Futures Rebound As Yields Drop

U.S. index futures rebounded on Tuesday from Monday’s stagflation-fear driven rout as an increase in Treasury yields abated and the greenback dropped from a 10 month high while Brent crude dropped from a 3 year high of $80/barrel after API showed a surprise stockpile build across all products.

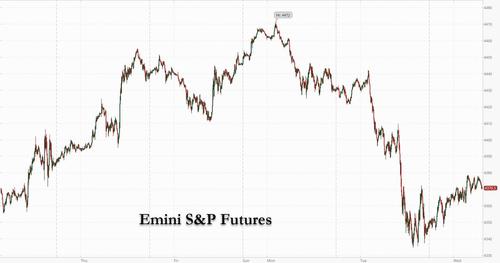

One day after one of Wall Street’s worst selloff of this year which saw the S&P’s biggest one-day drop since May, dip buyers made yet another another triumphal return to global markets, with Nasdaq 100 futures climbing 130 points or 0.9% after the tech-heavy index tumbled the most since March on Tuesday as U.S. Treasury yields rose on tapering and stagflationconcerns. S&P 500 futures rose 28 points or 0.6% after the underlying gauge also slumped amid mounting concern over the debt-ceiling impasse in Washington.

A key catalyst for today’s easing in financial conditions was the 10-year yield shedding four basis points and the five-year rate falling below 1%. In the past five sessions, the 10Y yield rose by a whopping 25 basis point, a fast enough move to trigger VaR shocks across risk parity investors.

“We think (10-year treasury yields) are likely to around 1.5% to 1.75%, so they obviously still have room to go,” said Daniel Lam, senior cross-asset strategist at Standard Chartered, who added that the rise in yields was driven by the fact that the United States was almost definitely going to start tapering its massive asset purchases by the end of this year, and that this would drive a shift from growth stocks into value names.

Shares of FAAMG gigatechs rose between 1% and 1.3% in premarket trading as the surge in yields eased. Oil firms and supermajors like Exxon and Chevron dipped as a rally in crude prices petered out. The S&P energy sector has gained 3.9% so far this week and is on track for its best monthly performance since February. Among stocks, Boeing rose 2.5% after it said 737 MAX test flight for China’s aviation regulator last month was successful and the planemaker hopes a two-year grounding will be lifted this year. Cybersecurity firm Fortinet Inc. led premarket gains among S&P 500 Index companies. Here are some of the other big movers this morning:

- Micron (MU US) shares down more than 3% in U.S. premarket trading after the chipmaker’s forecast came in well below analyst expectations. Co. was hurt by slowing demand from personal-computer makers

- Lucid (LCID US) shares rise 9.7% in U.S. premarket trading after the electric-vehicle company said it has started production on its debut consumer car

- EQT Corp. (EQT US) shares fell 4.8% in Tuesday postmarket trading after co. reports offering by certain shareholders who received shares as a part of its acquisition of Alta Resources Development’s upstream and midstream units

- PTK Acquisition (PTK US) rises in U.S. premarket trading after the blank-check company’s shareholders approved its combination with the Israel-based semiconductor company Valens

- Cal-Maine (CALM US) shares rose 4.4% postmarket Tuesday after it reported net sales for the first quarter that beat the average analyst estimate as well as a narrower-than-estimated loss

- Sherwin-Williams (SHW US) dropped 3.5% in Tuesday postmarket trading after its forecasted adjusted earnings per share for the third quarter missed the average analyst estimate

- Boeing (BA US) and Spirit Aerosystems (SPR US) climb as much as 3% after being upgraded to outperform by Bernstein on travel finally heading to inflection point

The S&P 500 is set to break its seven-month winning streak as fears about non-transitory inflation, China Evergrande’s default, potential higher corporate taxes and a sooner-than expected tapering of monetary support by the Federal Reserve clouded investor sentiment in what is usually a seasonally weak month. Meanwhile, Senate Democrats are seeking a vote Wednesday on a stopgap funding bill to avert a government shutdown, but without a provision to increase the federal debt limit. On Tuesday, Jamie Dimon said a U.S. default would be “potentially catastrophic” event, in other words yet another multibillion bailout for his bank.

“Many things are in flux: the pandemic is not over, the supply chain bottlenecks we are seeing are affecting all sorts of prices and we’ll need to see how it plays out because the results are not clear in terms of inflation,” Belita Ong, Dalton Investments chairman, said on Bloomberg Television.

