Futures Flat As Bitcoin Nears All-Time High, Yen Tumbles To 4 Year Low

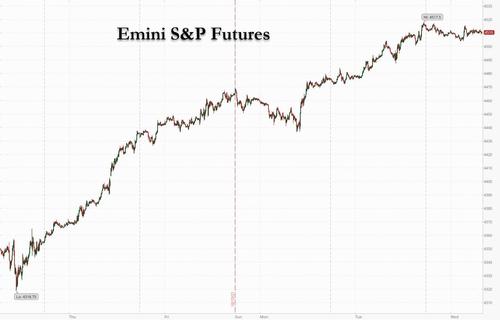

US index futures were little changed as investors weighed the start of the earnings season against growing stagflation, tightening, energy crisis, China property and supply risks. S&P 500 futures were flat after the cash index edged closer to a record on Tuesday, rising above 4,500. Contracts on the Nasdaq 100 were also unchanged after the main index rallied for the past five days. At 7:30 a.m. ET, Dow e-minis were down 8 points, or 0.02%, S&P 500 e-minis were down 1 point, or 0.03%, and Nasdaq 100 e-minis were up 5 points, or 0.03%. Oil was down and the dollar steadied. Bitcoin traded just shy of its all time high overnight, and was last seen around $64,000.

The S&P closed higher on Tuesday with the biggest boosts from the technology and healthcare sectors amid optimism about solid third-quarter earnings season. The index is just 0.4% below its early September record close, while the Dow Jones Industrials average is 0.5% below its all-time high reached in mid-August.

“Earlier this month, stagflation was the buzzword on Wall Street. But now excessive pessimism is receding, especially after strong U.S. retail sales data on Friday,” said Norihiro Fujito, chief investment strategist at Mitsubishi UFJ Morgan Stanley Securities. “Tech shares and other high-growth shares that would have been sold on rising bond yields are rallying, which clearly shows that there is now strong optimism on upcoming earnings.”

The positive mood saw U.S. bond yields rising further, with the 10-year U.S. Treasuries yield climbing to 1.67% , a high last seen in May. Shorter yields dipped, however, with the two-year yield slipping to 0.404% from Monday’s peak of 0.448% as traders took profits for now from bets that the U.S. Federal Reserve will turn hawkish at its upcoming policy meeting in early November. Investors expect the Fed to announce tapering of its bond buying and money markets futures are pricing in one rate hike later next year.

“The Fed is likely to become more hawkish, probably tweaking its language on its assessment that inflation will be transient. While the Fed will maintain tapering is not linked to a future rate hike, the market will likely try to price in rate hikes and flatten the yield curve,” said Naokazu Koshimizu, senior strategist at Nomura Securities.

In premarket trading, Tesla edged 0.4% lower in the run up to its quarterly results after markets close, with investors awaiting details on its performance in China. Anthem rose 0.6% as the second largest health U.S. insurer raised its profit outlook for 2021 after beating third-quarter profit estimates. United Airlines Holdings gained 1.6% after the carrier reported a smaller quarterly loss than a year ago on travel rebound. Ford gained 1.9% after Credit Suisse upgraded the U.S. automaker’s stock to ‘outperform’ on EV transition. Oil majors Exxon Mobil and Chevron Corp slipped 0.7% and 0.6%, respectively, tracking crude prices. Meanwhile, Chinese technology ADRs climbed as jitters in the wake of President Xi Jinping’s regulatory crackdowns fade.

Netflix’s global sensation “Squid Game” helped lure more customers than expected, the world’s largest streaming service said as it predicted a packed lineup would further boost signups through the end of the year. Its shares, however, fell 2.7% after hitting a record high earlier this month and gaining 18.2% year-to-date. Here are some of the other biggest U.S. movers today:

Chinese tech stocks listed in the U.S. rally in premarket with Hong Kong peers as jitters in the wake of President Xi Jinping’s regulatory crackdowns fade; Pinduoduo (PDD US) +1.7%; Didi (DIDI US) +1.3%

- Alibaba (BABA US) jumped 6.7% in Hong Kong after reports that founder Jack Ma has traveled abroad for the first time in a year

