Goldman Tells Hedge Funds How To Profit From Europe’s Gas Price Hyperinflation, Warns Of Blackouts

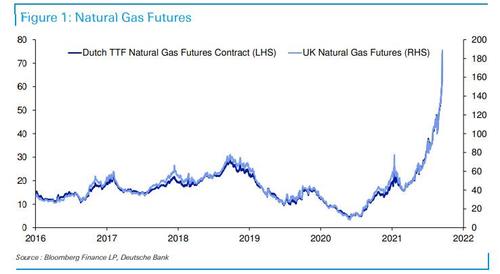

After weeks of covering the remarkable, record hyperinflation in European gas prices, which have soared to such tremendous levels that protests against the price of electricity across Europe are a daily occurrence, it is hardly a secret to anyone that the cost of living in Europe this winter will be especially miserable, and could be even more miserable if Vladimir Putin decides to throttle gas deliveries to Europe.

Of course, Europe’s “green” obsession to fight climate change is also a key contributor to the explosive move in the price, with Deutsche Bank writing today that “if governments are serious about addressing climate change then there will be a huge cost and taxing carbon will be regressive. As such they will have to spend even more to help out lower income households.”

In other words, all those who are have so generously signaled their virtuous desire to fix the climate are about to pay through the nose for the privilege.

A quick big picture recap for those who have missed the biggest move in gas prices in history, here is a quick primer.

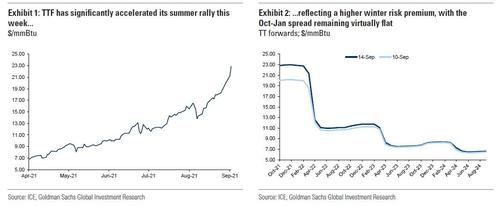

Over the past month, European natural gas prices have rallied more than 40% and more than 14% this week – to a record-high 22/mmBtu. While NW European gas inventories are at record-low levels for this time of the year, there have been no significant changes to fundamentals in recent days and the Oct-Jan spread has remained virtually flat in this latest rally.

This suggests that current prices reflect not only the tight current balances in NW Europe, but also a growing winter risk premium, which according to Goldman is near $3/mmBtu, to price a probability that regional gas prices will need to incentivize demand destruction and/or attract incremental LNG this winter. This is the equivalent to pricing a 21% probability that TTF rallies to the $32/mm Btu highs observed in JKM earlier this year, when Northeast Asia gas markets were tightened by a cold winter event.

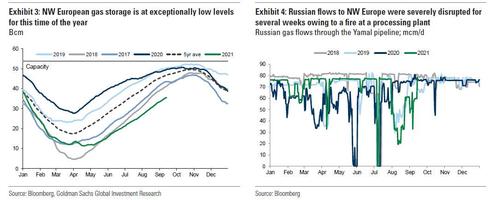

How did we get here? In three words, weather, LNG and, more recently, Russia.

Northwest European gas inventories, currently 24% below average, have been tight since the beginning of this summer, when the region experienced two consecutive cold weather events in April and May. Gas balances were subsequently further tightened by disappointing LNG imports, with heavy maintenance in Australia and Russia removing 7 mtpa (26 mcm/d or 0.9 Bcf/d) on average from peak summer supplies(Jun-Aug), while strong South American demand reduced the residual LNG flow to be sent to Europe by another 6 mtpa in the same period (we discussed this in “From Russia With 50% Less Supply: European Nat Gas Prices Explode To Record Highs As Putin Turns The Screws“).

More recently, NW European gas balances were made even tighter owing to an outage at a Russian condensate processing facility at Urengoy that impacted gas production and exports. The drop in Russian flows to NW Europe peaked at about 60 mcm/d (2Bcf/d) in mid-August and kept gas send outs to Germany through the Yamal pipeline about 20 mcm/d below normal for two weeks this month, before normalizing today (Sep 14th).

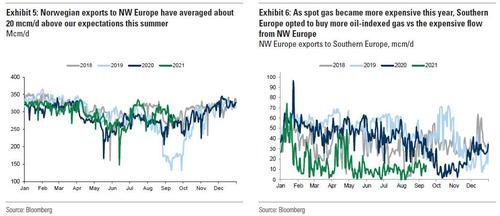

The meaningful rally seen in TTF prices as a response to these exceptionally low levels of gas storage has led to higher supply and lower demand of gas this summer.