Europe’s Stoxx 600 gauge rebounded from a two-month low, rising 0.9% and reversing half of yesterday’s losses. Semiconductor-equipment company ASM International posted the biggest increase on the index amid positive comments by analysts on its growth outlook. A sharp rebound during the European session marked a turnaround from the downbeat Asian session, when equities extended losses amid concerns over stagflation and China Evergrande Group’s debt crisis. Sentiment improved as a steady flow of buyers emerged in the Treasury market, ranging from foreign and domestic funds to leveraged accounts. Here are some of the biggest European movers today:

- Academedia shares rise as much as 6.9% in Stockholm, the most since June 1, after the company said the number of participants for its higher vocational education has increased 25% y/y.

- ASM International jumps as much as 7.3%, rebounding from a three-day sell-off, boosted by supportive analyst comments and easing bond yields.

- GEA Group gains as much as 4.7% after the company published new financial targets through 2026, which Citigroup says are above analysts’ consensus and an encouraging signal.

- DSV bounces as much as 4.4% as JPMorgan upgrades to overweight, saying the recent pullback in the shares presents an opportunity.

- Genova Property Group falls as much as 10% in Stockholm trading after the real estate services company placed shares at a discount to the last close.

- ITM Power drops as much as 6.4% after JPMorgan downgrades to neutral from overweight on relative valuation, with a more mixed near-term outlook making risk/reward seem less compelling.

- Royal Mail slides as much as 6.2% after UBS cuts its rating to sell from buy, expecting U.K. labor shortages and wage inflation pressures to hurt the parcel service company’s profit margins.

Earlier in the session, Asian equities slumped in delayed response to the US rout. MSCI’s broadest index of Asia-Pacific shares outside Japan fell 1.43% with Australia off 1.5%, and South Korea falling 2.06%. The Hong Kong benchmark shed 1.2% and Chinese blue chips were 1.1% lower. Japan’s Nikkei shed 2.35% hurt by the general mood as the country’s ruling party votes for a new leader who will almost certainly become the next prime minister ahead of a general election due in weeks. Also on traders’ minds was cash-strapped China Evergrande whose shares rose as much as 12% after it said it plans to sell a 9.99 billion yuan ($1.5 billion) stake it owns in Shengjing Bank. Evergrande is due to make a $47.5 million bond interest payment on its 9.5% March 2024 dollar bond, having missed a similar payment last week, but it said in the stock exchange filing the proceeds of the sale should be used to settle its financial liabilities due to Shengjing Bank. Chinese real estate company Fantasia Holdings Group is struggling to avoid falling deeper into distress, just as the crisis at China Evergrande flags broader risks to other heavily indebted developers. In Japan, the country’s PGIF, or Government Pension Investment Fund, the world’s largest pension fund, said it won’t include yuan- denominated Chinese sovereign debt in its portfolio.

In rates, as noted above, Treasuries lead global bonds higher, paring large portion of Tuesday’s losses with gains led by intermediates out to long-end of the curve. Treasury yields richer by up to 4bp across long-end of the curve with 10s at around 1.50%, outperforming bunds and gilts both by 2bp; front-end of the curve just marginally richer, flattening 2s10s spread by 3.2bp with 5s30s tighter by 0.5bp. Futures volumes remain elevated amid evidence of dip buyers emerging Tuesday and continuing over Wednesday’s Asia hours. Session highlights include a number of Fed speakers, including Chair Powell.

In FX, the Bloomberg Dollar Spot Index was little changed after earlier advancing, and the dollar slipped versus most of its Group-of-10 peers. The yen was the best G-10 performer as it whipsawed after earlier dropping to 111.68 per dollar, its weakest level since March 2020. The Australian dollar also advanced amid optimism over easing of Covid-related restrictions while the New Zealand dollar was the worst performer amid rising infections. The euro dropped to an 11-month low while the pound touched its weakest level since January against the greenback amid a bout of dollar strength as the London session kicked off. Confidence in the euro-area economy unexpectedly rose in September as consumers turned more optimistic about the outlook and construction companies saw employment prospects improve. The yen climbed from an 18-month low as a decline in stocks around the world helps boost demand for the currency as a haven. Japanese bonds also gained.