- United Airlines (UAL US) gains 2% in U.S. premarket trading after the airline posted a narrower loss than expected despite the impact of the coronavirus delta variant. Cowen notes that 3Q was better than expected and also ahead of management’s last guidance from early September

- Novavax (NVAX US) shares fall as much as 25% in U.S. premarket trading after Politico reported a potential delay in registering its Covid-19 vaccine candidate with the U.S. Food and Drug Administration in connection with inadequate purity levels

- Vinco Ventures (BBIG US) shares slump 15% in premarket trading after the company reported the resignations of Chief Executive Officer Christopher Ferguson and Chief Financial Officer Brett Vroman

- Ford (F US) shares gain 1.7% premarket after Credit Suisse upgrades to outperform with joint Street-high target of $20 following a significant turnaround over the past year

- Stride (LRN US) gained 7.9% Tuesday postmarket after the education company forecast revenue for the full year that beat the highest analyst estimate

- WD-40 (WDFC US) sank 10% in postmarket trading after forecasting earnings per share for 2022 that missed the average analyst estimate

- Omnicom (OMC US) fell 3% in postmarket trading after third quarter revenue fell short of some analyst estimates

- Canadian National (CNI US) U.S.-listed shares rose 4.6% in postmarket trading after reporting adjusted earnings per share for the third quarter that beat the average analyst estimate

- Akero Therapeutics (AKRO US) shares rose as much as 12% in Tuesday extended trading after co. said the U.S

Verizon Communication, Abbott Laboratories, Tesla Inc, Kinder Morgan and IBM are set to report their earnings later in the day. Analysts expect S&P 500 earnings to rise 32.4% from a year earlier, according to Refinitiv data, while also keeping a close eye on growth outlook from companies that are faced with rising costs, labor shortages and supply chain disruptions.

“Investor response to the latest set of earnings reports has been a touch hit and miss with supply chain issues dogging both Procter and Gamble and Philip Morris,” wrote Danni Hewson, financial analyst at AJ Bell in a client note.

“After six quarters of beating earnings expectations, the focus may now shift to forward guidance for 2022 and away from the likely better than expected results for this quarter,” Clive Emery, a multi asset fund manager at Invesco said in a note. “If CEOs are more conservative, this could dent market pricing – especially after such strong moves in equity markets over the last 18 months.”

In Europe, stocks were also little changed as gains in food and beverage stocks offset losses in miners which are some of the region’s steepest decliners as base metals slip after China launched a blitz of measures to tackle the energy crisis. The Stoxx Europe 600 basic resources index drops 2% as of 10:56am in London, worst performance among Stoxx 600 sectors. Here are some of the biggest European movers today:

- Falck Renewables shares rise as much as 15% after Infrastructure Investments Fund agreed to buy Falck SpA’s 60% stake in the company at EU8.81/share. IIF will launch a mandatory cash tender offer for Falck Renewables’ remaining share capital after the transaction.

- Husqvarna shares advance as much as 7.7%, the most intraday since May 2020, after reporting 3Q operating profit that Pareto Securities says is “substantially” stronger than expected.

- Getinge shares jump as much as 8.1% to a record high, leading the OMX Stockholm 30 index, after 3Q earnings which Handelsbanken (hold) says showed “impressive” order intake and operating leverage.

- Deliveroo shares jump as much as 4.9% to their highest level since Sept. 30, after the U.K. online food delivery firm hikes its growth forecast, which Jefferies says is an “aspiration” for players in the sector.

- Nestle shares advance as much as 3.9% after the world’s largest food company increased its sales outlook for the year. This along with the lack of a negative margin update “should be enough to reassure,” according to Citigroup.

- AutoStore Holdings shares jumped as much as 15% in its Oslo trading debut after pricing shares at the top end of the marketed range as an online shopping boom and labor shortages drive up demand for its automated warehouse robots.

- Kering SA shares tumbled as much as 5.8% after slowing growth at Gucci, its biggest brand, put more pressure on the label’s new collection to deliver a strong holiday season.

- Antofagasta shares slump as much as 6.3%, most intraday for two months, after the miner guides for lower copper production next year. Citi and Morgan Stanley analysts say 2022 outlook came in below expectations

- Kuehne + Nagel shares fall as much as 4.7% to their lowest level in five months after working- capital concerns outweighed a 3Q earnings beat for Swiss logistics operator.