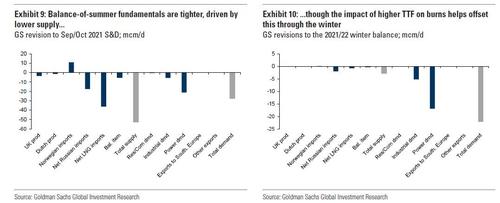

- On the supply side this has added up to about 40 mcm/d of incremental available volumes from a combination of higher imports from Norway and reduced pipeline exports to Southern Europe vs a roughly flat supply we originally expected vs last summer. Norwegian sendouts to NWEurope have relied on swing fields like Troll to surprise to the upside. Further, oil-indexed gas flows from Russia and North Africa to the Continent have also increased year-on-year owing to improved competitiveness vs spot gas, driving a 25 mcm/d year-on-year drop in NW European pipeline exports to Southern Europe this summer.

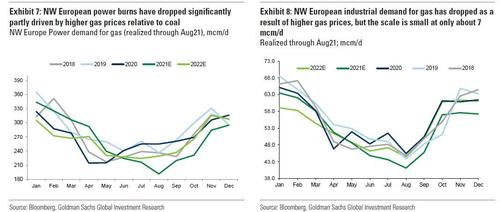

- On the demand side, the main response to higher prices has come from power burns, down 38 mcm/d year-on-year on average since June (19 mcm/d of that driven by price-driven gas-to-coal (G2C) substitution, the remainder by higher nuclear generation) despite higher total load and lower-than-expected wind generation(Exhibit 7). Realized data suggest industrial demand for gas has also dropped driven by higher prices, though the magnitude of the impact has been significantly smaller than what we have observed for power burns, at about 7 mcm/d.

Then there is the winter: while the abovementioned supply and demand responses to prices have helped add gas to storage ahead of the next winter, they have been insufficient to fully offset the primary tightening drivers discussed above. As a result, Goldman has revised its estimated end-Oct21 storage levels under current forwards lower by almost 2 Bcm to 42 Bcm (78% of full). That’s 8 Bcm and 6 Bcm down year-on-year and relative to the previous low of Oct18, respectively.

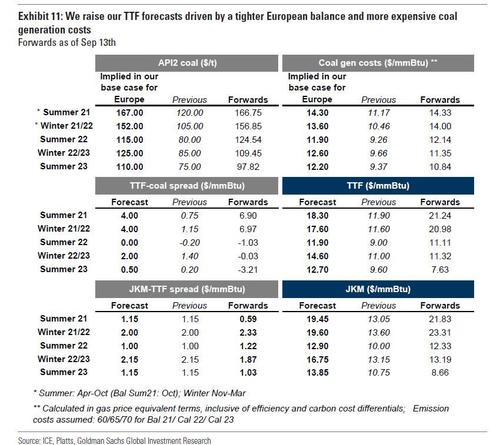

And while we know why prices are where they are, the next question is where they are going: according to a report published by Goldman’s Samantha Dart, “the max G2C substitution required during the winter to help normalize March inventories leads us to raise our winter TTF premium to coal generation costs to $4.00/mmBtu in line with our burn model parameters from $1.15 previously, vs the current forward spread near $7. Further, given the continued rally seen in international coal prices and carbon costs, we raise our assumed coal generation costs for the winter to $13.60/mmBtu from$10.50 previously, vs forwards at $14/mmBtu.” Net, this takes Goldman’s base case (under a10-year average weather assumption) Winter 2021/22 TTF price forecast (equivalen tto the coal generation cost plus the TTF premium) to $17.60/mmBtu from $11.60previously, vs forwards at $20.98 as of Sep 13th.

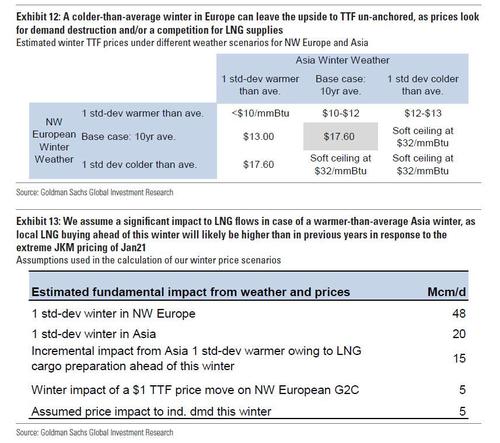

Naturally, this price forecast has risks, first to the upside.

