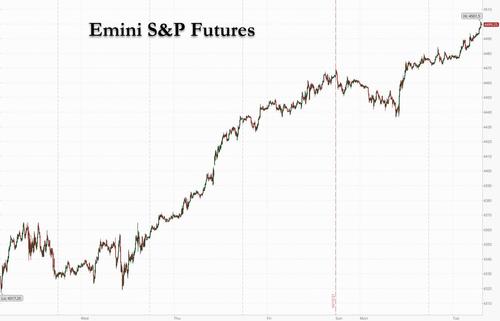

Futures Top 4,500 As Market Meltup Accelerates

Over the weekend, a Goldman flow trader explained why it expected a powerful market meltup to emerge in coming days, and this time Goldman was right because after trading at 4317 just one week ago, spoos are now almost 200 points higher, rising above 4500 this morning after a powerful ramp pushed US equity futures and global markets as an upbeat profit forecast from Johnson & Johnson which boosted (get it “boosted”) its Revenue and EPS guidance, added to the positive momentum in corporate earnings generated by big banks last week and helped counter concerns about elevated inflation. At 715 a.m. ET, Dow e-minis were up 183 points, or 0.52%, S&P 500 e-minis were up 22.75 points, or 0.51%, and Nasdaq 100 e-minis were up 61.75 points, or 0.40%. Treasury yields were unchanged at 1.60% and the dollar slumped to a 4 week low.

In premarket trading Johnson & Johnson – whose covid vaccine will soon be “mixed and matched” with mRNA platforms – rose 1.7% after it raised its 2021 adjusted profit forecast, even as it stuck to its outlook of $2.5 billion in sales from its COVID-19 vaccine this year. Walmart rose 2% after Goldman Sachs added the world’s largest retailer to its “Americas Conviction List”. Travelers Cos Inc rose 2.7% after the property and casualty insurer beat estimates for third-quarter profit. Large-cap FAAMG names all rose between 0.3% and 0.7%. Netflix Inc rose 0.1% ahead of its quarterly results later in the day, where it is expected to report blowout guidance for subscriber growth on the back of Squid Games. Here are some of the biggest U.S. movers today:

- Crypto stocks in spotlight as Bitcoin continued its climb toward all-time highs, bolstered by optimism over the launch of the first Bitcoin futures exchange-traded fund in the U.S. on Tuesday

- Hive Blockchain (HIVE US) +1.8%, Riot Blockchain (RIOT US) +2.3%, Marathon Digital (MARA US) +0.9%, Bitfarms (BITF US) +3.9%

- AgEagle Aerial Systems (UAVS US) shares rise as much as 16% in U.S. premarket after the provider of drones, sensors and software entered into a definitive agreement to buy Sensefly from Parrot at a valuation of $23m in cash and stock

- Steel Dynamics (STLD US) +1.5% in U.S. premarket trading after it reported 3Q adj. EPS above average analyst estimate

- Frontline (FRO US) jumps 6.5% in U.S. premarket trading, helped by rising oil prices

- Apple (AAPL US) marginally higher Tuesday premarket after analysts were upbeat on the company following an event where it showcased a revamp of its MacBook Pro laptops, along with new audio products

- EverQuote (EVER US) shares slipped Monday postmarket after co. cut 3Q revenue outlook

- TaskUS (TAS US) fell 6.8% Monday postmarket after holders offered shares via Goldman Sachs, JPMorgan

Markets have taken comfort from robust earnings, but also grappling with the prospect of tightening monetary policy to quell price pressures. As Bloomberg notesm, traders are waiting to see if a slate of Federal Reserve speakers this week will try to calm the jitters stemming from the scaling back of pandemic-era policy support.

“The world is watching interest rates more closely than it has for some time — and rightly so, the moves have been emphatic, especially in the short-term maturities,” Chris Weston, head of research at Pepperstone Financial Pty, wrote in a note. He added it’s “impressive how resilient and calm markets are in the face of the rates repricing.”