In commodities, oil prices dropped after touching a near three-year high the day before. Brent crude fell 0.83% to $78.25 per barrel after topping $80 yesterday; WTI dipped 1.09% to $74.47 a barrel. Gold edged higher with the spot price at $1,735.6 an ounce, up 0.1% from the seven-week low hit the day before as higher yields hurt demand for the non interest bearing asset. Base metals are under pressure with LME aluminum and copper lagging.

Looking at the day ahead, the biggest highlight will be a policy panel at the ECB forum on central banking featuring ECB President Lagarde, Fed Chair Powell, BoJ Governor Kuroda and BoE Governor Bailey. Other central bank speakers include ECB Vice President de Guindos, the ECB’s Centeno, Stournaras, Makhlouf, Elderson and Lane, as well as the Fed’s Harker, Daly and Bostic. Meanwhile, data releases include UK mortgage approvals for August, the final Euro Area consumer confidence reading for September, and US pending home sales for August.

Market Snapshot

- S&P 500 futures up 0.7% to 4,371.75

- STOXX Europe 600 up 0.8% to 455.97

- MXAP down 1.2% to 197.38

- MXAPJ down 0.7% to 635.17

- Nikkei down 2.1% to 29,544.29

- Topix down 2.1% to 2,038.29

- Hang Seng Index up 0.7% to 24,663.50

- Shanghai Composite down 1.8% to 3,536.29

- Sensex down 0.4% to 59,445.57

- Australia S&P/ASX 200 down 1.1% to 7,196.71

- Kospi down 1.2% to 3,060.27

- Brent Futures down 0.7% to $78.53/bbl

- Gold spot up 0.4% to $1,740.79

- U.S. Dollar Index little changed at 93.81

- German 10Y yield fell 1.1 bps to -0.210%

- Euro down 0.2% to $1.1664

Top Overnight News from Bloomberg

- China’s central bank governor said quantitative easing implemented by global peers can be damaging over the long term and vowed to keep policy normal for as long as possible

- China’s central bank injected liquidity into the financial system for a ninth day in the longest run since December as it sought to meet a surge in seasonal demand for cash

- China stepped in to buy a stake in a struggling regional bank from China Evergrande Group as it seeks to limit contagion in the financial sector from the embattled property developer

- The Chinese government is considering raising power prices for industrial consumers to help ease a growing supply crunch

- Japan’s Government Pension Investment Fund, the world’s largest pension fund, said it won’t include yuan-denominated Chinese sovereign debt in its portfolio. The decision comes as FTSE Russell is set to start adding Chinese debt to its benchmark global bond index, which the GPIF follows, from October

- Fumio Kishida is set to become Japan’s prime minister, after the ex-foreign minister overcame popular reformer Taro Kono to win leadership of the country’s ruling party, leaving stock traders feeling optimistic

- ECB Governing Council member Gabriel Makhlouf said policy makers must be ready to respond to persistently higher inflation that could result from lasting supply bottlenecks

- Inflation accelerated in Spain to the fastest pace in 13 years, evidence of how surging energy costs are feeding through to citizens around the euro-zone economy

- Sterling-debt sales by corporates exceeded 2020’s annual tally as borrowers rushed to secure ultra-cheap funding costs while they still can. Offerings will top 70 billion pounds ($95 billion) through Wednesday, beating last year’s total sales by at least 600 million pounds, according to data compiled by Bloomberg

A more detailed look at global markets courtesy of Newsquawk

Asian equity markets were pressured on spillover selling from global peers which saw the S&P 500 suffer its worst day since May after tech losses were magnified as yields climbed and with sentiment also dampened by weak data in the form of US Consumer Confidence and Richmond Fed indexes. ASX 200 (-1.1%) was heavily pressured by tech and with mining-related stocks dragged lower by weakness in underlying commodity prices, with the mood also clouded by reports that Queensland is on alert for a potential lockdown and that Australia will wind down emergency pandemic support payments within weeks. Nikkei 225 (-2.1%) underperformed amid the broad sell-off and as participants awaited the outcome of the LDP leadership vote which saw no candidate win a majority (as expected), triggering a runoff between vaccine minister Kono and former foreign minister Kishida to face off in a second round vote in which Kishida was named the new PM. KOSPI (-1.2%) was heavily pressured by the tech woes and after North Korea confirmed that yesterday’s launch was a new type of hypersonic missile. Hang Seng (+0.7%) and Shanghai Comp. (-1.8%) conformed to the broad risk aversion with tech stocks hit in Hong Kong, although the losses were milder compared to regional peers with Evergrande shares boosted after it sold CNY 10bln of shares in Shengjing Bank that will be used to pay the developer’s debt owed to Shengjing Bank, which is the Co.’s first asset sale amid the current collapse concerns although it still faces another USD 45.2mln in interest payments due today. In addition, the PBoC continued with its liquidity efforts and there was also the absence of Stock Connect flows to Hong Kong with Southbound trading already closed through to the National Holidays. Finally, 10yr JGBs were slightly higher as risk assets took a hit from the tech sell-off and with T-notes finding some reprieve overnight. Furthermore, the BoJ were also in the market for nearly JPY 1tln of JGBs mostly in 3yr-10yr maturities and there were notable comments from Japan’s GPIF that it is to avoid investments in Chinese government bonds due to concerns over China market.