- While Goldman estimates that a one-standard-deviation colder-than-average winter, worth approximately 7Bcm, would still keep end-winter storage above the lows of 2018 (albeit still below20% full), Goldman’s numbers assume above-consensus winter supplies, almost 40 mcm/dup year-on-year (which adds up to over 6 Bcm over the course of the winter). This is mainly driven by lower scheduled maintenance in Norway (17 mcm/d), higher LNG imports (9 mcm/d), UK production recovery from heavy maintenance this year (7mcm/d) and a marginal improvement in Russian sendouts owing to the start up ofNS2 (7 mcm/d). As a result, disappointing supply flows in the coming monthsrelative to our assumptions could significantly exacerbate the impact of a colder-than-average winter

- On the other hand, one potential risk to Goldman’s forecast price hike is that the European winter is warm. Here, Dart notes that “a one-standard-deviation warmer-than-average winter in Europe would, in our view move TTF prices backbelow coal generation costs, given that G2C substitution would no longer be required to manage winter storage. Since a warm winter would also reduce overall electricity generation vs the bank’s base case and, hence, coal demand and carbon emissions, coal generation costs would also be under pressure from current levels.With every $9/t move in coal prices worth about $0.50/mmBtu, and every 5 EUR/t move in carbon costs worth about $0.40/mmBtu in gas-equivalent terms, coal generation costs could easily drop $1-$2/mmBtu in this scenario, driving a$9-$11/mmBtu drop in winter TTF prices.

How does this forecast compare to the US, where prices – while nowhere near as high as Europe – are also rising fast, and today Bloomberg writes “Warding Off Winter Cold in U.S. Will Be Pricey as Propane Soars.” Well, according to Goldman, Europe is more vulnerable to an un-anchored price scenario this winter than the US. The reason is that while low natural gas inventory levels in Europe and in the US currently have left both markets with potentially very significant price upside, it is the extreme lack of flexibility in European gas markets from here (exhausted G2C substitution and poor industrial demand sensitivity), that leaves European gas markets even more vulnerable to these un-anchored price scenarios compared to the US. Unlike in Europe, US gas markets can still rely on Appalachia G2C substitution and/or an increase in Canadian imports to some extent to compensate for moderate or short-lived cold spikes this winter. This suggests that, while the latest moves in TTF have been remarkable, they are not unreasonable.

* * *

Had Goldman ended its note there, laying out all the fundamental drivers of the recent move and presenting its price forecasts, all would be well. However, we are confident that Europe’s unelected bureaucrats are about to be quite angry with the vampire squid for two main reasons:

First, in a surprising turn of truthiness, Goldman tells its clients what Europe’s green-obsessed government won’t, namely that Europe, with all of its ultra advanced and extensively “greenified” energy infrastructure, is facing blackouts! To wit:

Importantly, there’s a non-negligible risk that such redirection flows may be insufficient to prevent a stock-out in gas inventories by the end of winter, for example if weather is cold in both Europe and Asia. Under such an outcome, the only balancing mechanism would be a significant further rally in European gas and power prices reflective of the need to destroy demand, with curtailed power demand in the industrial sector through blackouts.

But if that wasn’t bad enough, what Goldman said next is sure to provoke furious anger out of Brussels, because in a paragraph which Goldman’s energy analysts strategically saved for the end of the note, the bank give its recommendation to European “gas consumers” on how “they should protect themselves.” This is amusing because virtually no European gas consumer will read the Goldman note which instead is targeted to hedge funds and institutional commodity funds, who will however be delighted to take Goldman’s advice to heart.

What advice? Here it is:

“we continue to recommend that gas consumers protect themselves via out-of-the-money calls for this winter. Further, we strongly recommend that European consumers in particular hedge their gas exposure further out the curve, where TTF appears especially underpriced relative to coal.”

Translation: Goldman’s clients (mostly hedge funds) are about to pour gasoline (or nat gas so to speak) on the hyperinflationary fire, and send nattie prices soaring even higher, in the process providing the missing link in the commodity price explosion, namely giving politicians a bullseye target to demonize hedge funds – and investment banks – for Europe’s insane energy prices (when in reality they are just capitalizing on Europe’s ruinous energy policies). But since Europe’s angry, and protesting, electorate needs a sacrificial lamb, whether it wanted to or not Goldman just provided one and we now look forward to the upcoming weeks and months of European hedge fund bashing who – like back in 2008 when crude prices hit $150 – will be summarily trotted out as the culprit behind the devastating move higher in European nat gas prices, even if that ultimately does nothing to alleviate what is shaping up as a very cold winter.

Tyler Durden

Wed, 09/15/2021 – 18:00![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com