With $750 Billion In Single Stock Options Expiring, These Names Will Be Especially Volatile Today

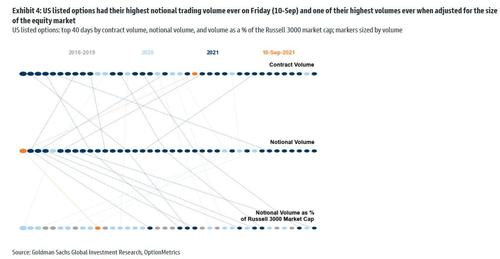

As we noted earlier this week, today’s expiry will be the second largest for single stock options outside of January months. It comes after a record surge in single stock options volumes – which last friday hit a record $2 trillion…

.. even as shares volumes have declined to YTD lows, as retail investors have decisively shifted to trading options. Meanwhile, as we have been documenting all year, trading activity has been concentrated in short term options; options with less than 2 weeks to maturity now comprise 71% of all US single stock volumes.

Furthermore, as Goldman notes, option market concentration remains high, with 58% of all trades in the top 5 underliers, while 84% are in the top 50 underliers.

Which brings us to today, when more than $750bn of single stock options will expire, making it the second largest non-January expiration. As Goldman’s Vishal Vivek writes, “today’s expiry could be important for stocks with large open interest in at-the-money (ATM) options; market makers delta-hedging large options portfolios will be active. This flow is likely to dampen volatility in some names while exacerbating stock price moves in others.”

Since every quarter we get questions why triple (or quad) witching matters, here is a quick reminder:

Open interest in ATM options expiring on Friday may impact stock trading

At major expirations, options traders track situations where a large amount of open interest is set to expire. In situations where there is a significant amount of expiring open interest in at-the-money strikes (strike prices at or very near the current stock price), delta-hedging activity can impact the underlying stock’s trading that day. If market makers or other options traders who delta-hedge their positions are net long ATM options, expiration-related flow could have the effect of dampening stock price movements, causing the stock price to settle near the strike with large open interest. This situation is often referred to as a “pin” and can be an ideal situation for a large investor trying to enter/exit a stock position. Alternatively, if delta-hedgers are net short ATM options (have a “negative gamma” position), their hedging activity could exacerbate stock price moves.

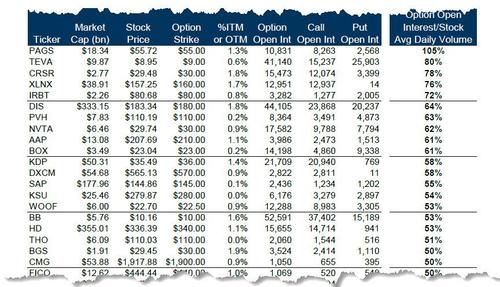

So with a massive amount of single-stock expiring today, and since expiration-related trades will cause trading activity to pick up for stocks with a significant amount of ATM, Goldman has identified 50 stocks with large ATM 17-Sep open interest, where volatility will be large. The list includes such large market cap names include UPS, DIS, AMZN, PG and GOOGL. As Goldman further explains, “expiration-related activity is likely to have more of an impact if the open interest represents a significant percentage of the stock’s volume.”

Tyler Durden

Fri, 09/17/2021 – 10:30![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com