Rabobank: Central Banks Are Starting To Worry

By Michael Every of Rabobank

Workers AND bourgeoise of the world, unite!

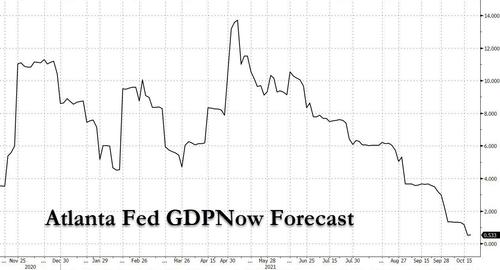

Yesterday’s slump in US housing starts (-1.6%) and building permits (-7.7%) dragged the Atlanta Fed’s GDPNow Q3 tracker down from 1.2% q/q annualised to just 0.5%. One or two more bricks pulled out of the Jenga wall, and it’s flat growth or even contraction. Q4 will be even worse on the present trend – after all, even The Washington Post says “Lower Your Expectations” is the best response to empty shelves, prompting the rest of the country to rant like Larry David in ‘Curb Your Enthusiasm’.

Back at the start of 2021, the financial press were saying “Roaring 20s!” as if it was a good thing. I was saying this latest iteration of their collective historical and economic illiteracy –based instead on fancy-dress office Xmas parties– would only prove ironically correct in that it meant a sugar rush of growth followed by a slump, global labor unrest, and extreme political polarization. The same press are just beginning to wake up to the upheaval in Western labor markets.

Again like Larry David, ordinary people are mad as hell. Try being told you are replaceable for years; then that you are a society-saving “essential worker”; and then being told to get back in your box and accept lower real wages – as the people you saved get vastly wealthier and say “Build Back Better” endlessly. The Great Resignation, as millions walk away from their jobs –look at the labor shortage in the NFIB business survey– is being matched by an uptick in US strike action, and an upswell of ‘Down with the sort of thing’ protests. And note Southwest airline just had to walk back its staff vaccine mandate after a spate of “bad weather” incidents.

As we pointed out a few months ago, supply chains were one of the key triggers for a more sustained inflation impulse. If they shifted, high inflation could become structural. True, they have still not shifted: that implies the need for a Yalta/Potsdam style vision current Western leadership has trepanned out of its skull via repeated rubbing with dollar bills. But supply chains have broken down, which still means you cannot ship goods in / outsource to foreign labor. As such, “essential workers” at home really are essential – and they intend to make sure they get paid appropriately, rather than with polite public applause.

So, central bank are starting to worry. They were wrong about inflation because they were wrong about supply chains, and they were perhaps wrong about labor markets, which they had just taken years to learn had no serious bargaining power. Hence, after much talk of social justice we now see actual, threatened, and market pricing for rate hikes. And, in the UK, chatter that the risk of higher rates should prompt less fiscal stimulus to help keep rates low. I am sure the essential workers who now have de facto bargaining power again, and who are *still* being promised Build Back Better as shelves empty and bills soar, will be thrilled to be told they need to “lower their expectations” and raise their mortgage payments.

Will central banks really tighten monetary policy to try to prevent the shift from capital back to labor they just told us was essential to a fairer economy(!), and even risk prompting a recession to do so? Or will they just talk and watch that power shift, impotently? Or will someone realise that *if* this is going to happen, they better at least shift supply chains home too to ensure less future inflation shocks, even if it also entrenches a new labour-capital balance of power? The latter seems the most logical…and also the least likely, given the hole-in-the-head-but-lots-of-dollars problem previously alluded to, which is evident on the part of all key Western decision-makers.

Meanwhile, in China, we just got another exclusive from Lingling Wei of the Wall Street Journal. The proposed push for a property tax as part of the shift to a ‘common prosperity’ policy, which was flagged in a Xi speech just days ago, is apparently facing huge internal resistance. Even though a 1% tax, for example, could raise $620bn a year in revenue given Chinese housing is the world’s single largest asset class, this would also ruin a huge swathe of investors who own multiple empty properties that generate zero income. They would be forced to sell, prices would crash, and the entire property bubble would burst. Naturally, this backtracking is going to be taken as bullish by the “because markets” crowd. However, it overlooks two important wrinkles.

One is that in the speech just alluded to, Xi argued: “At present, the problem of global income inequality is prominent. Some countries are divided between the rich and the poor, and the middle class has collapsed, leading to social tearing, political polarization, and populism. The lessons are very profound! China must resolutely prevent polarization, promote common prosperity, and achieve social harmony and stability.” Who can disagree? And that path must still run through property in China, just as much as it does in the US, EU, UK, etc., etc. (Where they are talking about raising rates to stop workers getting pay rises, recall.)

Second, the WSJ story says the alternative being floated is a surge in spending on affordable housing provided by state firms. “China would essentially go back to a ‘dual-track’ system with government-subsidized housing offered alongside commercial housing. It was the initial direction for China’s housing reform that started in the late 1990s, according to government advisers, but over the years the effort had focused almost only on commercialization.” Is that not precisely what I predicted would be the fate of Evergrande, which coincidentally looks like it may pay domestic creditors but not foreign ones? However, consider the implications beyond the obvious social good of more social housing:

- More, serious competition for already-struggling Chinese property developers. If workers can buy cheap public housing, why buy expensive private housing?

- What will the holders of multiple private apartments do as there is a clearer realisation, beyond slumping birth-rates, that these flats ultimately have no “use value” (to use Marxist terminology), and so logically less “exchange value” too?

- Where will local governments get revenues from if the land they used to sell at high prices to developers now has to be sold to SOEs to build public housing at low prices? Or are SOEs to have to match land bids to private developer levels, and so make public housing unaffordable, defeating the object of the exercise?

- If China cannot tax property, what can it tax? And with no tax, how can it spend without a further debt build-up, and/or an ultimate resort to monetisation, modern or ancient?

At root, this is the same housing dilemma we see in the West, which also used to build lots of public housing but ceased to in recent decades, “because markets”, and which now forces developers to throw in Potemkin “affordable housing options” as part of the towering ‘plutoflat’ follies that loom over our cities. And just look how well that is working out socially and politically, to say nothing of economically.

But don’t worry. We are weeks away from the start of the Xmas office party season, and I am sure there will be lots of “Roaring 20s/Great Gatsby”-themed events for Wall Streeters to attend.

Tyler Durden

Wed, 10/20/2021 – 09:21![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com