Top Asian News

- L&T Is Said in Talks to Merge Power Unit With Sembcorp India

- Prosecutors Seek Two Years Jail for Ghosn’s Alleged Accomplice

- Japan to Start Process to Sell $8.5 Billion Postal Stake

- Gold Climbs From Seven Week Low as Yields Retreat, Dollar Pauses

Bourses in Europe are attempting to claw back some ground lost in the prior session’s global stocks rout (Euro Stoxx 50 +0.9%; Stoxx 600 +0.8%). The upside momentum seen at the cash open has somewhat stabilised amid a lack of news flow and with a busy agenda ahead from a central bank standpoint, with traders also cognizant of potential month-end influence. US equity futures have also been gradually drifting higher since the reopen of electronic trade. As things stand, the NQ (+1.0%) narrowly outperforms the ES (+0.7%), RTY (+0.8%) and YM (+0.6%) following the tech tumble in the prior session, and with yields easing off best levels. Back to European cash, major regional bourses see broad-based gains with no standout performers. Sectors are mostly in the green; Oil & Gas resides at the foot of the bunch as crude prices drift lower and following two consecutive sessions of outperformance. On the flip side, Tech resides among today’s winners in what is seemingly a reversal of yesterday’s sector configuration, although ASML (+1.3%) may be offering some tailwinds after upping its long-term outlook whilst suggesting ASML and its supply chain partners are actively adding and improving capacity to meet this future customer demand – potentially alleviating some concerns in the Auto sector which is outperforming at the time of writing. Retail also stands strong as Next (+3.0%) upped its guidance whilst suggesting the longer-term outlook for the Co. looks more positive than it had been for many years. In terms of individual movers, Unilever (+1.0%) is underpinned by source reports that the Co. has compiled a shortlist of at least four bidders for its PG Tips and Lipton Iced Tea brands for some GBP 4bln. HeidelbergCement (-1.4%) is pressured after acquiring a 45% stake in the software firm Command Alko. Elsewhere, Morrisons (+1.3%) is on the front foot as the takeover of the Co. is to be decided via an auction process as touted earlier in the month.

Top European News

- Makhlouf Says ECB Must Be Ready to Act If Inflation Entrenched

- ASML to Ride Decade-Long Sales Boom After Chip Supply Crunch

- Spanish Inflation at 13-Year High in Foretaste of Regional Spike

- U.K. Mortgage Approvals Fall to 74,453 in Aug. Vs. Est. 73,000

In FX, the yield and risk backdrop is not as constructive for the Dollar directly, but the index has posted another marginal new y-t-d best, at 93.891 compared to 93.805 yesterday with ongoing bullish momentum and the bulk of the US Treasury curve remaining above key or psychological levels, in contrast to other global bond benchmarks. Hence, the Buck is still elevated and on an upward trajectory approaching month end on Thursday, aside from the fact that hedge rebalancing flows are moderately positive and stronger vs the Yen. Indeed, the Euro is the latest domino to fall and slip to a fresh 2021 low around 1.1656, not far from big barriers at 1.1650 and further away from decent option expiry interest at the 1.1700 strike (1 bn), and it may only be a matter of time before Sterling succumbs to the same fate. Cable is currently hovering precariously above 1.3500 and shy of the January 18 base (1.3520) that formed the last pillar of support for the Pound before the trough set a week earlier (circa 1.3451), and ostensibly supportive UK data in the form of BoE mortgage lending and approvals has not provided much relief.