Still, the recent bounce in the Nasdaq 100 index has failed to shoo away the bears, with net short positions on the tech-heavy benchmark higher than at the peak of the pandemic, Citigroup strategists said. J&J, P&G, Philip Morris, Netflix and United Airlines are scheduled to report today. “We’ve seen companies post some fairly decent beats,” said Michael Hewson, chief market analyst at CMC Markets in London. “While it’s been notable that most have cited concerns about rising costs, as well as supply-chain disruptions, we haven’t seen many significant profit downgrades yet.”

In Europe, gains for mining companies outweighed a retreat for the travel industry, lifting the Stoxx Europe 600 Index up 0.2%. Danone dropped 2.2% in Paris after the French food giant reported sales that were overall in line with expectations, but warned of rising costs of milk, packaging and transportation. Ericsson AB fell after sales were hit by supply chain issues. Miners and oil & gas are the strongest sectors, healthcare and travel underperform. Here are some of the biggest European movers today:

- Moneysupermarket.com shares climb as much as 8.9% after the British price comparison website posted its 3Q update and announced the acquisition of cashback site Quidco for GBP101m in cash.

- Hochschild gains as much as 6.8% after the silver miner said it plans to spin off the rare earths project it bought two years ago and list the new company in Canada.

- Software AG drops as much as 14%, the most since 2014, after the company cut its FY bookings growth guidance in the Digital Business segment, which analysts highlight as a negative.

- Bachem falls as much as 11% to CHF745 after placing 750,000 new shares at CHF778 apiece to raise CHF584m for growth.

- Beijer Ref trades down as much 7.2% after the cooling and heatings systems manufacturer missed analyst estimates on both sales and profit in 3Q.

Earlier in the session, Asian equities gained, buoyed by a rebound in technology shares listed in Hong Kong and elsewhere in the region amid better-than-expected earnings and lower valuations. The MSCI Asia Pacific Index climbed as much as 1%, as TSMC and Alibaba provided some of the biggest boosts. The Hang Seng Tech Index rose to its highest since Sept. 13, as Chinese authorities are said to be considering opening up access for content on Tencent and ByteDance platforms to search engines such as Baidu.

“Markets are currently adjusting their expectations around regulatory risks,” said Jun Rong Yeap, market strategist at IG Asia. Most benchmarks in the region were in the green as the earnings season comforted edgy investors, who are keenly watching inflation figures, supply chain bottlenecks and China’s growth slowdown. The Asian measure crossed above a key technical level that it’s been flip-flopping around for most of 2021. Some material and energy stocks took a breather, even as supply shortages and strong demand cause a price surge for raw materials. Profits for Asian oil refiners have shot back up to pre-pandemic levels as the shortage of gas and coal sparks a rush to secure alternative supplies. “The policy misstep, which I think is unlikely, is for central banks to confuse themselves by saying there’s inflation because of us, as aggregate demand is way too strong and so let’s fix a supply chain, Covid-driven pickup in costs by tightening monetary policies,” Ajay Kapur, head emerging markets strategy at BofA Global Research told Bloomberg Television.

In a notable development, China Evergrande Group’s main onshore unit paid interest due Tuesday on a yuan bond, Reuters reported, citing four people with knowledge of the matter.

Japanese equities rose, powered by advances in technology stocks as cyclicals fell. Electronics makers and telecommunications providers were the biggest boosts to the Topix, which gained 0.4%. Fast Retailing and SoftBank Group were the largest contributors to a 0.7% rise in the Nikkei 225.

Australian stocks snapped a 3-day winning streak as banks, miners declined. The S&P/ASX 200 index fell 0.1% to close at 7,374.90, edging lower after three consecutive days of advances. Mining stocks and banks were the biggest drags on the benchmark. Appen was among the top performers, extending gains for a fifth straight session. Chalice Mining retreated, snapping a four-day winning streak. Higher interest rates would remove some of the heat from the nation’s property market, though it would come at the cost of fewer jobs and weaker wages growth, the Reserve Bank of Australia said in minutes of its October meeting released Tuesday. In New Zealand, the S&P/NZX 50 index rose 0.5% to 13,065.92.

