JPMorgan: DeFi Adoption By Institutional Investors Surges

It was a busy week for crypto, with many updates in JPMorgan’s weekly Crypto Weekly note. Here are the highlights:

- Bitcoin and ether prices rise in the week. The price of bitcoin and ether rose by about 4% w/w and 6% w/w to $48.1K and $3.6K, respectively. This recovery follows the price decline across major cryptocurrencies after a selloff in the last week. The price of ether gained following the news of its co-founder Vitalik Buterin making it to the TIME’s ‘Most Influential’ List.

- Trading volume of major cryptocurrencies decline w/w. The average daily volume (ADV) of Bitcoin and Ether declined by 18% and 21% w/w, respectively, as did volatility. The ADV of Litecoin, Dogecoin and Uniswap also declined during the week.

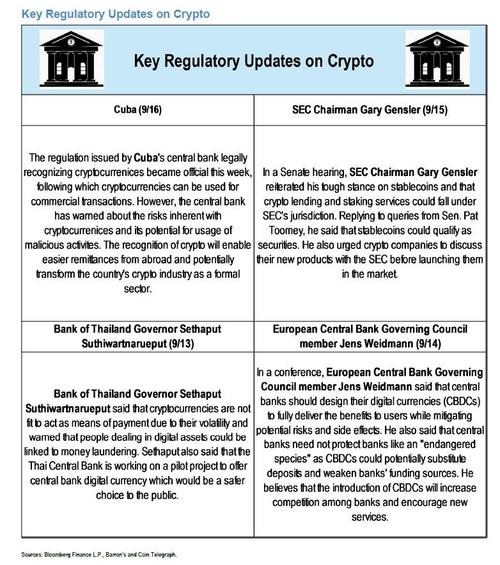

- At the Senate hearing, SEC Chair Gary Gensler reiterated that most cryptocurrencies, including stablecoins, qualify as securities, which should not be sold without proper risk disclosures. He also said that crypto lending and staking services are likely to fall under SEC’s jurisdiction as lending products come under the securities laws.

The size of the global market increased in the past week, with the global crypto sector’s market cap increasing 2.2% w/w from $2.1 trillion to $2.2 trillion as of 9/16.

A snapshot of the key regulatory updates this week:

It continues to be a busy time for crypto adoption by financial institutions. Among the notable developments:

- Interactive Brokers will start offering cryptocurrency trading and custody services for Bitcoin, Ethereum, Litecoin and Bitcoin Cash.

- Fidelity Digital Assets plans to increase its headcount by up to 70% between April and year-end. It also plans to offer yield funds and other products related to stablecoins or decentralized finance (DeFi) coins.

- The Fairfax County pension funds will invest a total of $50 million in a fund which invests in digital tokens and cryptocurrency derivatives. Earlier this year, the pension funds also invested in a crypto venture capital fund.

- Franklin Templeton is raising $20 million for the firm’s first blockchain VC fund. The fund was already raised $10 million from a single sale. The firm is also recruiting engineers in “tokenized asset development department.”

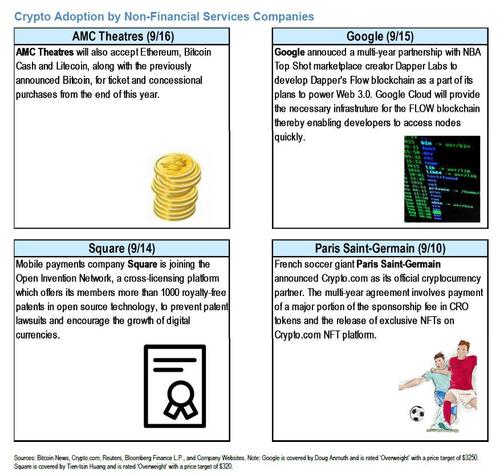

There was also a flurry of news on the adoption by non-financial services companies, including AMC Theaters accepting most cryptos, Googles announcing the development of an NBA-linked blockchain, Square joining the open invention network, and Paris Saint Germain announcing crypto.com as its official cryptocurrency partner.

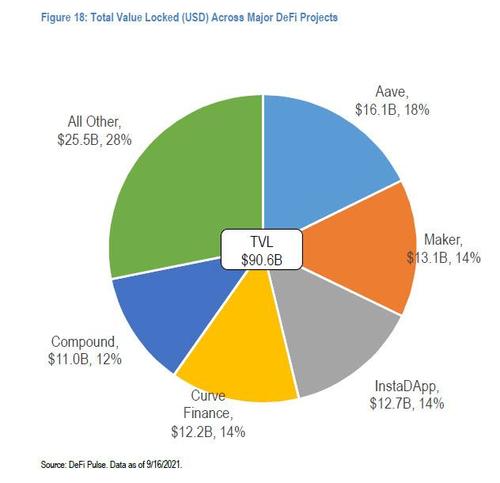

Which brings us to the main story: according to JPMorgan, the second quarter of 2021 saw an increase in DeFi adoption by institutional investors as more than 60% of all DeFi transactions were over $10 million versus less than half in the broader crypto market. Institutions in major economies are driving the DeFi activity as emerging markets are still adopting traditional crypto assets.

Huobi Ventures announces a $10mm GameFi fund (9/14) to invest in projects developing blockchain based games with “play-to-earn” features such as those in Axie Infinity. Huobi also set up a $100mm DeFi fund and a $10mm NFT fund in May.

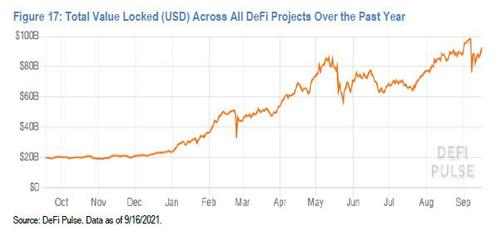

Total Value Locked (TVL) Across DeFi Projects is rising. Total value locked (TVL) refers to the total dollar amount of assets that is staked or “locked” up across all DeFi protocols. Put differently, TVL does not refer to transaction volumes or market cap of cryptocurrencies but rather the value of reserves that are “locked” into smart contracts. TVL can help assess the health of the entire DeFi ecosystem or a specific DeFi project or app. This value does not represent any leverage created by the underlying crypto assets. In traditional finance, this could be thought of as deposits in the banking system. Examples of assets included in total value locked include crypto assets staked in yield protocols (ex. depositors earn yield on staked crypto), lending protocols (ex. borrowers post collateral for loans), staked in automated market maker exchanges (ex. liquidity pools for decentralized exchanges), and underlying synthetic assets. As of 9/16/2021, total value locked in DeFi protocols stands at $90.6B.

Tyler Durden

Sat, 09/18/2021 – 18:00![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com