- AUD/JPY – A rather odd couple in many ways given their contrasting characteristics as a high beta or activity currency vs traditional safe haven, but both are benefiting from an element of corrective trade, consolidation and short covering relative to their US counterpart. Aud/Usd is clinging to 0.7250 in advance of Aussie building approvals on Thursday and Usd/Jpy is retracing from its new 111.68 y-t-d pinnacle amidst the less rampant yield environment and weighing up the implications of ex-Foreign Minister Kishida’s run-off win in the LDP leadership contest and the PM-in-waiting’s pledge to put together a Yen tens of trillion COVID-19 stimulus package before year end.

- CHF/CAD/NZD – All relatively confined vs their US rival, as the Franc continues to fend off assaults on the 0.9300 level with some impetus from a significant improvement in Swiss investor sentiment, while the Loonie is striving to keep its head above 1.2700 ahead of Canadian ppi data and absent the recent prop of galloping oil prices with WTI back under Usd 75/brl from Usd 76.67 at best on Tuesday. Elsewhere, the Kiwi is pivoting 0.6950 pre-NZ building consents and still being buffeted by strong Aud/Nzd headwinds.

- SCANDI/EM – Not much purchase for the Sek via upgrades to Swedish GDP and inflation forecast upgrades by NIER as sentiment indices slipped across the board, but some respite for the Try given cheaper crude and an uptick in Turkish economic confidence. Conversely, the Cnh and Cny have not received their customary fillip even though the PBoC added liquidity for the ninth day in a row overnight and China’s currency regulator has tightened control over interbank trade and asked market makers to narrow the bid/ask spread, according to sources.

In commodities, WTI and Brent front month futures have been trimming overnight losses in early European trade. Losses overnight were seemingly a function of profit-taking alongside the bearish Private Inventory Report – which showed a surprise build in weekly crude stocks of 4.1mln bbls vs exp. -1.7mln bbls, whilst the headline DoE looks for a draw of 1.652mln bbls. Further, there have been growing calls for OPEC+ to further open the taps beyond the monthly 400k BPD hike, with details also light on the White House’s deliberations with OPEC ahead of the decision-making meeting next week. Despite these calls, it’s worth bearing in mind that OPEC’s latest MOMR stated, “increased risk of COVID-19 cases primarily fuelled by the Delta variant is clouding oil demand prospects going into the final quarter of the year, resulting in downward adjustments to 4Q21 estimates. As a result, 2H21 oil demand has been adjusted slightly lower, partially delaying the oil demand recovery into 1H22.” Brent Dec dipped back under USD 78/bbl (vs low 763.77/bbl) after testing USD 80/bbl yesterday, whilst WTI Nov lost the USD 75/bbl handle (vs low USD 73.37/bbl). Over to metals, spot gold and silver have seen somewhat of divergence as real yields negate some effects of the new YTD peak printed by the Dollar index, whilst spot silver succumbs to the Buck. Over to base metals, LME copper trade is lacklustre as the firmer dollar weighs on the red metal. Shanghai stainless steel meanwhile extended on losses, notching the fourth session of overnight losses with desks citing dampened demand from the Chinese power crunch.

US Event Calendar

- 7am: Sept. MBA Mortgage Applications, prior 4.9%

- 10am: Aug. Pending Home Sales YoY, est. -13.8%, prior -9.5%

- 10am: Aug. Pending Home Sales (MoM), est. 1.3%, prior -1.8%

Central Bank speakers

- 9am: Fed’s Harker Discusses Economic Outlook

- 11:45am: Powell Takes Part in ECB Forum on Central Banking

- 11:45am: Bailey, Kuroda, Lagarde, Powell on ECB Forum Panel

- 1pm: Fed’s Daly Gives Speech to UCLA

- 2pm: Fed’s Bostic Gives Remarks at Chicago Fed Payments

DB’s Jim Reid concludes the overnight wrap

The main story of the last 24 hours has been a big enough rise in yields to cause a major risk-off move, with 10yr Treasury yields up another +5.0bps to 1.537% yesterday, and this morning only seeing a slight -0.3bps pullback to 1.534%. At the intraday peak yesterday, they did climb as high as 1.565% earlier in the session, but this accelerated the risk off and sent yields somewhat lower intraday as a result, which impacted the European bond closes as we’ll see below.