“We are going to get a lot of information on whether margins are being squeezed by these shortages and higher prices and wages continuing to go up,” JoAnne Feeney, Advisors Capital Management partner and portfolio manager, said on Bloomberg Television. She added the delta-plus Covid variant could be among sources of volatility in the next few months.

In rates, Treasury yields fell, led by the front end; Bund yields were also lower but by less than U.S. peers. Yields are richer by 2bp-3bp across front-end of the curve, cheaper by ~1bp across long-end, with 2s10s, 5s30s spreads steeper by 2bp-3bp; 10-year is little changed at 1.597%, with bunds, gilts lagging by ~2bp. Daily ranges remain narrow while bunds and gilts underperform. Stock index futures are rising, lifting S&P 500 futures to highest level in more than a month.

In FX, the Bloomberg Dollar Spot Index plunged as the dollar steepened its losses throughout the day; the greenback fell versus all of its Group-of-10 peers and risk-sensitive antipodean and Scandinavian currencies were the best performers. The euro advanced a fifth consecutive day against the greenback to touch an almost three-week high of $1.1663. Options suggest the euro will rise above a string of resistance levels that it faces in the spot market. Australian and New Zealand dollars both advanced to the strongest in more than a month as lower Treasury yields dragged down the U.S. currency. Australia’s sovereign bonds rebounded after minutes from the nation’s latest central bank meeting prompted a rollback of early rate-hike bets. The central bank said it is committed to maintaining a supportive policy until actual inflation is sustainably within its 2%-3% target range. The yen snapped a three-day decline aided by falling U.S. yields and as traders saw the recent losses as excessive; Japan’s 20-year debt sale drew the lowest bid-to-cover ratio since 2015.

In commodities, oil gained as Russia signaled that it won’t go out of its way to offer European consumers extra gas to ease the current energy crisis unless it gets regulatory approval to start shipments through the controversial Nord Stream 2 pipeline. Spot gold rallied, clawing back half of Friday’s losses to trade near $1,780/oz. Base metals are well bid. LME nickel and tin outperform, both rising over 2%.

Looking at the day ahead, and we’ll hear from an array of central bank speakers, including the BoE’s Governor Bailey, Pill and Mann, the ECB’s Rehn, Centeno, Elderson, Panetta and Lane, along with the Fed’s Daly, Barkin, Bostic and Waller. Otherwise, US Data releases including September’s housing starts and building permits, and earnings today include Johnson & Johnson, Procter & Gamble, Netflix, Philip Morris International and BNY Mellon.

Market Snapshot

- S&P 500 futures up 0.2% to 4,488.50

- STOXX Europe 600 up 0.2% to 467.87

- MXAP up 1.0% to 200.25

- MXAPJ up 1.2% to 658.33

- Nikkei up 0.7% to 29,215.52

- Topix up 0.4% to 2,026.57

- Hang Seng Index up 1.5% to 25,787.21

- Shanghai Composite up 0.7% to 3,593.15

- Sensex up 0.5% to 62,070.31

- Australia S&P/ASX 200 little changed at 7,374.85

- Kospi up 0.7% to 3,029.04

- Brent Futures up 0.4% to $84.63/bbl

- Gold spot up 1.0% to $1,782.67

- U.S. Dollar Index down 0.36% to 93.61

- German 10Y yield rose 4.7 bps to -0.155%

- Euro up 0.4% to $1.1652

Top Overnight News from Bloomberg

- Bank of France Governor Francois Villeroy de Galhau says there is no reason to raise rates next year as inflation will come back below ECB’s 2% target, according to France Info radio interview

- U.S. Treasuries, European sovereigns, U.K. gilts and emerging-market credit are all set to lose money over the 12 months through September as dwindling coupons provide little cushion against rising yields, according to forecasts from Bloomberg Intelligence. Adding to the potentially toxic environment for bonds is the prospect of major central banks unwinding debt purchases and raising interest rates

- U.K. Prime Minister Boris Johnson promised to find a solution to Brexit’s Northern Ireland Protocol, a sign that a compromise will be reached with the European Union in a dispute that had threatened to spiral into a trade war.