Earlier in the session, Asian stocks advanced with Hong Kong-listed tech shares extending their rally to a fourth day, buoyed by encouraging U.S. earnings and growing optimism that the strictest of China’s new regulations on tech firms may already be announced. The MSCI Asia Pacific Index rose as much as 0.7%, powered by Alibaba Group Holding Ltd., which closed up 6.7%. The equity gauge also climbed after Johnson & Johnson raised its profit forecast and Netflix Inc. reported a jump in subscribers. Hong Kong and Australia were among the top-performing markets.

“Asian stocks appear to be taking their cue from the U.S. earnings season and are being bought on the back of the nascent technical confirmation,” said Justin Tang, the head of Asian research at United First Partners. The regional benchmark has gained 5% over the past two weeks as the earnings season progresses and inflation and supply chain worries ease. The measure is close to surpassing its 100-day moving average. Coal stocks listed in mainland China slumped after the nation’s top economic planner said it’s studying ways to intervene in the coal market as the government tries to rein in rising prices and curtail shortfalls. Meanwhile, expectations are falling that China’s central bank will ease monetary policy by cutting the amount of cash banks have to hold in reserve, according to a front-page story from the central bank’s own newspaper.

Japanese equities eked out a second day of gains, driven by advances in telecommunications providers. Banks were also among the biggest boosts to the Topix, which rose less than 0.1%. SoftBank Group and Fast Retailing were the largest contributors to a 0.1% gain in the Nikkei 225. U.S. equities extended a rally on Tuesday as solid corporate results helped counter concerns stemming from elevated inflation.

In Australia, the S&P/ASX 200 index rose 0.5% to 7,413.70, its highest close since Sept. 16. Banks boosted the index as a subgauge of financials hit a four-year peak. Kogan.com rallied after the company reported gross sales for the first quarter of A$330.5 million vs. A$273 million y/y. Whitehaven plunged after China’s top economic planner said it is studying ways to intervene in the coal market as the government tries to rein in rising prices and curtail shortfalls. In New Zealand, the S&P/NZX 50 index rose 0.4% to 13,114.24

In FX, the Bloomberg dollar index is little changed in London trade following yesterday’s slide and the greenback traded mixed against its Group-of-10 peers. The Treasury curve held on to yesterday’s steepening as the 2-year yield fell a second day, while the 10- year yield was steady after earlier rising to 1.67% for the first time since May. Norway’s krone was the worst G-10 performer as it fell from the European open, after yesterday reaching a four-month high versus the dollar. The pound slipped, reversing modest gains, after the U.K.’s September inflation reading came in lower than expectations; still, it’s well beyond the Bank of England’s target and it’s the last before the rate decision in November. Australia’s led G-10 gains and the sovereign bond curve bear steepened, tracking yesterday’s Treasury moves. The yen fell to weakest level in almost four years as traders added to bets on Fed rate hikes and rising oil prices boosted concern about the Japanese trade deficit. China’s offshore yuan extends its overnight softness after a weaker than expected fixing, with USD/CNH 0.25% higher.

In rates, treasuries were narrowly mixed and off lows reached during Asia session after being led higher during European morning by gilts, where short maturities outperform. The 10-year TSY yield touched 1.67%, the highest level since May. The treasury futures rally stalled after a block sale in 10-year contracts, apparently fading strength. Treasury curve pivots around a little-changed 10-year sector, with front-end yields slightly richer on the day, long-end slightly cheaper; 5s30s, steeper by 2bp, extends rebound from Monday’s multimonth low; U.K. 10-year yield is lower by nearly 4bp. U.S. session includes 20-year bond auction.

Bunds and gilts ground higher in quiet trade, with curves having a small steepening bias. Long end USTs cheapen 1bp, gilts richen ~2.5bps at the short end. Peripheral spreads are marginally tighter to Germany. Italy’s green BTP syndication is well received with final books over EU48b. European equities fade a small opening dip to trade little changed. Price action is quiet, V2X drops toward 16

In commodities, crude futures drift lower. WTI drops 0.9% near $82.20, Brent is 1% lower holding above $84. Spot gold slowly extends Asia’s gains, rising $9 to trade near $1,780/oz. Most base metals are under pressure with LME copper and aluminum underperforming peers.