All told, US yields closed at their highest level in 3 months and up nearly +24bps since last Wednesday’s close, shortly after the FOMC meeting. That’s the largest 4-day jump in US yields since March 2020, at the outset of the pandemic and shortly after the Fed announced their latest round of QE. This all led to the worst day for the S&P 500 (-2.04%) since mid-May and the worst for the NASDAQ (-2.83%) since mid-March. The S&P 500 is down -4.06% from the highs now – trading just below the Evergrande (remember that?) lows from last week. So the index still has not seen a -5% sell-off on a closing basis for 228 days and counting. If we make it to Halloween it will be a full calendar year. Regardless, the S&P and STOXX 600 remain on track for their worst monthly performances so far this year.

Those moves have continued this morning in Asia, where the KOSPI (-2.05%), Nikkei (-1.64%), Hang Seng (-0.60%), and the Shanghai Comp (-1.79%) are all trading lower. The power crisis in China is further dampening sentiment there, and this morning Bloomberg have reported that the government are considering raising prices for industrial users to ease the shortage. Separately, we heard that Evergrande would be selling its stake in a regional bank at 10 billion yuan ($1.55bn) as a step to resolve its debt crisis, and Fitch Ratings also downgraded Evergrande overnight from CC to C. However, US equity futures are pointing to some stabilisation later, with those on the S&P 500 up +0.49%.

Running through yesterday’s moves in more depth, 23 of the 24 industry groups in the S&P 500 fell back yesterday with the lone exception being energy stocks (+0.46%), which gained despite the late pullback in oil prices. In fact only 53 S&P constituents gained on the day. The largest losses were in high-growth sectors like semiconductors (-3.82%), media (-3.08%) and software (-3.05%), whilst the FANG+ index was down -2.52% as 9 of the 10 index members lost ground – Alibaba’s +1.47% gain was the sole exception. Over in Europe it was much the same story, with the STOXX 600 (-2.18%) falling to its worst daily performance since July as bourses across the continent fell back, including the German DAX (-2.09%) and France’s CAC 40 (-2.17%).

Back to bonds and the rise in 10yr Treasury yields yesterday was primarily led by higher real rates (+2.1bps), which hit a 3-month high of their own, whilst rising inflation breakevens (+2.3bps) also offered support. In turn, higher yields supported the US dollar, which strengthened +0.41% to its highest level since November last year, though precious metals including gold (-0.92%) fell back as investors had less need for the zero-interest safe haven. Over in Europe the sell-off was more muted as bonds rallied into the close before selling off again after. Yields on 10yr bunds (+2.4bps), OATs (+3.0bps) and BTPs (+6.1bps) all moved higher but were well off the peaks for the day. 10yr Gilts closed up +4.2bps but that was -6.6bps off the high print. And staying with the UK, sterling (-1.18%) saw its worst day this year and fell to its lowest level since January 11 as sentiment has increasingly been knocked by the optics of the fuel crisis here. Given this and the hawkish BoE last week many are now talking up the stagflation risk. On the petrol crisis it’s hard to know how much is real and how much is like an old fashion bank run fuelled mostly by wild speculation. Regardless it doesn’t look good to investors for now.

All this came against the backdrop of yet further milestones on inflation expectations, as the German 10yr breakeven hit a fresh 8-year high of 1.690%, just as the Euro Area 5y5y forward inflation swap hit a 4-year high of its own at 1.789%. Meanwhile 10yr UK breakevens pulled back some, finishing -6bps lower on the day after initially spiking up nearly +5bps in the opening hours of trading. This highlights the uncertainty as to the implications of a more hawkish BoE last week.

As we’ve discussed over recent days, part of the renewed concerns about inflation have come from a fresh spike in energy prices, and yesterday saw Brent crude move above $80/bbl in regards intraday trading for the first time since 2018. Furthermore, natural gas prices continued to hit fresh highs yesterday, with European futures up +2.69% to a fresh high of €78.56 megawatt-hours. That said, oil prices did pare back their gains later in the session as the equity selloff got underway, with Brent crude (-0.55%) and WTI (-0.21%) both closing lower on the day, and this morning they’ve fallen a further -1.49% and -1.54% respectively.

