “were suffering from investor withdrawals in the three years before they went green”. Once the rebranding was complete, 13 funds saw investors put cash back into the funds.

Meanwhile, funds like the USAA Sustainable World Fund holds more than $100 million worth of 47 fossil fuel companies. The Sustainable World Fund holds shares of mining companies like Rio Tinto, the report noted.

Mannik S. Dhillon, president of VictoryShares & Solutions, an investment adviser for USAA, told the WSJ: “We believe incorporating ESG considerations into a portfolio should be an input under a larger mosaic of considerations any manager evaluates to achieve a well-balanced, diversified portfolio.”

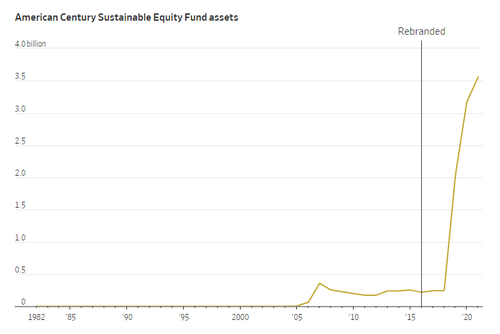

The American Century Investment’s Fundamental Equity Fund was also seeing outflows for years before it rebranded in 2016. Since then, it has brought in $1.7 billion.

American Century Vice President Joe Reiland commented: “To us, that was an affirmation that we made the right changes. The performance was getting better, the investment community was more interested in investing sustainably and it made us more marketable to clients.”

Sure, Joe. The performance.

The fund still owns ConocoPhillips, the report notes. But, hey, it’s the lesser of two evils, Reiland commented: “After analyzing the two, ConocoPhillips was demonstrating the ability to become an ESG leader over Exxon.”

Putnam Investments’ Putnam Multi-Cap Growth and Multi-Cap Value funds were both hovering near lows in the early 2000s before being rebranded. Since then, they’ve seen a boon:

Assets of the rechristened Putnam Sustainable Leaders Fund rose by 66% to $6.5 billion as of this June. The Putnam Sustainable Future Fund grew its assets by 93% to $649 million, according to the Journal’s analysis. Both funds have outperformed their benchmarks and the S&P 500 in the past three years after periods of mixed performance prior to rebranding.

“We’re happy not just with the numbers but with how those numbers have been generated,” concluded Putnam’s head of sustainable investing, Katherine Collins.

We bet.

Tyler Durden

Mon, 09/13/2021 – 05:45![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com