In cryptocurrencies, bitcoin stood at $64,068, near its all-time peak of $64,895 as the first U.S. bitcoin futures-based exchange-traded fund began trading on Tuesday

Looking at the day ahead now, and data releases include the UK and Canadian CPI readings for September, alongside the German PPI reading for the same month. From central banks, the Fed will be releasing their Beige Book, and we’ll hear from the Fed’s Bostic, Kashkari, Evans, Bullard and Quarles, as well as the ECB’s Villeroy, Elderson, Holzmann and Visco. Finally, today’s earnings releases include Tesla, Verizon Communications, Abbott Laboratories, NextEra Energy and IBM.

Market Snapshot

- S&P 500 futures little changed at 4,509.50

- MXAP up 0.4% to 200.82

- MXAPJ up 0.5% to 661.79

- Nikkei up 0.1% to 29,255.55

- Topix little changed at 2,027.67

- Hang Seng Index up 1.4% to 26,136.02

- Shanghai Composite down 0.2% to 3,587.00

- Sensex down 0.6% to 61,343.39

- Australia S&P/ASX 200 up 0.5% to 7,413.67

- Kospi down 0.5% to 3,013.13

- STOXX Europe 600 little changed at 468.88

- German 10Y yield rose 8.5 bps to -0.115%

- Euro little changed at $1.1628

- Brent Futures down 0.9% to $84.32/bbl

- Gold spot up 0.5% to $1,777.33

- U.S. Dollar Index little changed at 93.80

Top Overnight News from Bloomberg

- Business Secretary Kwasi Kwarteng said there won’t be a fresh lockdown of the U.K. economy even as Covid-19 cases tick upwards and Prime Minister Boris Johnson warns of a difficult winter ahead

- The recovery in France and in Europe “remains very strong,” Bank of France Governor Francois Villeroy de Galhau says on Wednesday during a National Assembly finance committee hearing

- The yen’s tough year is only going to get tougher as a rising tide of oil prices and global yields threatens to send Japan’s currency past 115 per dollar for the first time since 2017

- PBOC Deputy Governor Pan Gongsheng says financial activities by China’s property sector and financial market prices are gradually becoming normal, China Business News reports, citing a speech at a forum in Beijing

- Sinic Holdings Group Co. became the latest Chinese real estate firm to default as investors wait to see whether China Evergrande Group Inc. will meet overdue interest payments on dollar bonds this week

A more detailed look at global markets from Newsquawk

Asian equity markets traded mostly positive as the region took its cue from the extended gains on Wall Street where sentiment was underpinned amid encouraging earnings results and with some hopes for a breakthrough on reconciliation as the White House and Democrats continued deliberations. ASX 200 (+0.5%) was led higher by outperformance in tech and with nearly all of its sectors in the green, while there were also gains seen in some of the blue-chip miners and across the big four banks. Nikkei 225 (+0.1%) was lifted by the weaker currency and following better than expected Exports and Imports data, although the index stalled just shy of the 29.5k level, while KOSPI (-0.5%) failed to hold on to opening gains with confirmation from North Korea that it fired a new submarine launched ballistic missile on Tuesday. Hang Seng (+1.4%) and Shanghai Comp. (-0.1%) were varied whereby Hong Kong was boosted by tech and health care with Alibaba leading the advances after it recently unveiled China’s most advanced chip and with its founder Jack Ma travelling abroad for the first time in over a year who is currently on a study tour in Spain. Conversely, the mainland was subdued alongside weakness in domestic commodity prices and despite a firmer liquidity effort by the PBoC, while the central bank provided no surprises in maintaining its benchmark Loan Prime Rates unchanged for the 18th consecutive month and a PBoC-backed paper also noted that expectations for a RRR cut during Q4 have eased. Finally, 10yr JGBs were lower amid spillover selling from global peers and recent curve steepening in US which desks attributed to positioning and upcoming supply, although the downside for JGBs was limited by the presence of the BoJ in the market for nearly JPY 1.4tln of JGBs heavily concentrated in 1yr-10yr maturities.