Yesterday, Fed Chair Powell and his predecessor Treasury Secretary Yellen appeared jointly before the Senate Banking Committee. The most notable moment came from Senator Warren who criticized Chair Powell for his track record on regulation, saying he was a “dangerous man” and then saying on the record that the she would not support his re-nomination ahead of his term ending in February. Many senators, mostly Republicans, voiced concerns over inflationary pressures, but both Yellen and Powell maintained their stances that the current high level of inflation was temporary and due to the supply chain issues from Covid-19 that they expect to be resolved in time. Lastly, both Powell and Yellen warned the Senators that a potential US default would be “catastrophic” and Treasury Secretary Yellen said in a letter to Congress that the Treasury Department now estimated the US would hit the debt ceiling on October 18. So we’ve got an important few days and weeks coming up.

Last night, Senate Majority Leader Schumer tried to pass a vote that would drop the threshold from 60 to a simple majority to suspend the debt limit, but GOP Senator Cruz amongst others blocked this and went forward with forcing Democrats to use the budget reconciliation measure instead. Some Democrats have pushed back saying that the budget process would take too long and increases the risk of a default. While this is all going on we’re now less than 48 hours from a US government shutdown as it stands, though there seems to be an agreement on the funding measure if it were to be raised as clean bill without the debt ceiling provisions.

There is also other business in Washington due tomorrow, with the bipartisan infrastructure bill with $550bn of new spending up for a vote. While the funding bill is the higher short-term priority, there was news yesterday that progressive members of the House of Representatives may try and block the infrastructure bill if it comes up ahead of the budget reconciliation vote. That was according to Congressional Progressive Caucus Chair Jayapal who said “Progressives will vote for both bills, but a majority of our members will only vote for the infrastructure bill after the President’s visionary Build Back Better Act passes.” The infrastructure bill could be tabled once again as there is no real urgency to get it voted on until the more pressing debt ceiling and funding bill issues are resolved. Democratic leadership is trying to thread a needle and the key sticking point appears to be if the moderate and progressive wing can agree on the budget quickly enough to beat the clock on the US defaulting on its debt.

Shifting back to central bankers, ECB President Lagarde warned against withdrawing stimulus too rapidly as a response to inflationary pressures. She contested that there are “no signs that this increase in inflation is becoming broad-based across the economy,” and continued that the “key challenge is to ensure that we do not overreact to transitory supply shocks that have no bearing on the medium term.” Similar to her US counterpart, Lagarde cited higher energy prices and supply-chain breakdowns as the root cause for the current high inflation data and argued these would recede in due time. The ECB continues to strike a more dovish tone than the Fed and BoE.

Speaking of inflation, DB’s chief European economist, Mark Wall, has just put out a podcast where he discusses the ECB, inflation and the value of a flexible asset purchase programme. He and his team have a baseline assumption that the ECB will double the pace of their asset purchases to €40bn per month to smooth the exit from the Pandemic Emergency Purchase Programme, but the upward momentum in the inflation outlook and the latest uncertainty from recent supply shocks puts a premium on policy flexibility. You can listen to the podcast “Focus Europe: Podcast: ECB, inflation and the value of a flexible APP” here.

In Germany, there weren’t a great deal of developments regarding the election and coalition negotiations yesterday, but NTV reported that CSU leader Markus Söder had told a regional group meeting of the party that he expected the next government would be a traffic-light coalition of the SPD, the Greens and the FDP. Speaking to reporters later in the day, he went onto say that the SPD’s Olaf Scholz had the best chance of becoming chancellor, and that the SPD had the right to begin coalition negotiations.

Running through yesterday’s data, the Conference Board’s consumer confidence reading in the US for September fell to 109.3 (vs. 115.0 expected), which marks the third consecutive decline in the reading and the lowest it’s been since February. Meanwhile house prices continued to rise, with the FHFA’s house price index for July up +1.4% (vs. +1.5% expected), just as the S&P CoreLogic Case-Shiller index saw a record +19.7% increase in July as well.

To the day ahead now, and the biggest highlight will be a policy panel at the ECB forum on central banking featuring ECB President Lagarde, Fed Chair Powell, BoJ Governor Kuroda and BoE Governor Bailey. Other central bank speakers include ECB Vice President de Guindos, the ECB’s Centeno, Stournaras, Makhlouf, Elderson and Lane, as well as the Fed’s Harker, Daly and Bostic. Meanwhile, data releases include UK mortgage approvals for August, the final Euro Area consumer confidence reading for September, and US pending home sales for August.

Tyler Durden

Wed, 09/29/2021 – 07:42![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com