- Bitcoin continued its climb toward all-time highs, bolstered by optimism over the upcoming launch of the first Bitcoin futures exchange-traded fund in the U.S. by asset manager ProShares

- China’s property and construction industries contracted in the third quarter for the first time since the start of the pandemic, weighed by a slump in real estate

- China’s central bank has room to cut the amount of cash banks must hold in reserve in order to boost liquidity and support economic growth, a government adviser said

- Contagion effects on inflation from the recent surge in energy prices can’t be excluded, but they are not the most likely scenario, Riksbank Deputy Governor Martin Floden says in parliamentary hearing

A more detailed look at global markets courtesy of Newsquawk

Asian equity markets were kept afloat with the region encouraged after the mostly positive lead from US, where equity markets shrugged off the hawkish calls on global rates and big tech gained including Apple which benefitted following its hardware event. ASX 200 (-0.1%) was initially marginally higher as tech mirrored the outperformance of the sector stateside and with notable gains in property stocks, although the advances in the index were capped and upside faded ahead of resistance at the 7,400 level and due to weakness in mining-related stocks following yesterday’s cooldown in commodity prices, as well as lower production results from BHP. Nikkei 225 (+0.7%) was underpinned as exporters benefitted from favourable currency flows, while the KOSPI (+0.7%) was also firmer with the index unfazed by the latest North Korean projectile launches which were said to be ballistic missiles and therefore banned under UN Security Council resolutions. Hang Seng (+1.5%) and Shanghai Comp. (+0.7%) adhered to the upbeat mood with Hong Kong the biggest gainer in the region amid strength across a broad range of sectors aside from energy due to the recent pullback in oil and with casino names also underwhelmed by weaker Q3 Macau gaming revenue compared with the prior quarter. Finally, 10yr JGBs nursed some of yesterday’s losses after global counterparts also found reprieve from the latest bout of bond selling pressure but with the recovery only marginal amid the mostly positive risk tone and following mixed results from the 20yr JGB auction.

Top Asian News

- Alibaba Unveils One of China’s Most Advanced Chips

- Secretive Body Leads Xinjiang’s AI Policing, Report Finds

- China’s Central Bank Should Cut RRR, Government Adviser Says

- China’s Curbs on Fertilizer Exports to Worsen Global Price Shock

European equities (Euro Stoxx 50 +0.1%; Stoxx 600 +0.2%) trade with an upside in an attempt to claw back some of yesterday’s losses with fresh macro impulses relatively light since Monday’s close. The Asia-Pac session was predominantly firmer with indices kept afloat by the mostly positive lead from the US and performance in the tech sector. As it stands, US equity index futures are marginally firmer with performance across the majors relatively even (ES +0.4%) as markets await a slew of large-cap earnings. In terms of market commentary, JP Morgan notes that global EPS revisions remain plentiful as sell-side analysts’ global EPS upgrades continue to outnumber EPS downgrades. That said, JPM is of the view that the trend is slowing. In terms of the sector breakdown, analysts note that Defensive Sectors show improving EPS revisions, whilst Global Cyclicals sectors such as Technology, Financials, Energy, Industrials and Discretionary dominate the largest upgrades. Back to Europe, sectors are mostly firmer with outperformance in Basic Resources amid upside in underlying commodity prices. Elsewhere, Retail names also outperform peers with some of the French luxury names such as Kering, LVMH and Hermes trying to claw back some of yesterday’s post-Chinese GDP losses with the former set to release earnings after-hours. To the downside, the Telecoms sector sits in modest negative as Ericsson (-0.3%) acts as a drag post-Q3 results. In terms of individual movers, Pearson (+3.6%) stands at the top of the Stoxx 600 after being upgraded at Credit Suisse, whilst Iberdrola (+3.2%) is also a notable gainer amid news that it is to invest USD 8.3bln into a North Sea wind farm complex – its largest global investment. Laggards include Teamviewer (-4.8%) following a broker downgrade at Exane, whilst broker action has also hampered IAG (-3.5%). In terms of large cap earnings, Danone (-1%) shares are seen lower after flagging rising costs and a slowdown in sales growth.