Top Asian News

- Abu Dhabi’s Top Fund Backs Indonesia’s Largest Internet Firm

- Singapore Category E COE Price Rises to Highest Since Oct. 2013

- China’s Liu He Says Property Market Risks Are Controllable: 21st

- Rio’s New CEO Starts Turnaround With $7.5 Billion Climate Pledge

It’s been a choppy start to the session for European equities (Euro Stoxx 50 flat; Stoxx 600 flat) as opening losses were quickly trimmed after the cash open. Stocks in Europe were unable to benefit from the constructive APAC handover, which itself benefitted from a strong Wall St close as stocks in the US gained for a fifth consecutive session. As it stands, US equity index futures are relatively flat as indices succumb to the choppy price action with events on Capitol Hill not providing much guidance for price action as lawmakers strive to reach a deal on spending by the end of the week. Back to Europe and sectoral performance is somewhat mixed with clear outperformance in the Food & Beverage sector as earnings from Swiss heavyweight Nestle (+3.2%) provides support and prompts upside in the SMI (+0.7%). Nestle reported a beat on 9M revenues and raised FY guidance amid performance of coffee and pet food sales, whilst noting that it increased pricing in a “responsible manner” during Q3. Elsewhere in Switzerland, Roche (-1.0%) also beat on revenues and raised guidance but was unable to benefit from a lift in its share price. To the downside, Basic Resources lag amid softness in some base metals prices as well as a production update from Antofagasta (-4.2%) and a broker downgrade for Rio Tinto (-4.0%). Retail names are also trading on a softer footing after Q3 earnings from Kering (-4.0%) saw the Co. report a decline in consolidated revenues and note that performance for Gucci was hit by a resurgence of COVID-19 cases in Asia. H&M (-2.7%) is also weighing on the sector after a broker downgrade at Morgan Stanley. Elsewhere, Deliveroo (+3%) is seeing upside today after the Co. upgraded Gross Transaction Value (GTV) growth guidance. Additionally, in what has been a tough week for the Co., IAG (-3.6%) is seeing further losses after being downgraded at Peel Hunt. Finally, updates from the likes of materials name Akzo Nobel (supply chain woes) and semiconductor ASML (revenues fell short of expectations) have sent their shares lower by 1.5% and 1.7% respectively.

Top European News

- Weidmann to to Step Down as Bundesbank Chief at End of Year

- Credit Suisse Dodges Bigger Fine With Debt-Forgiveness Vow

- Vinci Up After Reporting Higher 9m Sales; Guidance Confirmed

- Covid Tests Boost Roche Growth Once Again, Lifting Outlook

In FX, the Index has recovered from yesterday’s decline, which saw a base at 93.500 – matching the 32.8% Fib retracement of the September move, with the Index now eyeing the 21 DMA at 93.917 ahead of 94.000. The main stateside development has been on the fiscal front, where President Biden told Democrat lawmakers he believed they could secure an agreement for a tax and spending proposal valued at USD 1.75tln-1.90tln, whilst US progressive Democratic Rep. Jayapal said she feels even more optimistic after the White House meeting. As Republicans fully opposed Biden’s plans, all Democrat votes are needed in the Senate, whilst only a few can be spared in the House. As a reminder, Congress set an Oct 31st deadline for the passage. Negotiations are expected to wrap up as soon as this week. Ahead, the stateside docket is quiet aside from several Fed regulars after the European close.

- NZD, AUD, CAD – The Kiwi stands as the current outperformer in a continuation of the strength seen as bets mount for a steeper RBNZ OCR hike at the upcoming meeting in light of the CPI metrics earlier this week. The NZD/USD pair also sees some technical tailwinds after failing to convincingly breach 0.7150 to the downside overnight. AUD/USD meanwhile eyes 0.7500 to the upside from a 0.7466 base with some potential support seen as China taps into Aussie coal amid surging demand. USD/CAD dips below 1.2350 but remains within yesterday’s 1.2309-76 range ahead of Canadian CPI later – with headline Y/Y expected to tick higher to 4.3% from 4.1%.

- EUR, GBP – Both flat vs the Dollar and against each other. Sterling saw some mild weakness as UK CPI narrowly missed expectations at 3.1% vs exp. 3.2% for the headline Y/Y, in turn prompting market pricing to ease a touch as the dust settled – with the implied rate for the 4th Nov meeting modestly under 25bps vs 25.71bps heading into the release. That being said, the slight miss is likely not to provide enough ammunition for the BoE doves, whilst the hawks will likely continue to warn the dangers of persistently high inflation – ultimately not settling the debate on the MPC regarding how soon it should raise rates. GBP/USD fell back under its 100 DMA (1.3805) from a 1.3814 high. From a technical standpoint, aside from yesterday’s 1.3833 peak, the pair sees the 200 DMA at 1.3846. EUR/USD meanwhile rebounded off its 21 DMA (1.1615) but remains under 1.1669 high, having seen little reaction to the unrevised Y/Y final EZ CPI metrics, although the M/M metrics were revised slightly higher as expected. Elsewhere, it is worth noting that ECB-hawk Weidmann has submitted his resignation to the Bundesbank and the ECB ahead of next week’s Governing Council confab.

- JPY – The JPY is relatively flat intraday, but overnight price action was interesting as USD/JPY drifted to a high of 114.69, with participants recently flagging barriers just ahead of 115.00. Some have also cited Gatobi demand, where accounts

In commodities, WTI and Brent Dec futures are marginally softer on the day in a continuation of the downward trajectory during US hours yesterday. WTI has dipped below USD 82/bbl (vs high USD 82.60/bbl) while its Brent counterpart hovers around USD 84.50/bbl (vs high USD 85.20/bbl). The subdued prices come amid a larger-than-expected build in Private inventories, although the internals were bullish, with the DoEs headline expected to print a build of some 1.8mln bbls. Elsewhere, the Iraqi energy minister has been vocal throughout the session, saying he expects oil prices to reach USD 100/bbl in Q1 and Q2 2022 – in contrast to comments he made last week which suggested that oil price is unlikely to increase further; whilst he also recently noted oil prices between USD 75-80/bbl is a fair price for producers and consumers. The Iraqi minister today said it is preferable for long-term oil prices between USD 75-85/bbl, and OPEC+ is now discussing ways to balance oil prices but no decision has yet been made to add more production above the agreed levels. Elsewhere, following India’s call on OPEC yesterday to lower prices, India’s HPCL executive says current oil prices are high for India; USD 60-70/bbl is comfortable and high oil prices may impact demand growth. Over to metals spot gold resides around its 50 DMA at USD 1,778/oz while spot silver eyes USD 24/bbl to the upside. Overnight, China’s coal intervention saw prices slump – with thermal coal futures hitting limit down and coke futures opening lower by 9%. LME copper prices are also softer, with the contract briefly dipping under USD 10k/t overnight.

US Event Calendar

- 7am: Oct. MBA Mortgage Applications, prior 0.2%

- Oct. 20-Oct. 22: Sept. Monthly Budget Statement, est. -$59b, prior -$124.6b

- 2pm: U.S. Federal Reserve Releases Beige Book

DB’s Jim Reid concludes the overnight wrap

Whilst inflation concerns are still very much bubbling under the surface of markets, risk appetite strengthened further yesterday thanks in no small part to decent earnings reports. There are no signs of widespread erosions of margins at the moment. Perhaps there is so much money sloshing about that for now prices are broadly being passed on. We’ll get a better picture of this as the earnings season develops.

Indeed, the selloff from September feels like an increasingly distant memory now, with the S&P 500 (+0.74%) advancing for a 5th consecutive session to leave the index just 0.38% beneath all-time closing high from early September. Earlier Europe’s STOXX 600 (+0.33%) also moved higher. In the US, earnings supported sentiment yet again. 10 of the 11 companies reporting during New York trading beating estimates, whilst all 4 of the after-hours reporting beat as well. That brings the total number of reporters for the season thus far to 57, 50 of whom have beat earnings expectations. Most sectors were higher yesterday, with health care (+1.31%), utilities (+1.26%), and energy (+1.14%) leading the way; only consumer discretionary (-0.29%) lagged. We even saw the FANG+ index (+1.56%) of megacap tech stocks hit a new record ahead of Tesla’s earnings today, whilst the NASDAQ (+0.72%) was also up for a 5th consecutive session.