Top European News

- European Gas Prices Drop on Windy and Mild Weather Forecasts

- Most of Barclays’ U.S. Workers Now Back in Office, Staley Says

- Poland Escalates Rule-of-Law Dispute, Risking EU Recovery Money

- Goldman Sachs Investment Banker Joins Nordic Venture Fund Hadean

In FX, a downbeat session for the Dollar thus far as the index retreats further from the 94.000 mark to extend the lower bound of a two-week range. There has been little in terms of fundamental catalysts to trigger the selloff as yields remain elevated (albeit off recent highs), and market sentiment remains tentative. State-side, there is a lack of developments Capitol Hill, with US President Biden stating that he is “right now” going to try for a deal with Moderate Democratic Senator Manchin, while it was separately reported that Senator Manchin said he does not see how a deal on Biden’s agenda will happen by October 31st. The DXY is more interesting from a technical standpoint after falling just short of the 100 WMA (94.213) during yesterday’s session to a high of 94.174 and losses exacerbated overnight by a breach of support at the 21 DMA (98.879) – with the line acting as firm support over the past three consecutive trading sessions. The next levels to the downside naturally reside at the 93.500 mark – with clean air seen until the psychological mark. Below that, the September 28th low resides at 93.360, followed by the 50 DMA at 93.242 and the 27th Sept base at 93.206. Ahead, the data docket remains light, but Fed speak is abundant, although from regulars.

- AUD, NZD, CAD – The antipodeans top the G10 chart, with the NZD the marked outperformer as participants mull stepper RBNZ rate hikes following yesterday’s hot Kiwi CPI metrics. ANZ Bank brought forward its forecast for the RBNZ to lift the OCR to a neutral rate of 2% by August 2022 from a prior forecast of a neutral rate by the end of 2022. NZD/USD surpassed its 200 DMA – which matches the 0.7100 psychological level (vs low 0.7079). The pair now probes 0.7150 with some potential resistance seen at 0.7156 (September 10th high), 0.7167 (September 6th high), and 0.7170 (September 3rd high). The Aussie meanwhile saw a relatively mundane RBA minutes release, but the AUD optimism is likely spurred by the rebound in base metals. AUD/USD found support at its 100 DMA (0.7406) and inches closer towards 0.7450. Gains in the CAD are still somewhat hampered by the slide in crude prices yesterday; nonetheless, USD/CAD re-eyes levels last seen in July.

- EUR, GBP, JPY – All benefit from the softer Dollar, although the Sterling fares slightly better as BoE market pricing provides further tailwinds; markets are currently assigning a 78% probability of a 25bps hike at the November 4th confab. HBSC weighed in this morning and suggested the economic fundamentals do not appear to have changed sufficiently to warrant the recent market move, with market pricing looking too aggressive given the balance of supply and demand in their view. This followed GS and JPM reeling in their BoE hike forecasts yesterday. GBP/USD extends upside above 1.3800 and topped its 100 DMA situated at 1.3809. On the UK docket, BoE’s Mann and Chief Economic Pill could provide some more meat on the bones following Governor Bailey’s weekend remarks. EUR/USD was bolstered above its 21 DMA (1.1620) and posts gains north of 1.1650 at the time of writing, with the pair also eyeing chunky OpEx with EUR 1.3bln between 1.1600-15 and EUR 581mln between 1.1670-75. EUR/GBP meanwhile tests 0.8450 to the downside from a current 0.8463 high. USD/JPY has pulled back after failing to breach resistance just ahead of the 114.50 mark, with the softer Buck bringing the pair back towards the 114.00 ahead – with Friday’s base at 113.63.

In commodities, WTI and Brent front-month futures are nursing yesterday’s wounds and prices remain elevated despite a lack of fresh catalysts and with the macro landscape little changed as of late. The themes remain a) OPEC+ supply, b) supply crunch in the natural gas, LNG, electricity, and coal markets and c) winter demand. Elsewhere, the White House said it is continuing to press OPEC members to address the oil supply issue and is also addressing logistics of supply. Furthermore, the White House will use every lever at its disposal and the FTC is also looking at possible price gouging. WTI Nov extends gains above USD 83/bbl (vs 82.05/bbl low) while Brent Dec aims at USD 85/bbl (vs low 83.83/bbl). Elsewhere, metals have been spurred by the retreat in the Dollar, with spot gold topping its 50 DMA (1,778/oz) after testing its 21 DMA (1,760/oz) overnight, with the yellow metal also seeing its 200 and 100 DMAs at 1,793/oz and 1,794/oz respectively. Over to base metals, Dalian iron ore futures snapped a four-day losing streak, with iron ore shipments departing from Australia and Brazil lower W/W according to Mysteel data. Copper prices meanwhile are buoyed with the LME future holding onto comfortable gains north of USD 10k/t.

US Event Calendar

- 8:30am: Sept. Building Permits MoM, est. -2.4%, prior 6.0%, revised 5.6%

- 8:30am: Sept. Housing Starts MoM, est. -0.2%, prior 3.9%

- 8:30am: Sept. Building Permits, est. 1.68m, prior 1.73m, revised 1.72m

- 8:30am: Sept. Housing Starts, est. 1.61m, prior 1.62m

DB’s Jim Reid concludes the overnight wrap

At home we have recently bought a wooden bench for our kitchen table with the names of our three kids carved into the seats. We are pretty confident that there’ll be no need for more names. The problem was though that we chose an elegant, flamboyant font. The twins have just started to learn how to recognise and write their own names with the school having a very strict letter formation. As such last night when we were discussing it, young James refused to accept that this was his name on the bench and was hysterical with anger screaming that the bench needed to go as it was wrong. He kept on shouting “that’s not my name”. Nothing could persuade him otherwise. I thought I was defusing the situation by playing the famous Ting Tings song “that’s not my name” on the kitchen speakers but this just made matters far worse just before bedtime. So if anyone wants a bench with Edward, Maisie and James carved into it let me know as it’s causing a lot of grief at home.

It seems like rate hikes are increasingly being carved into markets at the moment as Bank of England Governor Bailey’s hawkish Sunday comments that we discussed yesterday set the tone for the last 24 hours. Rates opened very weak across the globe but a similar pattern broke out to that seen over the last couple of weeks where higher yields have either brought in fresh bond buyers or markets have decided that the higher rate story is enough of a potential risk-off or negative growth story that dip buying mentality sets in. So yields have been a bit 3 steps higher, two steps lower over the last couple of weeks even though the inflation data has been largely one way higher.

It was the UK that saw the most seismic shifts yesterday after Governor Bailey’s comments, with yields on 2yr UK gilts (+13.1bps) seeing their biggest daily move higher since August 2015, and the 2s10s curve (-9.8bps) flattening by the most since the height of the pandemic in March 2020. Markets are now pricing in a move in the Bank Rate up to around 0.45% by the December meeting (from 0.1%), and up to around 0.95% by the June meeting, around 15-30bps more priced in across the next several meetings from Friday’s close. So tomorrow’s CPI release from the UK will be interesting in light of this but it will likely be the calm before the storm given favourable base effects and with other pipeline inflation items yet to feed into the data. You can get a sense of how the UK is moving much faster than others in its rate hike pricing in that the spread between 2yr gilts and treasury yields is now at its widest in favour of gilt yields since late 2014.

Yields on shorter maturities saw the most sustained movement elsewhere as well as investors began to anticipate imminent rate hikes. In fact, by the close of trade yesterday, markets were just shy of pricing in 2 Fed hikes by the end of 2022, which is some way ahead of the Fed’s dot plot from last month, when half the members didn’t see any hikes until at least 2023. Indeed, December 2022 Eurodollar futures have increased some 40 basis points over the last month, whilst September 2022 futures have increased more than 20 basis points. 10yr Treasury yields climbed +3.0 to 1.600%, with the rise entirely driven by higher real yields (+4.6bps). They were at 1.625% at the session highs, though.