Equities may be brushing off the inflation stories for now but they are hardly going away, as yesterday saw oil prices climb to fresh multi-year highs. Brent Crude was up +0.89% to close above $85/bbl for the first time since 2018, whilst WTI (+0.63%) similarly advanced to close just shy of $83/bbl, a mark not reached since 2014. And investor expectations of future inflation are still moving higher in many places, with the Euro Area 5y5y forward inflation swap up +4.0bps to 1.90%, also the highest level since 2014.

Against this backdrop, sovereign bonds continued to selloff on both sides of the Atlantic, even though investors slightly pared back some of their Monday bets on near-term rate hikes by the Fed and the BoE. 10yr yields moved higher across the board, with those on Treasuries up +3.7bps to 1.64%, their highest closing level since early June, just as those on bunds (+4.3bps), OATs (+4.3bps) and BTPs (+4.8bps) similarly moved higher. It was a more divergent picture at the 2yr horizon however, with those on 2yr Treasuries down -3.0bps after five days of increases, whereas those on gilts were up +1.0bps. Watch out for UK inflation numbers shortly after this hits your inboxes although this may be the calm (due to base effects) before the inflationary storm in the coming months.

From central banks, we had the latest global hike yesterday in Hungary, where the base rate was raised by 15bps to 1.80%, in line with consensus expectations, with Deputy Governor Virag saying afterwards that this monetary tightening was set to carry on into next year. However, we did get some pushback to recent market pricing from ECB chief economist Lane, who said that “If you look at market pricing of the forward interest rate curve, I think it’s challenging to reconcile some of the market views with our pretty clear rate forward guidance”. This didn’t really hit fixed income but it did see the euro pare back some of its gains against the US dollar yesterday, ending the session up just +0.08%, down from an intraday high of +0.51%.

Asian equities have followed those moves higher overnight, with the Hang Seng (+1.71%), Nikkei (+0.27%), CSI (+0.08%) and Shanghai Composite (+0.03%) all trading higher, although the KOSPI (-0.11%) has lost ground. China’s property market continues to be in focus after home prices fell -0.08% in September, which is their first monthly decline since April 2015. Separately, Chinese coal futures (-8.00%) have snapped a run of 8 consecutive gains this morning after the country’s National Development and Reform Commission said that it wanted to ensure a rise in coal output to 12m tons per day, and that they would also be looking at other measures to intervene in the market. Outside of Asia, equity futures are pointing slightly lower, with those on the S&P 500 down -0.03%.

The pandemic hasn’t been a major influence on markets in recent weeks but there may be some initial signs that the global decline in cases that we’ve seen since late August has stopped. Looking at data from John Hopkins University, the rolling weekly change in confirmed cases has ticked up on each of Saturday, Sunday and Monday. And although we shouldn’t over-interpret a few days’ numbers, we had already seen the rate of decline slow for 3 successive weeks now, which was probably to be expected given the time of year. We’re certainly coming up to a key period where a more indoor northern hemisphere life will combine with waning vaccine effectiveness to test the resolve of the authorities to maintain relatively restriction-free economies. Boosters may be key here. Once we get past this winter things may get easier particularly with new medicines in the pipeline like the viral pill from Merck that trials showed reduced hospitalisations and deaths by around half.

On the data front, US housing starts fell to an annualised rate of 1.555m in September (vs. 1.615m expected), whilst building permits also fell to an annualised rate of 1.589m (vs. 1.680m expected). The previous month’s numbers were also revised down for both.

Finally in the US, after an acrimonious weekend, Senators Sanders and Manchin expressed optimism they could agree on a framework for the next reconciliation bill by the end of the week in bilateral negotiations, which is set to contain a number of President Biden’s key legislative goals.

To the day ahead now, and data releases include the UK and Canadian CPI readings for September, alongside the German PPI reading for the same month. From central banks, the Fed will be releasing their Beige Book, and we’ll hear from the Fed’s Bostic, Kashkari, Evans, Bullard and Quarles, as well as the ECB’s Villeroy, Elderson, Holzmann and Visco. Finally, today’s earnings releases include Tesla, Verizon Communications, Abbott Laboratories, NextEra Energy and IBM.

Tyler Durden

Wed, 10/20/2021 – 07:59![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com