Those movements were echoed in the Euro Area, although the main difference to the US and the UK was that higher inflation breakevens rather than real rates drove the moves higher in yields. By the close of trade, yields on 10yr bunds (+2.1bps), OATs (+2.2bps) and BTPs (+3.0bps) had all moved higher even if again a few bps off the highs for the session. On the inflation side, the 10yr German breakeven hit a post-2013 high of 1.85%, just as the 5y5y forward inflation swap for the Euro Area was up +4.5bps to 1.91%, its highest closing level since 2014.

The prospect of faster rate hikes put a dampener on equities, especially earlier in the day, though the S&P 500 (+0.34%) recovered to close just -1.13% beneath its all-time closing high from early September. Cyclical industries led the index higher, with the FANG+ index of megacap tech stocks (+1.99%) seeing a strong outperformance as all but 1 of its 10 constituents moved higher on the day. It was a different story in Europe however, where the STOXX 600 fell -0.50% in line with the losses elsewhere on the continent.

At the sectoral level, energy was the outperformer in Europe but faded into the US close. After 8 successive weekly advances for WTI oil prices, yesterday saw it hit fresh multi-year highs (again…) intraday, gaining as much as +1.89% during the London session. However WTI made an about turn after the London close, and ultimately finished only slightly higher (+0.19%) on the day.

Elsewhere, Bitcoin increased +3.31% yesterday and is up another +1.95% this morning to $62,564, bringing it within 1.5% of its own all-time closing high back in April and 3.6% beneath its all-time intraday high. The cryptocurrency has rallied in recent weeks as news picked up that the first US bitcoin ETF would be approved. Later today the ProShares ETF is expected to start trading, offering US retail investors a new avenue to trade the world’s largest cryptocurrency. The ETF will offer exposure to bitcoin futures contracts rather than “physical” bitcoin.

Stocks are trading higher in Asia overnight, with the Hang Seng (+1.30%), CSI (+1.01%), Shanghai Composite (+0.74%), the Nikkei (+0.73%) and the KOSPI (+0.61%) all advancing thanks to an outperformance from technology stocks. For now at least, positive earnings are outweighing the impact from the prospect of faster than expected interest rate hikes. However, the issues stemming from Evergrande will continue to remain in focus as the developer has a Yuan bond interest due today. Outside of Asia, futures are pointing towards modest gains at the open, with those on the S&P 500 (+0.06%) and the DAX (0.11%) moving higher.

Turning to the pandemic, the continued decline in global cases over the last couple of months and the lack of new variants has rather taken it off the front business pages of late. That said, there were a few concerning indications yesterday when it came to the health picture. Firstly, China is dealing with a fresh cluster in its northwestern provinces, with further positive tests reported overnight. Second, there are signs that we could be facing a more severe flu season as we approach winter in the northern hemisphere, with the Walgreens Boots Alliance reporting that flu cases are 23% higher in the US relative to a year ago. Third, there were some questions from the UK, as former US FDA Commissioner Scott Gottlieb wrote on Twitter on Sunday that given the recent rise in UK cases and the “delta-plus” variant, that there should be “urgent research” to discover if it was more transmissible or had partial immune evasion. Finally, New Zealand (which had been pursuing a zero-Covid strategy in the past) reported a record 94 cases yesterday as Auckland remains in lockdown.

There wasn’t a massive amount of data yesterday, though US industrial production fell -1.3% in September (vs. +0.1% expected), and the August number was also revised down half a percentage point to now show a -0.1% contraction. Partly that was thanks to the continuing effects of Hurricane Ida, which contributed around 0.6 percentage point of the overall drop in production, but the contraction also reflected supply-chain issues (eg auto chip shortages). Otherwise, the NAHB housing market index for October unexpectedly rose to 80 (vs. 75 expected).

To the day ahead now, and we’ll hear from an array of central bank speakers, including the BoE’s Governor Bailey, Pill and Mann, the ECB’s Rehn, Centeno, Elderson, Panetta and Lane, along with the Fed’s Daly, Barkin, Bostic and Waller. Otherwise, US Data releases including September’s housing starts and building permits, and earnings today include Johnson & Johnson, Procter & Gamble, Netflix, Philip Morris International and BNY Mellon.

Tyler Durden

Tue, 10/19/2021 – 07:50![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com